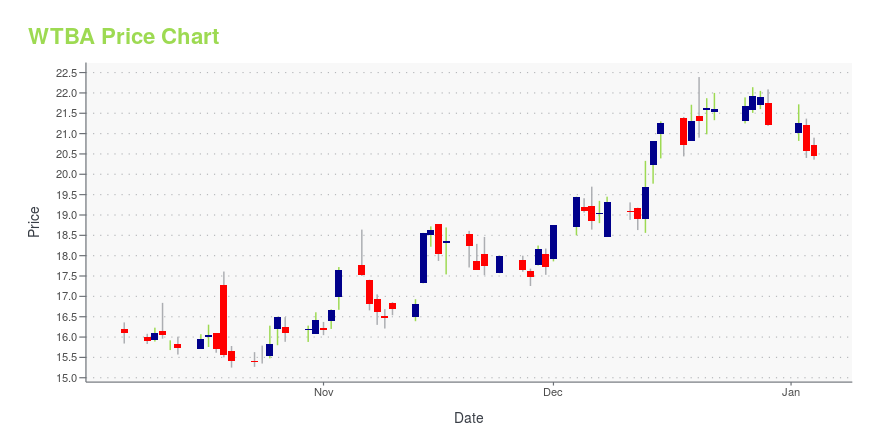

West Bancorporation (WTBA): Price and Financial Metrics

WTBA Price/Volume Stats

| Current price | $20.65 | 52-week high | $22.39 |

| Prev. close | $20.89 | 52-week low | $15.25 |

| Day low | $19.95 | Volume | 73,148 |

| Day high | $21.28 | Avg. volume | 26,966 |

| 50-day MA | $17.96 | Dividend yield | 4.56% |

| 200-day MA | $17.95 | Market Cap | 347.21M |

WTBA Stock Price Chart Interactive Chart >

West Bancorporation (WTBA) Company Bio

West Bancorp provides community banking and trust services to individuals and small to medium-sized businesses in Iowa. The company was founded in 1893 and is based in West Des Moines, Iowa.

Latest WTBA News From Around the Web

Below are the latest news stories about WEST BANCORPORATION INC that investors may wish to consider to help them evaluate WTBA as an investment opportunity.

West Bancorporation, Inc. to Announce Quarterly Results, Hold Conference CallWEST DES MOINES, Iowa, Dec. 22, 2023 (GLOBE NEWSWIRE) -- West Bancorporation, Inc. (Nasdaq: WTBA) (the “Company”), parent company of West Bank, will report its results for the fourth quarter of 2023 on Thursday, January 25, 2024 before the markets open. The Company will discuss its results in a conference call scheduled for 2:00 p.m. Central Time on Thursday, January 25, 2024. The telephone number for the conference call is 888-300-4030. The conference ID for the conference call is 3218904. A re |

Individual investors account for 46% of West Bancorporation, Inc.'s (NASDAQ:WTBA) ownership, while institutions account for 44%Key Insights Significant control over West Bancorporation by individual investors implies that the general public has... |

West Bancorporation (NASDAQ:WTBA) Will Pay A Dividend Of $0.25The board of West Bancorporation, Inc. ( NASDAQ:WTBA ) has announced that it will pay a dividend of $0.25 per share on... |

The West Bancorp Inc (WTBA) Company: A Short SWOT AnalysisUnveiling the Strengths, Weaknesses, Opportunities, and Threats of West Bancorp Inc (WTBA) Amidst Its Latest Financial Performance |

West Bancorporation, Inc. (NASDAQ:WTBA) Q3 2023 Earnings Call TranscriptWest Bancorporation, Inc. (NASDAQ:WTBA) Q3 2023 Earnings Call Transcript October 26, 2023 West Bancorporation, Inc. beats earnings expectations. Reported EPS is $0.35, expectations were $0.31. Operator: Hello. My name is Chris and I’ll be your conference operator today. At this time, I’d like to welcome everyone to the West Bancorporation, Inc. Q3 Earnings Call. All […] |

WTBA Price Returns

| 1-mo | 21.04% |

| 3-mo | 25.37% |

| 6-mo | 7.84% |

| 1-year | 5.57% |

| 3-year | -18.73% |

| 5-year | 17.77% |

| YTD | 0.21% |

| 2023 | -12.38% |

| 2022 | -14.43% |

| 2021 | 66.46% |

| 2020 | -21.18% |

| 2019 | 39.47% |

WTBA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WTBA

Want to see what other sources are saying about West Bancorporation Inc's financials and stock price? Try the links below:West Bancorporation Inc (WTBA) Stock Price | Nasdaq

West Bancorporation Inc (WTBA) Stock Quote, History and News - Yahoo Finance

West Bancorporation Inc (WTBA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...