Westwater Resources, Inc. (WWR): Price and Financial Metrics

WWR Price/Volume Stats

| Current price | $0.52 | 52-week high | $0.93 |

| Prev. close | $0.52 | 52-week low | $0.40 |

| Day low | $0.51 | Volume | 90,539 |

| Day high | $0.55 | Avg. volume | 183,399 |

| 50-day MA | $0.50 | Dividend yield | N/A |

| 200-day MA | $0.53 | Market Cap | 30.08M |

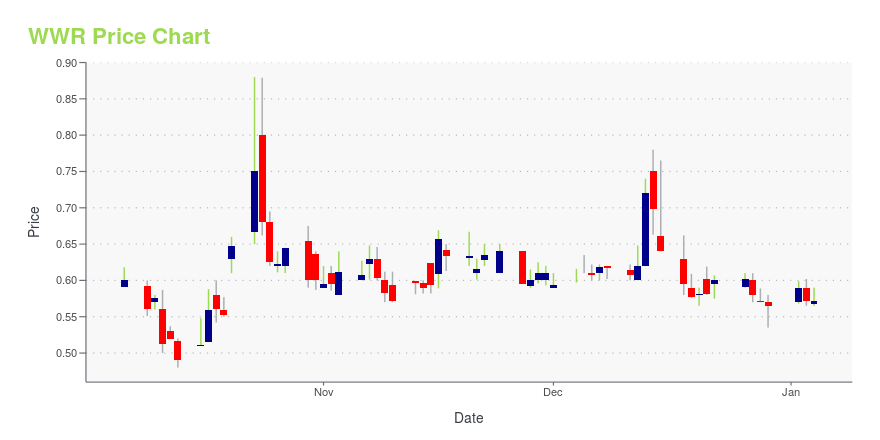

WWR Stock Price Chart Interactive Chart >

Westwater Resources, Inc. (WWR) Company Bio

Westwater Resources, formerly known as Uranium Resources, Inc. explores for, develops, and produces uranium. The company was founded in 1977 and is based in Centennial, Colorado.

Latest WWR News From Around the Web

Below are the latest news stories about WESTWATER RESOURCES INC that investors may wish to consider to help them evaluate WWR as an investment opportunity.

Westwater Resources says recent US Department of Energy announcement good news for companyWestwater Resources CCO Jon Jacobs joined Steve Darling from Proactive to delve into the recent guidance issued by the Department of Energy regarding Foreign Entities of Concern, and how this devel... |

Westwater Announces Availability of an Initial Assessment with Economic Analysis for the Coosa Graphite DepositCENTENNIAL, Colo., December 13, 2023--Westwater Resources, Inc. ("Westwater" or the "Company") (NYSE American: WWR), an energy technology and battery-grade natural graphite development company, today announced the availability of an Initial Assessment, with an economic analysis ("IA"), for the Company’s Coosa Graphite Deposit located in Coosa County, Alabama (the "Coosa Deposit"). |

Westwater Resources Announces Investor Conference CallCENTENNIAL, Colo., December 12, 2023--Westwater Resources, Inc. (NYSE American: WWR) an energy technology and battery-grade natural graphite development company, today announced it will hold a conference call to provide an update to investors. The call will be held on December 14, 2023, at 11:00 AM Eastern time. |

Westwater Resources Announces Q3 2023 Business and Financial UpdatesCENTENNIAL, Colo., November 15, 2023--Westwater Resources, Inc. (NYSE American: WWR), an energy technology and battery-grade natural graphite development company ("Westwater" or the "Company"), is pleased to announce its third quarter results for the quarter ended September 30, 2023, and to provide business and financial updates. |

New Chinese Restrictions on Supply of Natural Graphite Will Negatively Impact Batteries Used in EV MarketCENTENNIAL, Colo., October 23, 2023--Westwater Resources, Inc. (NYSE: American: WWR), an energy technology and battery-grade natural graphite company ("Westwater Resources"), today acknowledged that new Chinese restrictions on the supply of natural graphite will negatively impact the availability of battery anode material which is a critical component in producing the lithium-ion batteries that are used in electric vehicles. |

WWR Price Returns

| 1-mo | 9.24% |

| 3-mo | 18.24% |

| 6-mo | 1.96% |

| 1-year | -34.99% |

| 3-year | -86.28% |

| 5-year | -86.67% |

| YTD | -7.95% |

| 2023 | -28.49% |

| 2022 | -63.26% |

| 2021 | -56.39% |

| 2020 | 133.65% |

| 2019 | -69.86% |

Loading social stream, please wait...