WisdomTree Investments, Inc. (WETF): Price and Financial Metrics

WETF Price/Volume Stats

| Current price | $5.26 | 52-week high | $6.92 |

| Prev. close | $5.33 | 52-week low | $4.60 |

| Day low | $5.23 | Volume | 1,013,100 |

| Day high | $5.41 | Avg. volume | 985,627 |

| 50-day MA | $5.02 | Dividend yield | 2.28% |

| 200-day MA | $5.41 | Market Cap | 771.04M |

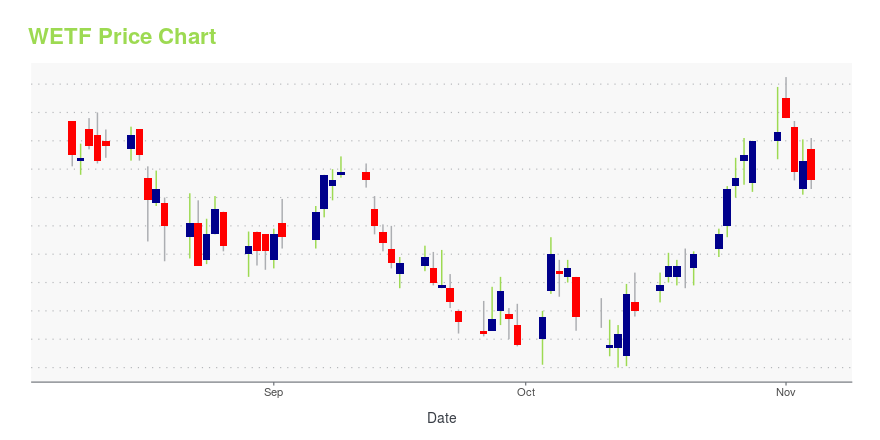

WETF Stock Price Chart Interactive Chart >

WisdomTree Investments, Inc. (WETF) Company Bio

WisdomTree Investments operates as an exchange-traded funds (ETFs) sponsor and asset manager. The company was founded in 1985 and is based in New York, New York.

Latest WETF News From Around the Web

Below are the latest news stories about WISDOMTREE INVESTMENTS INC that investors may wish to consider to help them evaluate WETF as an investment opportunity.

WisdomTree Reports Monthly Metrics for October 2022Robust October net inflowsYear-to-date organic growth accelerates NEW YORK, Nov. 09, 2022 (GLOBE NEWSWIRE) -- WisdomTree, Inc. (NYSE: WT), a global financial innovator, today released monthly metrics for October 2022, including assets under management (AUM) and flow data by asset class. Key Highlights: WisdomTree’s organic growth accelerated to nearly 14% year-to-date through October, up from the 12% annualized year-to-date pace at the end of September.Nearly $2 billion of inflows in October ext |

WisdomTree to Ring Opening Bell in Celebration of Listing Transfer to the NYSE, Change in Company Name and Ticker (NYSE: WT)Transfer of common stock listing and change in corporate name highlights Company’s natural evolution and holistic opportunity that is more than investments NEW YORK, Nov. 07, 2022 (GLOBE NEWSWIRE) -- WisdomTree, Inc. (NYSE: WT), a global financial innovator, today announced that it will ring the opening bell at the New York Stock Exchange (“NYSE”), celebrating the transfer of its common stock listing to the NYSE under the new ticker symbol “WT” and its new company name, WisdomTree, Inc. In doing |

With EPS Growth And More, WisdomTree Investments (NASDAQ:WETF) Makes An Interesting CaseInvestors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks... |

WisdomTree Wins Best US Fixed Income ETF Issuer ($1bn-$5bn) at ETF Express US Awards 2022WisdomTree continues to be recognized across categories in ETF Express US AwardsNEW YORK, Oct. 28, 2022 (GLOBE NEWSWIRE) -- WisdomTree Investments, Inc. (NASDAQ: WETF), an exchange-traded fund (“ETF”) and exchange-traded product (“ETP”) sponsor and asset manager, is pleased to announce that it has been named “Best US Fixed Income ETF Issuer ($1bn-$5bn)” for the ETF Express US Awards 2022, which recognizes excellence among ETF issuers and service providers across a wide range of categories. This |

WisdomTree Announces Third Quarter 2022 Results - Diluted Earnings Per Share of $0.50 ($0.06, as adjusted)Year-to-date (YTD) annualized inflow rate of 14% across all productsU.S. Equity products inflowing at a YTD annualized rate of 13% (inflows of $1.2 billion in the quarter)WisdomTree Floating Rate Treasury Fund (USFR) inflows of $2.8 billion in the quarter NEW YORK, Oct. 28, 2022 (GLOBE NEWSWIRE) -- WisdomTree Investments, Inc. (NASDAQ: WETF) today reported financial results for the third quarter of 2022. $81.2 million net income ($9.3(1) million net income, as adjusted); see “Non-GAAP Financial |

WETF Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -9.85% |

| 5-year | -9.47% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 16.57% |

| 2020 | 14.14% |

| 2019 | -25.75% |

WETF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WETF

Want to do more research on WisdomTree Investments Inc's stock and its price? Try the links below:WisdomTree Investments Inc (WETF) Stock Price | Nasdaq

WisdomTree Investments Inc (WETF) Stock Quote, History and News - Yahoo Finance

WisdomTree Investments Inc (WETF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...