Xometry, Inc. (XMTR): Price and Financial Metrics

XMTR Price/Volume Stats

| Current price | $15.20 | 52-week high | $38.74 |

| Prev. close | $15.09 | 52-week low | $11.08 |

| Day low | $14.91 | Volume | 528,600 |

| Day high | $15.88 | Avg. volume | 644,084 |

| 50-day MA | $14.01 | Dividend yield | N/A |

| 200-day MA | $20.74 | Market Cap | 701.08M |

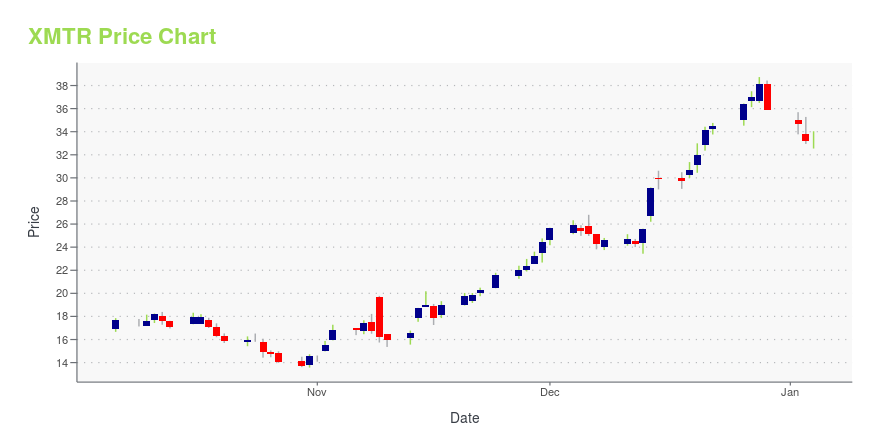

XMTR Stock Price Chart Interactive Chart >

Xometry, Inc. (XMTR) Company Bio

Xometry, Inc. operates an artificial intelligence (AI) enabled marketplace that enables buyers to source manufactured parts and assemblies. The company's platform offers CNC manufacturing, sheet metal manufacturing, 3D printing, sheet metal fabrication, die casting, injection molding and urethane casting, and other products. It serves product designers, engineers, buyers, and supply chain professionals. Xometry, Inc., through its subsidiary, Machine Tool & Supply Corporation, operates as a machine and tool supplier. The company was formerly known as NextLine Manufacturing Corp. and changed its name to Xometry, Inc. in June 2015. Xometry, Inc. was incorporated in 2013 and is headquartered in Derwood, Maryland.

Latest XMTR News From Around the Web

Below are the latest news stories about XOMETRY INC that investors may wish to consider to help them evaluate XMTR as an investment opportunity.

This Promising AI Stock Is Up Over 100% in the Last 2 Months and Still Has Long-Term Multibagger PotentialIs this the best platform for addressing a $2.4 trillion market? |

Xometry Inc CFO James Rallo Sells 5,000 SharesJames Rallo, the Chief Financial Officer of Xometry Inc (NASDAQ:XMTR), executed a sale of 5,000 shares of the company on December 20, 2023, according to a recent SEC Filing. |

Manufacturing CEOs Are Stepping Into 2024 Embracing AI, Accelerating Reshoring And Investing In High-Tech TalentDrawn From A Year’s Worth Of Proprietary Polling, Xometry’s 2024 Predictions Show An Industry Embracing High-Tech Tools And Talent To Navigate A Constantly Changing WorldModernizing Operations Remains The Priority, With Investments In AI And TalentAuto Execs Are Tapping The Brakes On EVs Though Sustainability Remains A Priority NORTH BETHESDA, Md., Dec. 19, 2023 (GLOBE NEWSWIRE) -- After a challenging 2023, manufacturing CEOs are stepping into 2024 overwhelmingly optimistic about the future and |

Xometry and Lazydays Holdings have been highlighted as Zacks Bull and Bear of the DayXometry and Lazydays Holdings are part of the Zacks Bull and Bear of the Day article. |

Bull Of The Day: Xometry (XMTR)This stock has all the buzzwords and is showing accelerating growth for 2024. |

XMTR Price Returns

| 1-mo | 25.98% |

| 3-mo | -13.29% |

| 6-mo | -52.90% |

| 1-year | -23.96% |

| 3-year | -78.64% |

| 5-year | N/A |

| YTD | -57.67% |

| 2023 | 11.42% |

| 2022 | -37.11% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...