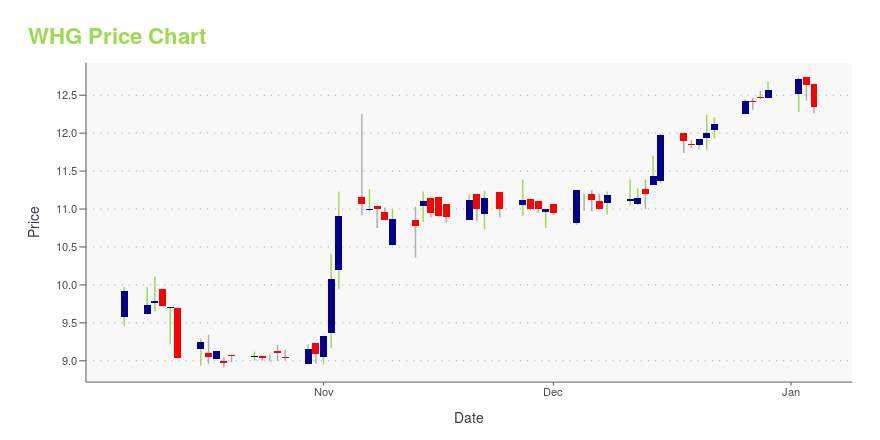

Westwood Holdings Group Inc (WHG): Price and Financial Metrics

WHG Price/Volume Stats

| Current price | $13.37 | 52-week high | $13.63 |

| Prev. close | $13.33 | 52-week low | $8.91 |

| Day low | $13.25 | Volume | 11,020 |

| Day high | $13.37 | Avg. volume | 11,223 |

| 50-day MA | $12.41 | Dividend yield | 4.48% |

| 200-day MA | $11.86 | Market Cap | 124.51M |

WHG Stock Price Chart Interactive Chart >

Westwood Holdings Group Inc (WHG) Company Bio

Westwood Holdings provides investment management services to institutional investors, private wealth clients and financial intermediaries. The company was founded in 1983 and is based in Dallas, Texas.

Latest WHG News From Around the Web

Below are the latest news stories about WESTWOOD HOLDINGS GROUP INC that investors may wish to consider to help them evaluate WHG as an investment opportunity.

Do These 3 Checks Before Buying Westwood Holdings Group, Inc. (NYSE:WHG) For Its Upcoming DividendWestwood Holdings Group, Inc. ( NYSE:WHG ) stock is about to trade ex-dividend in three days. The ex-dividend date is... |

Westwood Holdings Group (NYSE:WHG) Is Paying Out A Dividend Of $0.15The board of Westwood Holdings Group, Inc. ( NYSE:WHG ) has announced that it will pay a dividend of $0.15 per share on... |

Westwood Holdings Group, Inc. (NYSE:WHG) Q3 2023 Earnings Call TranscriptWestwood Holdings Group, Inc. (NYSE:WHG) Q3 2023 Earnings Call Transcript October 31, 2023 Operator: Good day, and thank you for standing by. Welcome to the 3Q 2023 Westwood Holdings Group, Inc., earnings conference call. [Operator Instructions]. Please be advised that today’s conference is being recorded and would now like to hand the conference over to […] |

Q3 2023 Westwood Holdings Group Inc Earnings CallQ3 2023 Westwood Holdings Group Inc Earnings Call |

Westwood Holdings Group Inc (WHG) Reports Q3 2023 Earnings: Revenues and Net Income RiseWHG's Q3 2023 earnings show a significant increase in revenues and net income compared to the same period last year |

WHG Price Returns

| 1-mo | 11.42% |

| 3-mo | 5.68% |

| 6-mo | 12.07% |

| 1-year | 18.30% |

| 3-year | -23.89% |

| 5-year | -42.86% |

| YTD | 9.04% |

| 2023 | 19.00% |

| 2022 | -31.43% |

| 2021 | 32.00% |

| 2020 | -50.15% |

| 2019 | -4.41% |

WHG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WHG

Want to see what other sources are saying about Westwood Holdings Group Inc's financials and stock price? Try the links below:Westwood Holdings Group Inc (WHG) Stock Price | Nasdaq

Westwood Holdings Group Inc (WHG) Stock Quote, History and News - Yahoo Finance

Westwood Holdings Group Inc (WHG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...