Wheeler Real Estate Investment Trust, Inc. (WHLR): Price and Financial Metrics

WHLR Price/Volume Stats

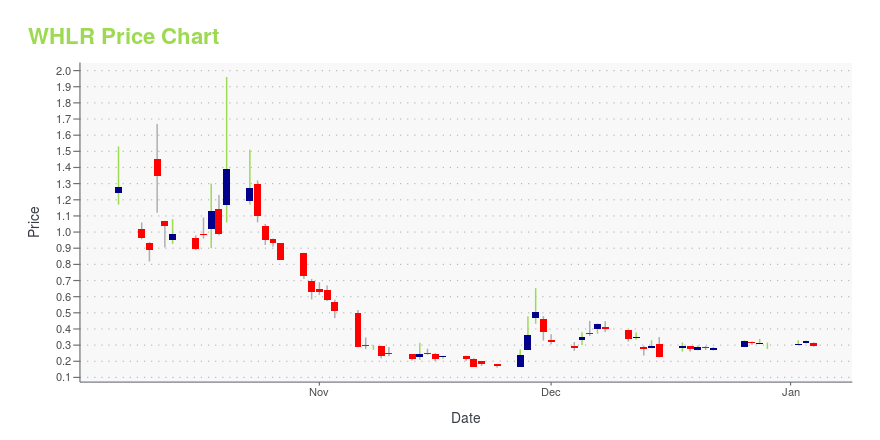

| Current price | $8.96 | 52-week high | $1,130.40 |

| Prev. close | $9.27 | 52-week low | $7.35 |

| Day low | $8.58 | Volume | 35,936 |

| Day high | $9.15 | Avg. volume | 59,622 |

| 50-day MA | $11.98 | Dividend yield | N/A |

| 200-day MA | $30.35 | Market Cap | 5.08M |

WHLR Stock Price Chart Interactive Chart >

Wheeler Real Estate Investment Trust, Inc. (WHLR) Company Bio

Wheeler Real Estate Investment Trust, Inc. engages in acquiring, financing, developing, leasing, owning, and managing real estate properties in the mid-Atlantic, southeast, and southwest United States. It acquires strip centers, neighborhood, grocery-anchored, community, and free-standing retail properties. The company was founded in 2011 and is based in Virginia Beach, Virginia.

Latest WHLR News From Around the Web

Below are the latest news stories about WHEELER REAL ESTATE INVESTMENT TRUST INC that investors may wish to consider to help them evaluate WHLR as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week with a breakdown of the biggest pre-market stock movers worth keeping an eye on for Monday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the hottest trading news for Tuesday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's the final day of trading this week and we're starting it with a breakdown of the biggest pre-market stock movers on Friday morning! |

Why Is Leslie’s (LESL) Stock Down 24% Today?Leslie's stock is falling hard on Wednesday as investors in LESL react to it missing EPS estimates in Q4 and posting weak 2024 guidance. |

Why Is Seelos Therapeutics (SEEL) Stock Down 42% Today?Seelos Therapeutics stock is falling on Wednesday after the company announced and priced a public offering for shares of SEEL. |

WHLR Price Returns

| 1-mo | -35.54% |

| 3-mo | -49.21% |

| 6-mo | -63.59% |

| 1-year | -98.77% |

| 3-year | -99.72% |

| 5-year | -99.54% |

| YTD | -75.53% |

| 2023 | -97.81% |

| 2022 | -28.03% |

| 2021 | -29.96% |

| 2020 | 68.90% |

| 2019 | 84.27% |

Continue Researching WHLR

Want to do more research on Wheeler Real Estate Investment Trust Inc's stock and its price? Try the links below:Wheeler Real Estate Investment Trust Inc (WHLR) Stock Price | Nasdaq

Wheeler Real Estate Investment Trust Inc (WHLR) Stock Quote, History and News - Yahoo Finance

Wheeler Real Estate Investment Trust Inc (WHLR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...