EXAGEN INC. (XGN): Price and Financial Metrics

XGN Price/Volume Stats

| Current price | $6.98 | 52-week high | $7.95 |

| Prev. close | $6.97 | 52-week low | $1.78 |

| Day low | $6.81 | Volume | 90,815 |

| Day high | $7.05 | Avg. volume | 202,222 |

| 50-day MA | $6.83 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 148.67M |

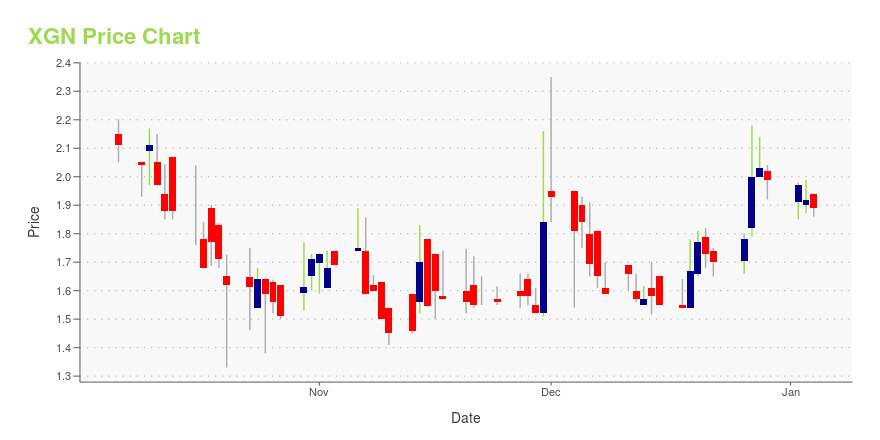

XGN Stock Price Chart Interactive Chart >

EXAGEN INC. (XGN) Company Bio

Exagen, Inc. is a commercial-stage diagnostics company. It engages in transforming the care continuum for patients suffering from debilitating and chronic autoimmune diseases by enabling timely differential diagnosis and optimizing therapeutic intervention. The company operates under the Avise brand.

XGN Price Returns

| 1-mo | -3.46% |

| 3-mo | 22.03% |

| 6-mo | 74.94% |

| 1-year | 263.54% |

| 3-year | -12.97% |

| 5-year | -41.00% |

| YTD | 70.24% |

| 2024 | 106.03% |

| 2023 | -17.08% |

| 2022 | -79.36% |

| 2021 | -11.89% |

| 2020 | -48.03% |

Loading social stream, please wait...