Wipro Limited (WIT): Price and Financial Metrics

WIT Price/Volume Stats

| Current price | $6.20 | 52-week high | $7.01 |

| Prev. close | $6.02 | 52-week low | $4.48 |

| Day low | $6.18 | Volume | 2,974,400 |

| Day high | $6.27 | Avg. volume | 2,845,132 |

| 50-day MA | $5.85 | Dividend yield | 0.18% |

| 200-day MA | $5.52 | Market Cap | 32.36B |

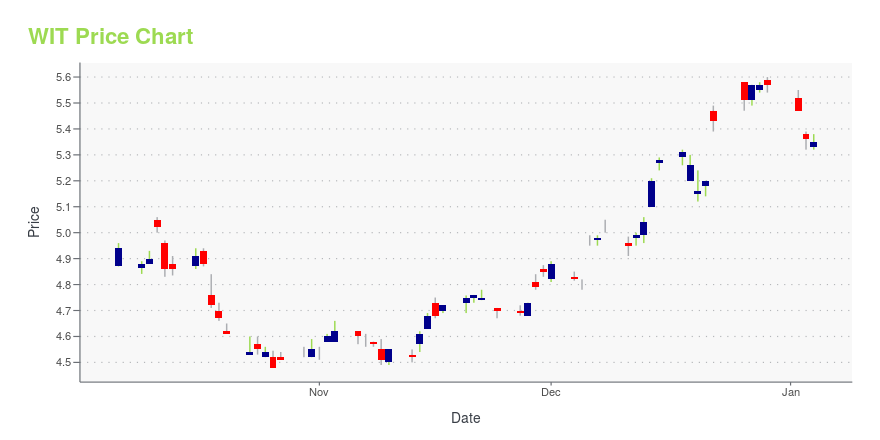

WIT Stock Price Chart Interactive Chart >

Wipro Limited (WIT) Company Bio

Wipro Ltd. is a global information technology (IT), services Provider. The Company develops and integrates solutions that enable its clients to leverage IT in achieving their business objectives at competitive costs. The company was founded in 1945 and is based in Bengaluru, India.

Latest WIT News From Around the Web

Below are the latest news stories about WIPRO LTD that investors may wish to consider to help them evaluate WIT as an investment opportunity.

The 3 Hottest 5G Stocks to Watch in 2024With the 5G services market set for unprecedented growth over the next decade, investors cannot ignore the three hottest 5G stocks for 2024. |

Strength Seen in MSCI (MSCI): Can Its 3.9% Jump Turn into More Strength?MSCI (MSCI) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term. |

Wipro and Marelli Create First Cabin Digital Twin Viable ProductPARIS & BENGALURU, India, December 11, 2023--Wipro and Marelli Create First Cabin Digital Twin Viable Product. |

Wipro Teams with NVIDIA to Bring the Power of Generative AI to Healthcare Insurance CompaniesEAST BRUNSWICK, N.J. & BENGALURU, India, November 21, 2023--Wipro Limited today announced a collaboration with NVIDIA to help healthcare companies accelerate adoption of generative artificial intelligence. |

Radware (RDWR) to Equip North American Airport With Its SolutionsRadware (RDWR) to implement security solutions for a major North American airport with its Cloud DDoS Protection and Cloud Application Protection Services. |

WIT Price Returns

| 1-mo | 5.62% |

| 3-mo | 13.55% |

| 6-mo | 8.39% |

| 1-year | 27.55% |

| 3-year | -24.78% |

| 5-year | 51.82% |

| YTD | 11.52% |

| 2023 | 19.79% |

| 2022 | -51.83% |

| 2021 | 73.06% |

| 2020 | 51.22% |

| 2019 | -2.36% |

WIT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WIT

Want to see what other sources are saying about Wipro Ltd's financials and stock price? Try the links below:Wipro Ltd (WIT) Stock Price | Nasdaq

Wipro Ltd (WIT) Stock Quote, History and News - Yahoo Finance

Wipro Ltd (WIT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...