G. Willi-Food International, Ltd. - Ordinary Shares (WILC): Price and Financial Metrics

WILC Price/Volume Stats

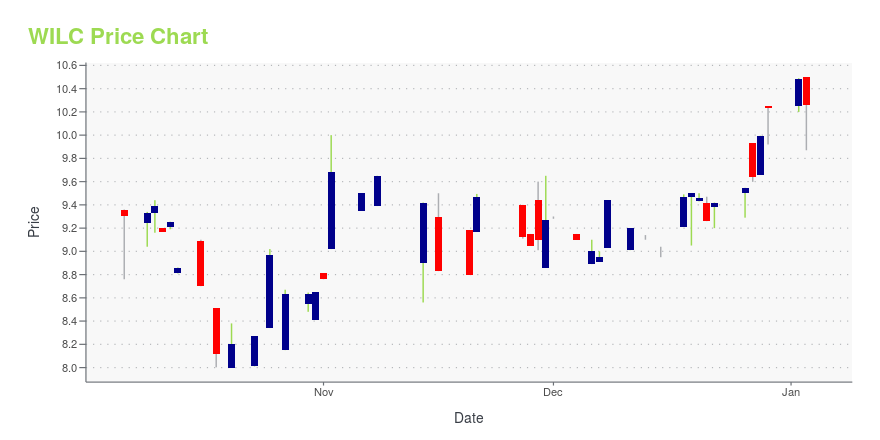

| Current price | $9.83 | 52-week high | $12.99 |

| Prev. close | $9.68 | 52-week low | $8.00 |

| Day low | $9.81 | Volume | 1,307 |

| Day high | $9.83 | Avg. volume | 2,244 |

| 50-day MA | $9.36 | Dividend yield | 4.16% |

| 200-day MA | $9.63 | Market Cap | 136.31M |

WILC Stock Price Chart Interactive Chart >

G. Willi-Food International, Ltd. - Ordinary Shares (WILC) Company Bio

G. Willi-Food International Ltd. develops, imports, exports, markets, and distributes various food products worldwide. The company was founded in 1994 and is based in Yavne, Israel.

Latest WILC News From Around the Web

Below are the latest news stories about G WILLI FOOD INTERNATIONAL LTD that investors may wish to consider to help them evaluate WILC as an investment opportunity.

G. Willi-Food International Third Quarter 2023 Earnings: EPS: ₪0.35 (vs ₪0.55 in 3Q 2022)G. Willi-Food International ( NASDAQ:WILC ) Third Quarter 2023 Results Key Financial Results Revenue: ₪123.9m (flat on... |

G. WILLI-FOOD ANNOUNCES SHARE REPURCHASE PROGRAMG. Willi-Food International Ltd. (NASDAQ: WILC) (TASE: WILF) (the "Company" or "Willi-Food"), a global company that specializes in the development, marketing and international distribution of kosher foods, announces today that its Board of Directors has authorized a share repurchase program permitting the Company to repurchase up to $5 million of the Company's Ordinary Shares over the next six months. |

WILC Stock Earnings: G. Willi-Food Intl Reported Results for Q3 2023G. |

Israeli food importer G. Willi warns of delays, higher costs from Red Sea attacksIsraeli food importer G. Willi-Food International said on Thursday the Gaza war has so far not impacted its operations but that business could be harmed by consequences of attacks by Iran-backed Houthi militants on shipping in the Red Sea. G. Willi reported third-quarter net profit of 4.9 million shekels ($1.4 million), down from 7.6 million shekels a year earlier on flat sales of 123.9 million. The company said that in the wake of the Oct. 7 attack on Israel by Gaza's ruling Palestinian militant group Hamas and subsequent rocket fire by Lebanon's Hezbollah into northern Israel, business activity had slackened in Israel. |

G. Willi-Food international reports the results of THIRD quarter 2023G. Willi-Food International Ltd. (NASDAQ: WILC) (the "Company" or "Willi-Food"), a global company that specializes in the development, marketing and international distribution of kosher foods, today announced its unaudited financial results for the third quarter ended September 30, 2023. |

WILC Price Returns

| 1-mo | 7.08% |

| 3-mo | 8.98% |

| 6-mo | -10.91% |

| 1-year | -18.01% |

| 3-year | -42.97% |

| 5-year | 16.63% |

| YTD | -2.02% |

| 2023 | -17.53% |

| 2022 | -26.06% |

| 2021 | -5.72% |

| 2020 | 79.16% |

| 2019 | 70.96% |

WILC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WILC

Here are a few links from around the web to help you further your research on G Willi Food International Ltd's stock as an investment opportunity:G Willi Food International Ltd (WILC) Stock Price | Nasdaq

G Willi Food International Ltd (WILC) Stock Quote, History and News - Yahoo Finance

G Willi Food International Ltd (WILC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...