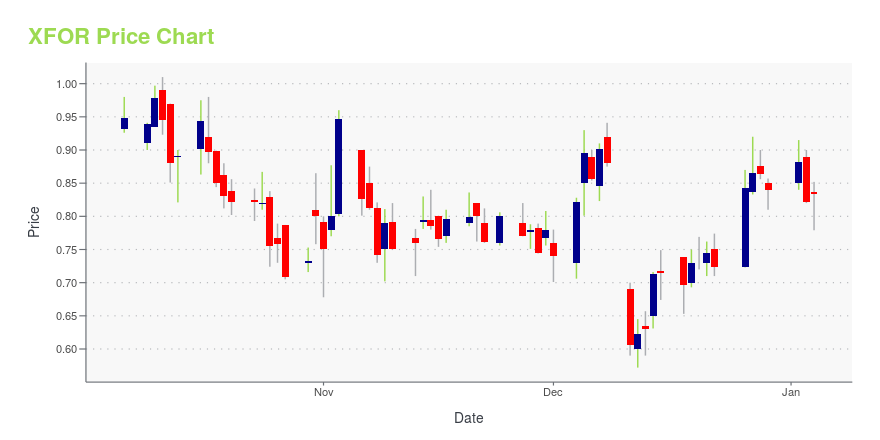

X4 Pharmaceuticals, Inc. (XFOR): Price and Financial Metrics

XFOR Price/Volume Stats

| Current price | $0.86 | 52-week high | $1.88 |

| Prev. close | $0.86 | 52-week low | $0.53 |

| Day low | $0.83 | Volume | 1,067,831 |

| Day high | $0.89 | Avg. volume | 2,520,722 |

| 50-day MA | $0.86 | Dividend yield | N/A |

| 200-day MA | $0.92 | Market Cap | 144.76M |

XFOR Stock Price Chart Interactive Chart >

X4 Pharmaceuticals, Inc. (XFOR) Company Bio

X4 Pharmaceuticals, Inc. operates as a clinical-stage biopharmaceutical company. The Company specializes in developing novel therapeutics designed to improve immune cell trafficking to treat rare diseases including primary immunodeficiencies and cancer. X4's oral small molecule drug candidates antagonize the CXCR4 pathway which plays a central role in immune surveillance.

Latest XFOR News From Around the Web

Below are the latest news stories about X4 PHARMACEUTICALS INC that investors may wish to consider to help them evaluate XFOR as an investment opportunity.

XFOR: Update on Phase 2 CN Trial at ASH 2023By David Bautz, PhD NASDAQ:XFOR READ THE FULL XFOR RESEARCH REPORT Business Update Case Studies of First Three Patients from Phase 2 CN Trial Presented at ASH 2023 On December 9, 2023, X4 Pharmaceuticals, Inc. (NASDAQ:XFOR) announced that additional preliminary data from the company’s ongoing Phase 2 clinical trial of mavorixafor in patients with chronic neutropenia (CN) was presented at the 2023 |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the trading week with a look at the biggest pre-market stock movers worth watching for Monday morning! |

X4 Pharmaceuticals Announces Presentation of Additional Data from Mavorixafor Phase 2 Trial in Chronic Neutropenia at ASH 2023Initial data continue to support advancement of mavorixafor into pivotal, global Phase 3 trial in certain chronic neutropenic disorders; company on track to initiate in 1H 2024 X4 expects to present additional CN Phase 2 clinical trial data in 1H 2024 BOSTON, Dec. 09, 2023 (GLOBE NEWSWIRE) -- X4 Pharmaceuticals (Nasdaq: XFOR), a company driven to improve the lives of people with rare diseases of the immune system, today announced the presentation of additional preliminary data from its ongoing P |

X4 Pharmaceuticals Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)BOSTON, Dec. 04, 2023 (GLOBE NEWSWIRE) -- X4 Pharmaceuticals (Nasdaq: XFOR), a company driven to improve the lives of people with rare diseases of the immune system, today announced that, effective on November 30, 2023, the company issued inducement awards to new employees under the X4 Pharmaceuticals, Inc. 2019 Inducement Equity Incentive Plan (the “2019 Inducement Plan”). The 2019 Inducement Plan is used exclusively for the grant of equity awards to individuals who were not previously an emplo |

XFOR: Mavorixafor NDA Accepted by FDA; PDUFA Date of April 30, 2024By David Bautz, PhD NASDAQ:XFOR READ THE FULL XFOR RESEARCH REPORT Business Update NDA Accepted for Priority Review; PDUFA Action Date of April 30, 2024 On October 31, 2023, X4 Pharmaceuticals, Inc. (NASDAQ:XFOR) announced that the U.S. Food and Drug Administration (FDA) has accepted for filing the company’s New Drug Application (NDA) for mavorixafor for the treatment of patients 12 and older |

XFOR Price Returns

| 1-mo | -14.00% |

| 3-mo | -26.18% |

| 6-mo | 11.00% |

| 1-year | -49.41% |

| 3-year | -84.45% |

| 5-year | -92.84% |

| YTD | 2.56% |

| 2023 | -15.56% |

| 2022 | -56.64% |

| 2021 | -64.39% |

| 2020 | -39.91% |

| 2019 | -23.13% |

Continue Researching XFOR

Want to see what other sources are saying about X4 Pharmaceuticals Inc's financials and stock price? Try the links below:X4 Pharmaceuticals Inc (XFOR) Stock Price | Nasdaq

X4 Pharmaceuticals Inc (XFOR) Stock Quote, History and News - Yahoo Finance

X4 Pharmaceuticals Inc (XFOR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...