Xylem Inc. (XYL): Price and Financial Metrics

XYL Price/Volume Stats

| Current price | $140.84 | 52-week high | $146.08 |

| Prev. close | $137.13 | 52-week low | $87.59 |

| Day low | $137.82 | Volume | 1,074,100 |

| Day high | $142.13 | Avg. volume | 1,195,986 |

| 50-day MA | $138.81 | Dividend yield | 1.02% |

| 200-day MA | $121.41 | Market Cap | 34.15B |

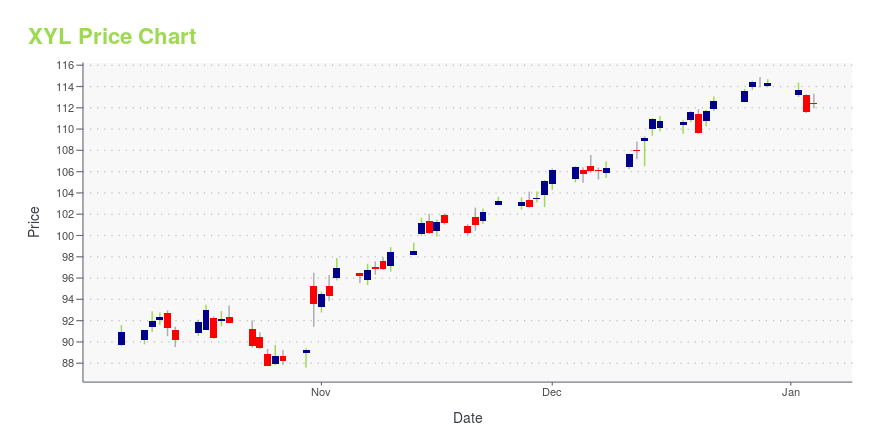

XYL Stock Price Chart Interactive Chart >

Xylem Inc. (XYL) Company Bio

Xylem Inc. is a large American water technology provider, in public utility, residential, commercial, agricultural and industrial settings. The company does business in more than 150 countries. Launched in 2011 as the spinoff of the water-related businesses of ITT Corporation, Xylem is headquartered in Rye Brook, New York, with 2018 revenues of $5.2 billion and 17,000 employees worldwide. (Source:Wikipedia)

Latest XYL News From Around the Web

Below are the latest news stories about XYLEM INC that investors may wish to consider to help them evaluate XYL as an investment opportunity.

Water Wealth: 3 Stocks Tapping into Liquid GoldWhile mining for gold or cryptocurrencies offer a sexier path to profits, at a basic level, nothing beats the permanent narrative underlying water stocks. |

The Zacks Analyst Blog Highlights NVIDIA, Oracle, The TJX Companies, Chubb and XylemNVIDIA, Oracle, The TJX Companies, Chubb and Xylem are part of the Zacks top Analyst Blog . |

Top Stock Reports for NVIDIA, Oracle & The TJX CompaniesToda's Research Daily features new research reports on 16 major stocks, including NVIDIA Corporation (NVDA), Oracle Corporation (ORCL) and The TJX Companies, Inc. (TJX). |

Here's Why Investing in Xylem (XYL) Stock Makes Sense NowXylem (XYL) benefits from strength in the Measurement & Control Solutions segment and the acquisition of Evoqua. Its measures to reward its shareholders are encouraging. |

Manufacturing Activity Poised for Rebound in 2024: 5 PicksStocks like Eaton Corporation (ETN), A. O. Smith Corporation (AOS), Xylem (XYL), Graham Corporation (GHM) and Applied Industrial Technologies (AIT) are poised to benefit from the jump in durable goods orders. |

XYL Price Returns

| 1-mo | 3.26% |

| 3-mo | 6.65% |

| 6-mo | 24.93% |

| 1-year | 26.57% |

| 3-year | 18.73% |

| 5-year | 84.89% |

| YTD | 23.84% |

| 2023 | 4.77% |

| 2022 | -6.60% |

| 2021 | 18.94% |

| 2020 | 30.90% |

| 2019 | 19.59% |

XYL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching XYL

Want to do more research on Xylem Inc's stock and its price? Try the links below:Xylem Inc (XYL) Stock Price | Nasdaq

Xylem Inc (XYL) Stock Quote, History and News - Yahoo Finance

Xylem Inc (XYL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...