Willis Lease Finance Corporation (WLFC): Price and Financial Metrics

WLFC Price/Volume Stats

| Current price | $86.51 | 52-week high | $87.33 |

| Prev. close | $86.05 | 52-week low | $39.50 |

| Day low | $85.61 | Volume | 16,066 |

| Day high | $87.25 | Avg. volume | 12,443 |

| 50-day MA | $68.00 | Dividend yield | N/A |

| 200-day MA | $52.91 | Market Cap | 568.37M |

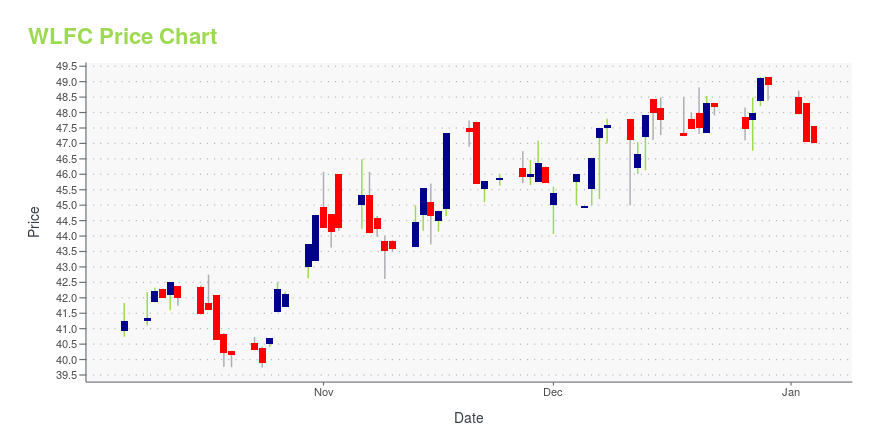

WLFC Stock Price Chart Interactive Chart >

Willis Lease Finance Corporation (WLFC) Company Bio

Willis Lease Finance Corporation leases commercial aircraft engines and other aircraft-related equipment to air carriers, manufacturers, and overhaul/repair facilities worldwide. The company was founded in 1985 and is based in Novato, California.

Latest WLFC News From Around the Web

Below are the latest news stories about WILLIS LEASE FINANCE CORP that investors may wish to consider to help them evaluate WLFC as an investment opportunity.

Willis Lease Finance Corporation Welcomes Brendan Curran to its Board of DirectorsCurran brings a wealth of aerospace industry experience in corporate scaling and integration strategies across the engine and airframe segmentsCOCONUT CREEK, Fla., Dec. 28, 2023 (GLOBE NEWSWIRE) -- Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC”), a leading lessor of commercial aircraft engines and global provider of aviation services, is pleased to announce the appointment of Brendan Curran to its Board of Directors (the “Board”), effective January 1, 2024. With a distinguished career i |

Willis Lease Finance Corp EVP, CFO Scott Flaherty Sells 2,638 SharesScott Flaherty, Executive Vice President and Chief Financial Officer of Willis Lease Finance Corp (NASDAQ:WLFC), executed a sale of 2,638 shares in the company on December 21, 2023, according to a recent SEC Filing. |

Willis Sustainable Fuels (UK) Limited, Awarded £4.721M Grant in UK’s Advanced Fuels Fund (AFF) CompetitionFunding to Support Planned Development of New Power-to-Liquid (PtL) Sustainable Aviation Fuel (SAF) Refinery at Teesworks in Northeastern England View of Carbonshift PtL SAF Refinery at Teesworks in the UK View from Southeast COCONUT CREEK, Fla., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Willis Lease Finance Corporation (NASDAQ: WLFC) (“WLFC”), a leading lessor of commercial aircraft engines and global provider of aviation services, today announces that its subsidiary, Willis Sustainable Fuels (UK) Limi |

Willis Lease Finance Corp (WLFC) Reports Q3 Pre-tax Income of $20.3 Million, a 143.4% YoY IncreaseLease Rent Revenue and Maintenance Reserve Revenue Show Significant Growth |

Willis Lease Finance Corporation Reports Third Quarter Pre-tax Income of $20.3 millionCOCONUT CREEK, Fla., Nov. 03, 2023 (GLOBE NEWSWIRE) -- Willis Lease Finance Corporation (NASDAQ: WLFC) today reported third quarter total revenues of $105.7 million and pre-tax earnings of $20.3 million. For the three months ended September 30, 2023, aggregate lease rent and maintenance reserve revenues were $91.3 million and spare parts and equipment sales were $3.4 million. The Company reported increased total revenues in the third quarter when compared to the prior year period, primarily due |

WLFC Price Returns

| 1-mo | 28.70% |

| 3-mo | 76.37% |

| 6-mo | 74.42% |

| 1-year | 113.39% |

| 3-year | 105.34% |

| 5-year | 36.02% |

| YTD | 76.98% |

| 2023 | -17.17% |

| 2022 | 56.73% |

| 2021 | 23.60% |

| 2020 | -48.29% |

| 2019 | 70.26% |

Continue Researching WLFC

Here are a few links from around the web to help you further your research on Willis Lease Finance Corp's stock as an investment opportunity:Willis Lease Finance Corp (WLFC) Stock Price | Nasdaq

Willis Lease Finance Corp (WLFC) Stock Quote, History and News - Yahoo Finance

Willis Lease Finance Corp (WLFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...