Select Energy Services, Inc. (WTTR): Price and Financial Metrics

WTTR Price/Volume Stats

| Current price | $11.52 | 52-week high | $11.55 |

| Prev. close | $11.23 | 52-week low | $6.78 |

| Day low | $11.22 | Volume | 1,188,731 |

| Day high | $11.55 | Avg. volume | 1,119,281 |

| 50-day MA | $10.59 | Dividend yield | 2.16% |

| 200-day MA | $8.72 | Market Cap | 1.37B |

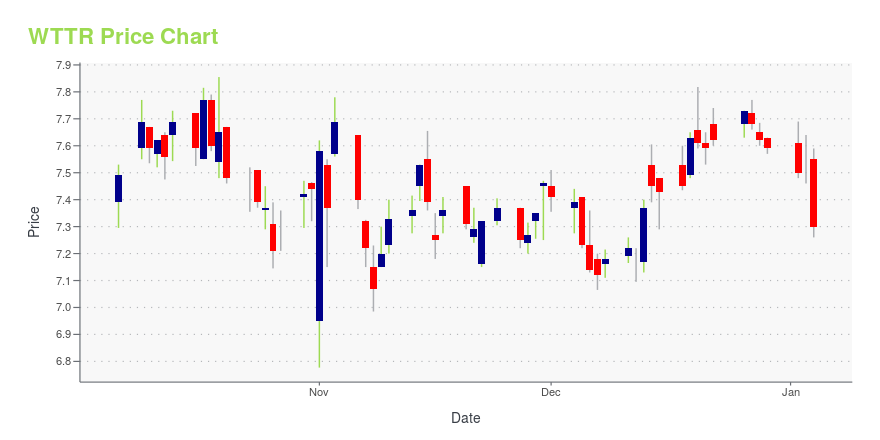

WTTR Stock Price Chart Interactive Chart >

Select Energy Services, Inc. (WTTR) Company Bio

Select Energy Services, Inc., an oilfield services company, provides water solutions to the United States unconventional oil and gas industry. The company operates through three segments: Water Solutions, Accommodations and Rentals, and Well-site Completion and Construction Services. The company is based in Gainesville, Texas.

Latest WTTR News From Around the Web

Below are the latest news stories about SELECT WATER SOLUTIONS INC that investors may wish to consider to help them evaluate WTTR as an investment opportunity.

Select Water Solutions' (NYSE:WTTR) investors will be pleased with their respectable 70% return over the last three yearsOne simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with... |

Select Water Solutions, Inc. (NYSE:WTTR) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?With its stock down 9.6% over the past three months, it is easy to disregard Select Water Solutions (NYSE:WTTR... |

Select Energy Services, Inc. (NYSE:WTTR) Q3 2023 Earnings Call TranscriptSelect Energy Services, Inc. (NYSE:WTTR) Q3 2023 Earnings Call Transcript November 1, 2023 Operator: Greetings, and welcome to Select Water Solutions Third Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode. [Operator Instructions] It is now my pleasure to introduce your host, Chris George, Senior Vice President, Corporate Development, Investor […] |

The Zacks Analyst Blog Highlights AbbVie, Exxon Mobil, Kontoor Brands, Select Water Solutions and Macatawa BankAbbVie, Exxon Mobil, Kontoor Brands, Select Water Solutions and Macatawa Bank are part of the Zacks top Analyst Blog. |

Select Water Solutions (NYSE:WTTR) Could Be A Buy For Its Upcoming DividendSome investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be... |

WTTR Price Returns

| 1-mo | 10.03% |

| 3-mo | 22.32% |

| 6-mo | 51.43% |

| 1-year | 41.10% |

| 3-year | 117.21% |

| 5-year | 23.49% |

| YTD | 54.03% |

| 2023 | -15.63% |

| 2022 | 49.18% |

| 2021 | 51.95% |

| 2020 | -55.82% |

| 2019 | 46.84% |

WTTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WTTR

Want to see what other sources are saying about Select Energy Services Inc's financials and stock price? Try the links below:Select Energy Services Inc (WTTR) Stock Price | Nasdaq

Select Energy Services Inc (WTTR) Stock Quote, History and News - Yahoo Finance

Select Energy Services Inc (WTTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...