Xenetic Biosciences, Inc. (XBIO): Price and Financial Metrics

XBIO Price/Volume Stats

| Current price | $4.28 | 52-week high | $5.97 |

| Prev. close | $4.23 | 52-week low | $2.87 |

| Day low | $3.99 | Volume | 18,500 |

| Day high | $4.38 | Avg. volume | 5,919 |

| 50-day MA | $4.00 | Dividend yield | N/A |

| 200-day MA | $3.82 | Market Cap | 6.60M |

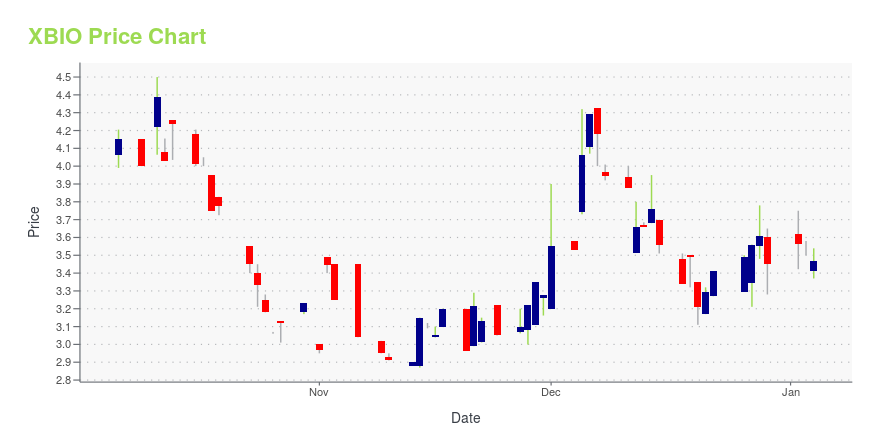

XBIO Stock Price Chart Interactive Chart >

Xenetic Biosciences, Inc. (XBIO) Company Bio

Xenetic Biosciences, Inc. operates as a biopharmaceutical company. The Company focuses on progressing XCART, a personalized CAR T platform technology engineered to target patient-specific tumor neoantigens, as well as offers cell-based therapeutics targeting the B-cell receptor on the surface of malignant tumor cells. Xenetic Biosciences serves patients in the United States.

Latest XBIO News From Around the Web

Below are the latest news stories about XENETIC BIOSCIENCES INC that investors may wish to consider to help them evaluate XBIO as an investment opportunity.

Most Shareholders Will Probably Agree With Xenetic Biosciences, Inc.'s (NASDAQ:XBIO) CEO CompensationKey Insights Xenetic Biosciences will host its Annual General Meeting on 6th of December Total pay for CEO Jeff... |

Xenetic Biosciences, Inc. Reports Third Quarter 2023 Financial ResultsEncouraging growing body of preclinical data guiding pathway to first in human trial for DNase-based oncology platformDriving development towards Phase 1 program for the treatment of pancreatic carcinoma and other locally advanced or metastatic solid ... |

Xenetic Biosciences, Inc. to Participate at the Virtual Investor Ask the CEO ConferenceLive moderated webcast with Jeffrey Eisenberg, Chief Executive Officer of Xenetic Biosciences on Tuesday, October 24th at 1:00 PM ETFRAMINGHAM, MA / ACCESSWIRE / October 11, 2023 / Xenetic Biosciences, Inc. (NASDAQ:XBIO) ("Xenetic" or the "Company"), ... |

Xenetic Biosciences, Inc. to Present at the H.C. Wainwright 25th Annual Global Investment ConferenceXenetic Biosciences, Inc. (NASDAQ:XBIO) ("Xenetic" or the "Company"), a biopharmaceutical company focused on advancing innovative immune-oncology technologies addressing hard to treat cancers, today announced that Jeffrey Eisenberg, Chief Executive Officer of Xenetic will present at the H.C. Wainwright 25th Annual Global Investment Conference being held September 11-13, 2023 in New York, NY and virtually. |

Xenetic Biosciences (XBIO) Reports Q2 Loss, Tops Revenue EstimatesXenetic Biosciences (XBIO) delivered earnings and revenue surprises of 38.94% and 47.96%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock? |

XBIO Price Returns

| 1-mo | 3.13% |

| 3-mo | 4.65% |

| 6-mo | 18.56% |

| 1-year | 13.83% |

| 3-year | -86.67% |

| 5-year | -82.09% |

| YTD | 24.05% |

| 2023 | 21.01% |

| 2022 | -77.90% |

| 2021 | -36.76% |

| 2020 | 41.67% |

| 2019 | -92.68% |

Loading social stream, please wait...