Walker & Dunlop, Inc (WD): Price and Financial Metrics

WD Price/Volume Stats

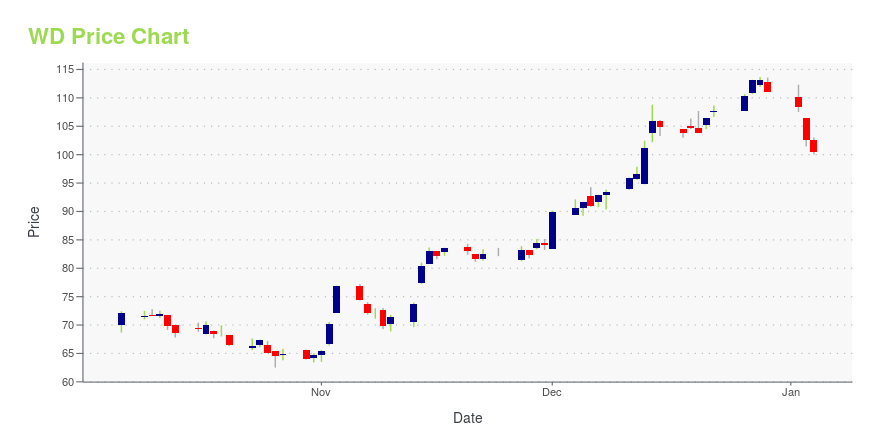

| Current price | $108.35 | 52-week high | $113.67 |

| Prev. close | $107.04 | 52-week low | $62.51 |

| Day low | $106.78 | Volume | 433,200 |

| Day high | $109.30 | Avg. volume | 213,592 |

| 50-day MA | $98.08 | Dividend yield | 2.4% |

| 200-day MA | $92.66 | Market Cap | 3.65B |

WD Stock Price Chart Interactive Chart >

Walker & Dunlop, Inc (WD) Company Bio

Walker & Dunlop provides financing and investment sales to owners of multifamily and commercial properties. The company was founded in 1937 and is based in Bethesda, Maryland.

Latest WD News From Around the Web

Below are the latest news stories about WALKER & DUNLOP INC that investors may wish to consider to help them evaluate WD as an investment opportunity.

Walker & Dunlop Partners With Black Commercial Real Estate NetworkThe Black Commercial Real Estate Network (BCREN), an advocacy group launched in the summer of 2020 with the goal of amplifying the voices of Black members of a largely white industry following the tragic police-involved killing of George Floyd, has formed a strategic partnership with Walker & Dunlop (W&D) that will provide extensive networking opportunities through the brokerage giant. “Our partnerships are critical to our mission,” said Derith Jarvis, executive director at BCREN. W&D adds to a growing list of CRE firms that joined BCREN as partners or sponsors, including JLL (JLL), Meissner Commercial Real Estate Services, Onyx Legacy Group, Allan Bailey Johnson Group, Keller Augusta and the Black Developers Forum. |

Walker & Dunlop Arranges $157 Million Loan with Affinius Capital and Clarion Partners for SLC Mixed-Use DevelopmentBETHESDA, Md., November 28, 2023--Walker & Dunlop arranged $157.5 million in loan proceeds to refinance Post District in Salt Lake City, Utah. |

Bull Market Buy: You Haven't Missed Out on This Magnificent Real Estate StockThis multifamily lender has pulled back 45% from its all-time high and looks like a solid buy ahead of a new bull market. |

It Might Not Be A Great Idea To Buy Walker & Dunlop, Inc. (NYSE:WD) For Its Next DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

Following a 2.1% decline over last year, recent gains may please Walker & Dunlop, Inc. (NYSE:WD) institutional ownersKey Insights Given the large stake in the stock by institutions, Walker & Dunlop's stock price might be vulnerable to... |

WD Price Returns

| 1-mo | 15.38% |

| 3-mo | 17.00% |

| 6-mo | 9.65% |

| 1-year | 23.46% |

| 3-year | 15.16% |

| 5-year | 108.46% |

| YTD | -1.08% |

| 2023 | 45.98% |

| 2022 | -46.80% |

| 2021 | 67.03% |

| 2020 | 45.89% |

| 2019 | 52.68% |

WD Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WD

Want to do more research on Walker & Dunlop Inc's stock and its price? Try the links below:Walker & Dunlop Inc (WD) Stock Price | Nasdaq

Walker & Dunlop Inc (WD) Stock Quote, History and News - Yahoo Finance

Walker & Dunlop Inc (WD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...