Xponential Fitness, Inc. (XPOF): Price and Financial Metrics

XPOF Price/Volume Stats

| Current price | $17.80 | 52-week high | $24.00 |

| Prev. close | $17.46 | 52-week low | $7.40 |

| Day low | $17.28 | Volume | 268,638 |

| Day high | $17.93 | Avg. volume | 770,513 |

| 50-day MA | $13.61 | Dividend yield | N/A |

| 200-day MA | $13.05 | Market Cap | 855.68M |

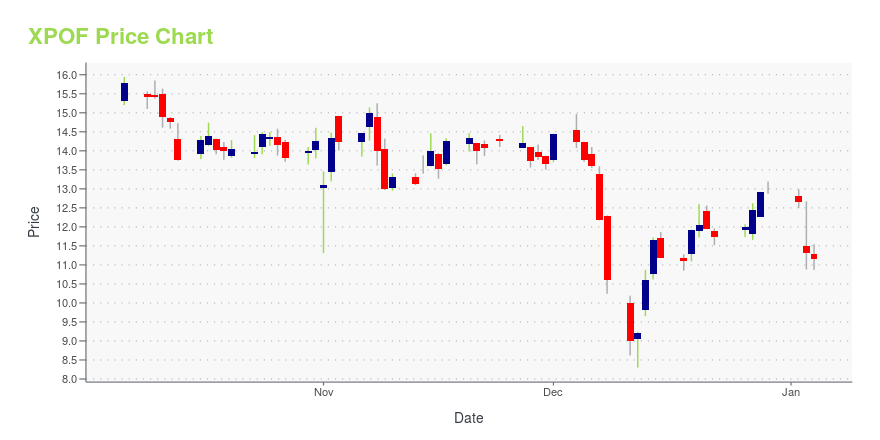

XPOF Stock Price Chart Interactive Chart >

Xponential Fitness, Inc. (XPOF) Company Bio

Xponential Fitness, Inc., through its subsidiaries, operates as a boutique fitness franchisor in North America and internationally. The company offers fitness and wellness workouts, including Pilates, barre, cycling, stretch, rowing, yoga, boxing, dance, and running under the Club Pilates, Pure Barre, CycleBar, Stretch Lab, Row House, Yoga Six, Rumble, AKT, and Stride brand names. As of March 31, 2021, it had 1,060 franchisees operating 1,775 open studios on an adjusted basis. The company was founded in 2017 and is headquartered in Irvine, California.

Latest XPOF News From Around the Web

Below are the latest news stories about XPONENTIAL FITNESS INC that investors may wish to consider to help them evaluate XPOF as an investment opportunity.

Xponential Fitness, Inc. Announces Participation at Upcoming ICR and Jefferies ConferencesIRVINE, Calif., December 27, 2023--Xponential Fitness, Inc. (NYSE: XPOF) (the "Company" or "Xponential Fitness"), the largest global franchisor of health and wellness brands, today announced Anthony Geisler, Chief Executive Officer, John Meloun, Chief Financial Officer, and Sarah Luna, President, will participate in the following upcoming investor conferences: |

Xponential Fitness, Inc. and American Cancer Society Announce National PartnershipIRVINE, Calif., December 12, 2023--Xponential Fitness, Inc. (NYSE: XPOF) ("Xponential" or "the Company"), the largest global franchisor of health and wellness brands, and the American Cancer Society, the only organization combating cancer through advocacy, research, and patient support, to ensure that everyone has an opportunity to prevent, detect, treat, and survive cancer, today announced a national partnership launching in January aimed at leveraging the power of health, wellness and fitness |

Xponential (XPOF) Enters Into a Partnership With KINRGYXponential (XPOF) partners with KINRGY to launch brick-and-mortar KINRGY studio locations. |

Xponential Fitness, Inc. Partners with KINRGY to Transform the Leading Fitness and Dance Platform into Brick-and-Mortar ExperienceIRVINE, Calif., December 05, 2023--Xponential Fitness, Inc. (NYSE: XPOF) ("Xponential" or "the Company"), the largest global franchisor of health and wellness brands, today announced that it has partnered with KINRGY, a dance and fitness platform founded by Julianne Hough to launch brick-and-mortar KINRGY studio locations. Under the terms of the agreement, Xponential will acquire certain intellectual property of KINRGY and up to three existing AKT, Xponential’s dance-cardio brand, studio locatio |

Xponential Fitness, Inc. Agrees to Acquire Lindora and Further Solidifies Holistic Approach to Health and WellnessIRVINE, Calif., December 04, 2023--Xponential Fitness, Inc. (NYSE: XPOF) ("Xponential" or "the Company"), the largest global franchisor of health and wellness brands, today announced that it has agreed to acquire Lindora, a leading metabolic health brand. Under the terms of the transaction, the 31 existing Lindora clinics will become Xponential franchise locations. Xponential will acquire all of the intellectual property of Lindora and plans to franchise the brand nationally and globally. Given |

XPOF Price Returns

| 1-mo | 15.66% |

| 3-mo | 38.95% |

| 6-mo | 51.75% |

| 1-year | -9.32% |

| 3-year | 46.99% |

| 5-year | N/A |

| YTD | 38.09% |

| 2023 | -43.79% |

| 2022 | 12.18% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...