W. P. Carey Inc. (WPC): Price and Financial Metrics

WPC Price/Volume Stats

| Current price | $60.64 | 52-week high | $73.38 |

| Prev. close | $59.22 | 52-week low | $51.36 |

| Day low | $59.47 | Volume | 853,763 |

| Day high | $60.79 | Avg. volume | 1,300,305 |

| 50-day MA | $57.01 | Dividend yield | 5.9% |

| 200-day MA | $58.16 | Market Cap | 13.27B |

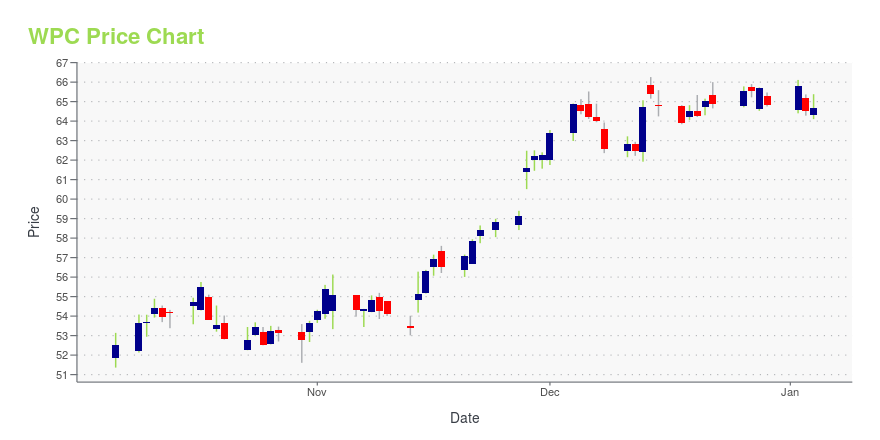

WPC Stock Price Chart Interactive Chart >

W. P. Carey Inc. (WPC) Company Bio

W. P. Carey Inc. is a real estate investment trust that invests in properties leased to single tenants via NNN leases. The company is organized in Maryland, with its primary office in New York City. (Source:Wikipedia)

Latest WPC News From Around the Web

Below are the latest news stories about W P CAREY INC that investors may wish to consider to help them evaluate WPC as an investment opportunity.

W.P. Carey: Buy, Sell, or Hold?The longtime dividend grower recently reset its dividend payment and moved to unlock capital for long-term investment opportunities. |

W. P. Carey Announces Unsecured Revolving Credit Facility Extended and UpsizedW. P. Carey Inc. (W. P. Carey, NYSE: WPC) today announced that it closed an amended and restated $2.0 billion multicurrency unsecured revolving credit facility (the "Revolver"), a €215 million term loan and a £270 million term loan (the "Term Loans"). |

This Once Magnificent Dividend Stock Is Still an Attractive Income InvestmentW.P. Carey (NYSE: WPC) was a magnificent dividend stock. The diversified real estate investment trust (REIT) had increased its payment each year for a quarter century. W.P. Carey has reset its payment rate by reducing it by nearly 20% following its strategic exit from the office sector. |

W. P. Carey Announces Quarterly Dividend of $0.860 per ShareW. P. Carey Inc. (W. P. Carey, NYSE: WPC) reported today that its Board of Directors declared a quarterly cash dividend of $0.860 per share, equivalent to an annualized dividend rate of $3.44 per share, reflecting both the Company's strategic plan to exit the office assets within its portfolio (announced on September 21, 2023) and a lower payout ratio. The dividend is payable on January 16, 2024 to stockholders of record as of December 29, 2023. |

Why W. P. Carey Stock Rebounded 16% in NovemberShares of W. P. Carey (NYSE: WPC) rallied 16% in November, according to data provided by S&P Global Market Intelligence. W. P. Carey caught its investors off guard in late September when the diversified REIT unveiled an accelerated plan to exit the office sector. The two-part strategy would see the company spin off part of its office portfolio into a new office REIT, Net Lease Office Properties, which it completed in November. |

WPC Price Returns

| 1-mo | 11.88% |

| 3-mo | 11.94% |

| 6-mo | -0.42% |

| 1-year | -7.97% |

| 3-year | -9.00% |

| 5-year | -3.25% |

| YTD | -3.45% |

| 2023 | -10.34% |

| 2022 | 0.47% |

| 2021 | 22.88% |

| 2020 | -5.99% |

| 2019 | 28.84% |

WPC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WPC

Want to see what other sources are saying about W P Carey Inc's financials and stock price? Try the links below:W P Carey Inc (WPC) Stock Price | Nasdaq

W P Carey Inc (WPC) Stock Quote, History and News - Yahoo Finance

W P Carey Inc (WPC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...