Xos, Inc. (XOS): Price and Financial Metrics

XOS Price/Volume Stats

| Current price | $6.18 | 52-week high | $19.80 |

| Prev. close | $6.11 | 52-week low | $5.50 |

| Day low | $6.11 | Volume | 9,700 |

| Day high | $6.24 | Avg. volume | 16,041 |

| 50-day MA | $7.12 | Dividend yield | N/A |

| 200-day MA | $8.41 | Market Cap | 48.66M |

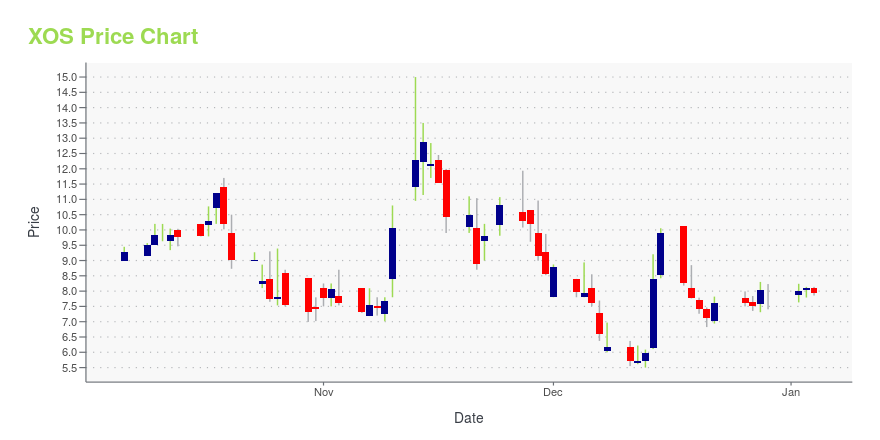

XOS Stock Price Chart Interactive Chart >

Xos, Inc. (XOS) Company Bio

Xos, Inc., an electric mobility company, manufactures and sells electric commercial vehicles. It designs and develops fully electric battery mobility systems primarily for commercial fleets. The company is headquartered in Los Angeles, California.

Latest XOS News From Around the Web

Below are the latest news stories about XOS INC that investors may wish to consider to help them evaluate XOS as an investment opportunity.

Xos Announces 1-for-30 Reverse Stock SplitLOS ANGELES, Dec. 01, 2023 (GLOBE NEWSWIRE) -- Xos, Inc. (Nasdaq: XOS), a leading electric truck manufacturer and fleet electrification services provider, today announced that it intends to effect a 1-for-30 reverse stock split of its issued and outstanding shares of common stock, effective at 5:00 p.m. Eastern Time on December 6, 2023. Beginning on December 7, 2023, Xos’ common stock with the ticker symbol “XOS” will continue to trade on the Nasdaq Capital Market (“Nasdaq”) on a split-adjusted |

3 EV Stocks Still Flying Under Wall Street’s RadarWager on these three under-the-radar EV stocks reshaping the auto industry, while offering solid long-term rewards ahead |

Xos, Inc. Reports Third Quarter 2023 ResultsDelivered 105 units in the quarter, the highest quarterly volume to date, and a 176% quarter-over-quarter increaseAchieved average positive GAAP gross margin of over $18,000 per unitLOS ANGELES, CA / ACCESSWIRE / November 9, 2023 / Xos, Inc. (NASDAQ:XOS) ... |

Penske Truck Leasing Adds Xos Stepvan to its Electric Fleet OfferingPenske Branded Stepvan Driving on a Treelined Street Penske Branded Stepvan Driving on a Treelined Street LOS ANGELES, Oct. 26, 2023 (GLOBE NEWSWIRE) -- Xos, Inc. (NASDAQ: XOS), a leading electric truck manufacturer and fleet electrification services provider, today announced Penske Truck Leasing has added Xos 100% battery-electric trucks to its fleet. Penske will deploy the trucks with multiple customers in various industries. "We are very pleased to build on our growing portfolio of all-electr |

Xos, Inc. Announces Third Quarter 2023 Earnings Release Date and Conference CallLOS ANGELES, Oct. 24, 2023 (GLOBE NEWSWIRE) -- Xos, Inc. (NASDAQ: XOS), a leading electric truck manufacturer and fleet services provider, announced it will release its third quarter 2023 operating results on Thursday, November 9, 2023 after the close of the U.S. financial markets. Management will host a conference call to discuss these financial results at 4:30 p.m. Eastern Daylight Time / 1:30 p.m. Pacific Daylight Time that same day. Conference Call and Webcast Details Date / Time:Thursday, N |

XOS Price Returns

| 1-mo | -8.98% |

| 3-mo | -18.25% |

| 6-mo | -24.91% |

| 1-year | -45.04% |

| 3-year | -97.92% |

| 5-year | N/A |

| YTD | -22.56% |

| 2023 | -39.94% |

| 2022 | -85.94% |

| 2021 | -68.72% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...