Yellow Corp. (YELL): Price and Financial Metrics

YELL Price/Volume Stats

| Current price | $1.10 | 52-week high | $7.89 |

| Prev. close | $1.55 | 52-week low | $0.43 |

| Day low | $1.00 | Volume | 8,127,100 |

| Day high | $1.52 | Avg. volume | 5,781,654 |

| 50-day MA | $1.49 | Dividend yield | N/A |

| 200-day MA | $2.27 | Market Cap | 57.18M |

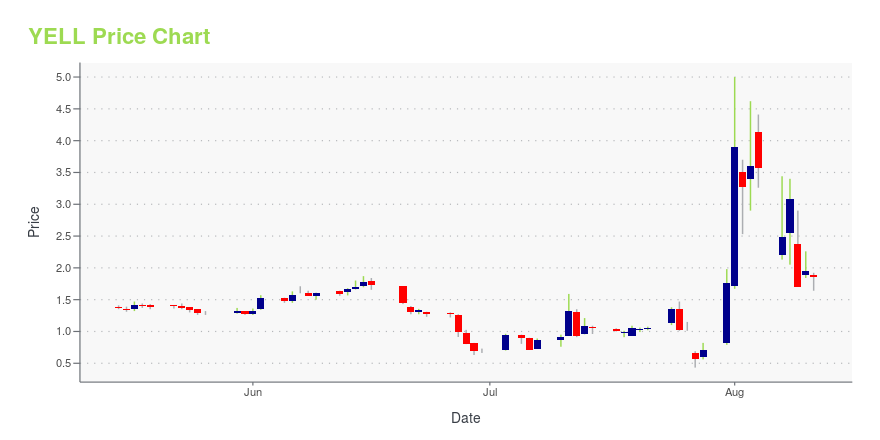

YELL Stock Price Chart Interactive Chart >

Yellow Corp. (YELL) Company Bio

Yellow Corp. operates as a holding company, which through its subsidiaries engages in the provision of transportation services. It operates through the portfolio of LTL brands including Holland, New Penn, Reddaway, and YRC Freight, as well as the logistics company. The company was founded by A. J. Harrell in 1924 and is headquartered in Overland Park, KS.

Latest YELL News From Around the Web

Below are the latest news stories about YELLOW CORP that investors may wish to consider to help them evaluate YELL as an investment opportunity.

3 Penny Stocks to Sell in August Before They Crash and BurnTraders love a good penny stock opportunity. |

YELL Stock Alert: Yellow Receives MORE Bankruptcy Loan OffersShareholders in now-bankrupt trucking company Yellow continue to be in selling mode, with YELL stock declining today despite catalysts. |

Yellow Expects to Pay Back Private, Government Loans in BankruptcyBankrupt trucking giant Yellow said it has enough real estate and equipment it can sell to cover $1.2 billion it borrowed from the U.S. government and private lenders led by Apollo Global Management. |

Why Is Tango Therapeutics (TNGX) Stock Up 117% Today?Tango Therapeutics (TNGX) stock is soaring higher on Wednesday after getting a couple of updates from analysts covering the shares. |

YELL Stock Alert: Yellow Receives Nasdaq Delisting NoticeYellow (YELL) stock is falling on Wednesday after the struggling U.S. trucking company received a Nasdaq delisting notice! |

YELL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 92.98% |

| 3-year | -77.69% |

| 5-year | -67.16% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -80.06% |

| 2021 | 184.20% |

| 2020 | 73.73% |

| 2019 | -19.05% |

Loading social stream, please wait...