Weyerhaeuser Co. (WY): Price and Financial Metrics

WY Price/Volume Stats

| Current price | $31.60 | 52-week high | $36.27 |

| Prev. close | $30.31 | 52-week low | $26.73 |

| Day low | $30.10 | Volume | 4,898,500 |

| Day high | $31.71 | Avg. volume | 3,514,016 |

| 50-day MA | $29.39 | Dividend yield | 2.64% |

| 200-day MA | $31.74 | Market Cap | 23.04B |

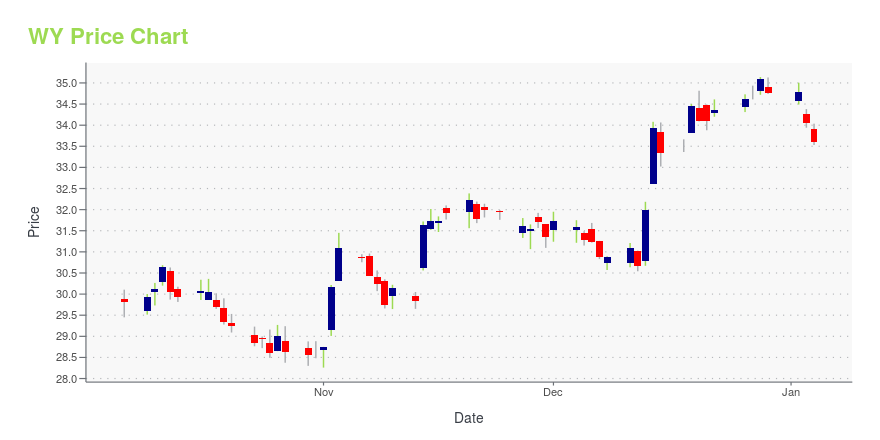

WY Stock Price Chart Interactive Chart >

Weyerhaeuser Co. (WY) Company Bio

Weyerhaeuser Company (/ˈwɛərhaʊzər/) is an American timberland company which owns nearly 12,400,000 acres (19,400 sq mi; 50,000 km2) of timberlands in the U.S., and manages an additional 14,000,000 acres (22,000 sq mi; 57,000 km2) of timberlands under long-term licenses in Canada.[3] The company also manufactures wood products.[4] It operates as a real estate investment trust. (Source:Wikipedia)

Latest WY News From Around the Web

Below are the latest news stories about WEYERHAEUSER CO that investors may wish to consider to help them evaluate WY as an investment opportunity.

Weyerhaeuser Sells Its First Carbon OffsetsWeyerhaeuser, America's largest private landowner, said it has sold its first batch of carbon offsets, marking the forest-products giant's entry into [the booming market for standing trees](https://www. |

Weyerhaeuser Completes Sale of Initial Carbon Credit OfferingWeyerhaeuser Company (NYSE: WY) today announced an agreement for the sale of nearly 32,000 forest carbon credits at $29 per credit. This agreement marks Weyerhaeuser's first transaction in the voluntary carbon market and represents the sale of all credits issued by ACR for the first year of the company's Kibby Skinner Improved Forest Management (IFM) Project in Maine. Weyerhaeuser will immediately retire these credits on behalf of the buyer. |

Weyerhaeuser Co President and CEO Devin Stockfish Sells 29,008 SharesOn December 20, 2023, Devin Stockfish, President and CEO of Weyerhaeuser Co (NYSE:WY), sold 29,008 shares of the company according to a recent SEC Filing. |

Weyerhaeuser to Release Fourth Quarter Results on January 25Weyerhaeuser Company (NYSE: WY) will release fourth quarter 2023 results on Thursday, January 25, after the market closes. The company will then hold a live webcast and conference call the following day, on Friday, January 26, at 7 a.m. Pacific (10 a.m. Eastern), to discuss the results. |

5 Market-Beating Construction Picks That Might Lose Steam in 2024Despite reducing inflationary pressure and stable interest rates, a few stocks in the construction sector are likely to perform tepidly in 2024. Let's check what is hurting WY, PCH, CHX, MTZ and HLMN. |

WY Price Returns

| 1-mo | 13.02% |

| 3-mo | 2.46% |

| 6-mo | -2.94% |

| 1-year | -4.67% |

| 3-year | 4.98% |

| 5-year | 47.03% |

| YTD | -7.58% |

| 2023 | 18.04% |

| 2022 | -20.44% |

| 2021 | 26.92% |

| 2020 | 13.04% |

| 2019 | 45.57% |

WY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WY

Want to do more research on Weyerhaeuser Co's stock and its price? Try the links below:Weyerhaeuser Co (WY) Stock Price | Nasdaq

Weyerhaeuser Co (WY) Stock Quote, History and News - Yahoo Finance

Weyerhaeuser Co (WY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...