Xunlei Limited - American Depositary Receipts (XNET): Price and Financial Metrics

XNET Price/Volume Stats

| Current price | $1.66 | 52-week high | $2.06 |

| Prev. close | $1.67 | 52-week low | $1.36 |

| Day low | $1.63 | Volume | 70,200 |

| Day high | $1.69 | Avg. volume | 66,578 |

| 50-day MA | $1.76 | Dividend yield | N/A |

| 200-day MA | $1.59 | Market Cap | 106.73M |

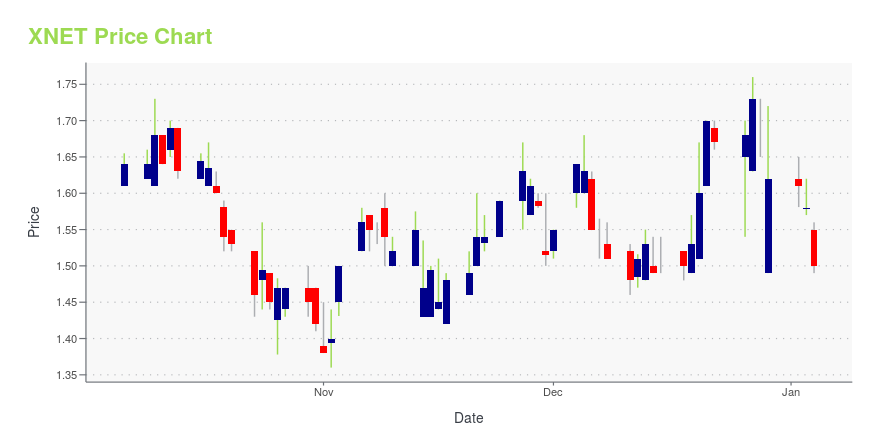

XNET Stock Price Chart Interactive Chart >

Xunlei Limited - American Depositary Receipts (XNET) Company Bio

Xunlei Limited operates an Internet platform for digital media content in China. was founded in 2003 and is based in Shenzhen, China.

Latest XNET News From Around the Web

Below are the latest news stories about XUNLEI LTD that investors may wish to consider to help them evaluate XNET as an investment opportunity.

Xunlei Limited (NASDAQ:XNET) Q3 2023 Earnings Call TranscriptXunlei Limited (NASDAQ:XNET) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Welcome, ladies and gentlemen, and thank you for your patience. You joined Xunlei’s 2023 Third Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode. Please be advised that today’s conference is being recorded. I would now like to […] |

Xunlei Announces Unaudited Financial Results for the Third Quarter Ended September 30, 2023SHENZHEN, China, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Xunlei Limited ("Xunlei" or the "Company") (NASDAQ: XNET), a leading innovator in shared cloud computing and blockchain technology in China, today announced its unaudited financial results for the third quarter ended September 30, 2023. Third Quarter 2023 Financial Highlights: Total revenues were US$84.2 million, a decrease of 4.6% year-over-year. Cloud computing revenues were US$29.5 million, an increase of 1.4% year-over-year. Subscription rev |

Xunlei Limited Schedules 2023 Unaudited Third Quarter Earnings Release on November 14, 2023SHENZHEN, China, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Xunlei Limited (“Xunlei” or the “Company”) (NASDAQ: XNET), a leading innovator in shared cloud computing and blockchain technology in China, today announced that it plans to release its unaudited financial results for the third quarter ended September 30, 2023 on November 14, 2023 before market open. The earnings press release will be available on the Company's investor relations page at http://ir.xunlei.com. Conference Call Xunlei's management |

Returns Are Gaining Momentum At Xunlei (NASDAQ:XNET)If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an... |

Xunlei Announces Changes of Board of DirectorsSHENZHEN, China, Sept. 01, 2023 (GLOBE NEWSWIRE) -- Xunlei Limited (“Xunlei”) (Nasdaq: XNET), a leading innovator in shared cloud computing and blockchain technology in China, today announced the resignation of Mr. Sean Shenglong Zou and Mr. Hui Duan as directors of the Company for personal reasons from August 31, 2023. Mr. Jinbo Li, Chairman and Chief Executive Officer of Xunlei, stated “On behalf of the board of directors and the management of the Company, I wish to express my appreciation of |

XNET Price Returns

| 1-mo | -2.64% |

| 3-mo | 5.73% |

| 6-mo | 8.85% |

| 1-year | -17.41% |

| 3-year | -54.52% |

| 5-year | -29.06% |

| YTD | 2.47% |

| 2023 | -10.99% |

| 2022 | -9.45% |

| 2021 | -30.45% |

| 2020 | -41.02% |

| 2019 | 44.12% |

Continue Researching XNET

Here are a few links from around the web to help you further your research on Xunlei Ltd's stock as an investment opportunity:Xunlei Ltd (XNET) Stock Price | Nasdaq

Xunlei Ltd (XNET) Stock Quote, History and News - Yahoo Finance

Xunlei Ltd (XNET) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...