22nd Century Group, Inc. (XXII): Price and Financial Metrics

XXII Price/Volume Stats

| Current price | $5.10 | 52-week high | $581.85 |

| Prev. close | $6.19 | 52-week low | $3.90 |

| Day low | $5.00 | Volume | 788,600 |

| Day high | $6.50 | Avg. volume | 4,499,927 |

| 50-day MA | $9.60 | Dividend yield | N/A |

| 200-day MA | $83.10 | Market Cap | 2.83M |

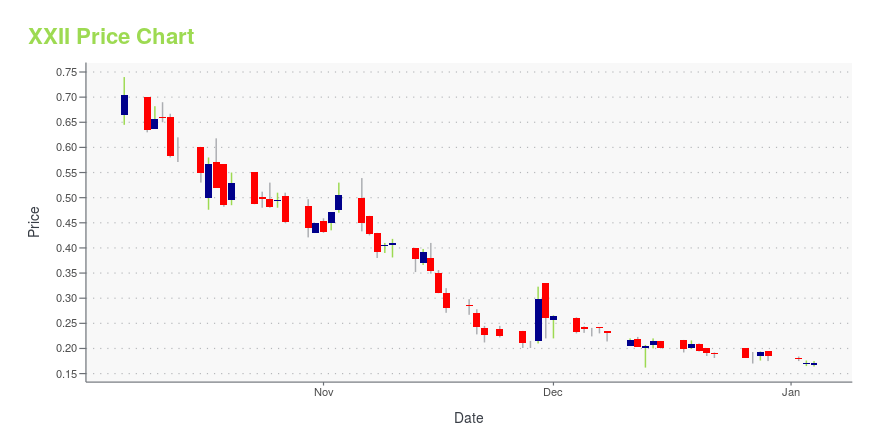

XXII Stock Price Chart Interactive Chart >

22nd Century Group, Inc. (XXII) Company Bio

22nd Century Group, Inc., a plant biotechnology company, provides technology that allows for the level of nicotine and other nicotinic alkaloids in tobacco plants to be decreased or increased through genetic engineering and plant breeding. The company was founded in 1998 and is based in Clarence, New York.

XXII Price Returns

| 1-mo | 3.03% |

| 3-mo | -69.03% |

| 6-mo | -94.76% |

| 1-year | -98.64% |

| 3-year | -99.99% |

| 5-year | -99.99% |

| YTD | -3.95% |

| 2024 | -98.68% |

| 2023 | -98.65% |

| 2022 | -70.21% |

| 2021 | 40.45% |

| 2020 | 100.00% |

Continue Researching XXII

Here are a few links from around the web to help you further your research on 22nd Century Group Inc's stock as an investment opportunity:22nd Century Group Inc (XXII) Stock Price | Nasdaq

22nd Century Group Inc (XXII) Stock Quote, History and News - Yahoo Finance

22nd Century Group Inc (XXII) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...