Warner Music Group Corp. (WMG): Price and Financial Metrics

WMG Price/Volume Stats

| Current price | $29.83 | 52-week high | $38.05 |

| Prev. close | $29.58 | 52-week low | $28.89 |

| Day low | $29.73 | Volume | 2,137,443 |

| Day high | $30.45 | Avg. volume | 1,942,940 |

| 50-day MA | $30.77 | Dividend yield | 2.12% |

| 200-day MA | $33.15 | Market Cap | 15.45B |

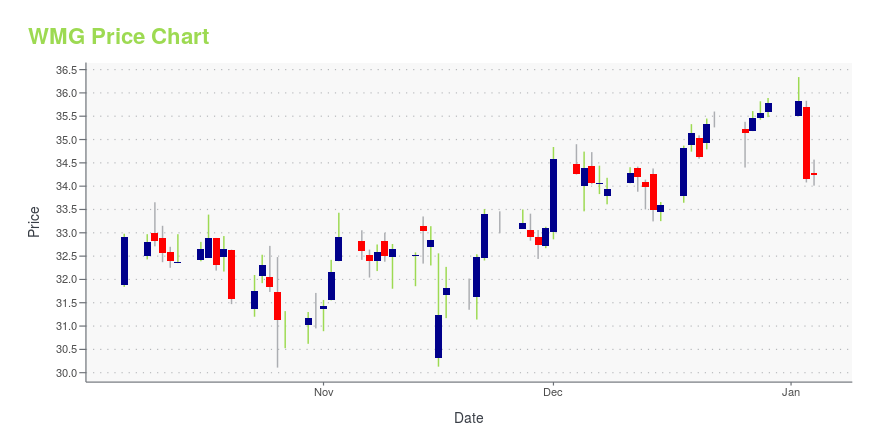

WMG Stock Price Chart Interactive Chart >

Warner Music Group Corp. (WMG) Company Bio

Warner Music Group Corp. (d.b.a. Warner Music Group, commonly abbreviated as WMG) is an American multinational entertainment and record label conglomerate headquartered in New York City. It is one of the "big three" recording companies and the third-largest in the global music industry, after Universal Music Group (UMG) and Sony Music Entertainment (SME). Formerly part of Time Warner (now Warner Bros. Discovery), WMG was publicly traded on the New York Stock Exchange from 2005 until 2011, when it announced its privatization and sale to Access Industries. It later had its second IPO on Nasdaq in 2020, once again becoming a public company. With a multibillion-dollar annual turnover, WMG employs more than 3,500 people and has operations in more than 50 countries throughout the world. (Source:Wikipedia)

Latest WMG News From Around the Web

Below are the latest news stories about WARNER MUSIC GROUP CORP that investors may wish to consider to help them evaluate WMG as an investment opportunity.

Zacks Industry Outlook Highlights Warner Music, News, Lions Gate Entertainment and IMAXWarner Music, News, Lions Gate Entertainment and IMAX are part of the Zacks Industry Outlook article. |

4 Film & Television Production Stocks to Watch on Solid Industry TrendsFilm and television production and distribution companies like WMG, NWSA, LGF.A and IMAX are benefiting from higher consumption of digital entertainment and a recovering ad spending environment. |

Lionsgate (LGF.A) to Boost Portfolio With Upcoming DivestitureLionsgate (LGF.A) plans to create a standalone company, Lionsgate Studios, by merging the Lionsgate Studio Business with Screaming Eagle in a $4.6 billion deal. |

Top 5 Consumer-Centric Stocks Amid Rising Consumer ConfidenceWe have narrowed our search to five consumer-centric large-cap stocks that have strong potential for 2024. These are: LYV, RCL, CMCSA, NKE, WMG. |

5 Nasdaq Composite Laggards Likely to Gather Pace in 2024We have narrowed our search to five Nasdaq Composite listed laggards of 2023 with strong potential for 2024. These are: PEP, KHC, WMG, PODD, BGNE. |

WMG Price Returns

| 1-mo | -2.13% |

| 3-mo | -7.44% |

| 6-mo | -19.06% |

| 1-year | -3.71% |

| 3-year | -13.38% |

| 5-year | N/A |

| YTD | -15.80% |

| 2023 | 4.44% |

| 2022 | -17.21% |

| 2021 | 15.31% |

| 2020 | N/A |

| 2019 | N/A |

WMG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...