MingZhu Logistics Holdings Ltd. (YGMZ): Price and Financial Metrics

YGMZ Price/Volume Stats

| Current price | $1.32 | 52-week high | $7.54 |

| Prev. close | $1.37 | 52-week low | $1.23 |

| Day low | $1.23 | Volume | 73,143 |

| Day high | $1.41 | Avg. volume | 138,908 |

| 50-day MA | $2.36 | Dividend yield | N/A |

| 200-day MA | $3.53 | Market Cap | 6.13M |

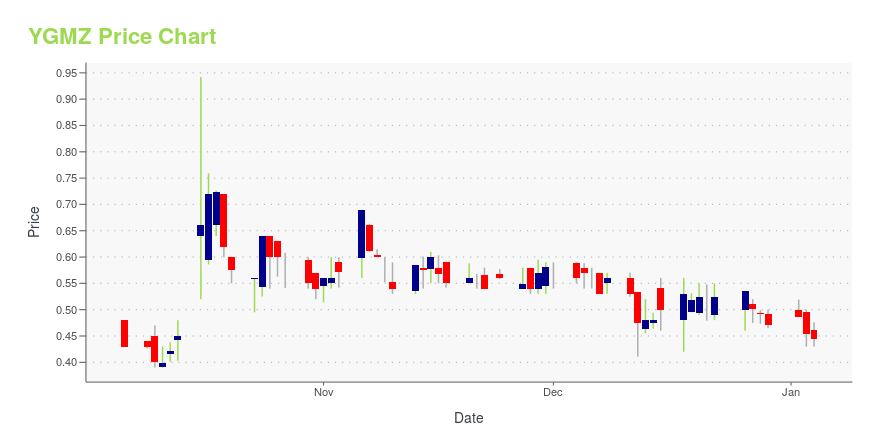

YGMZ Stock Price Chart Interactive Chart >

MingZhu Logistics Holdings Ltd. (YGMZ) Company Bio

MingZhu Logistics Holdings Ltd. is a transportation company, which engages in the provision of trucking and delivery services. It also operates a truckload fleet. The company was founded by Jin Long Yang in 2002 and is headquartered in Shenzhen, China.

Latest YGMZ News From Around the Web

Below are the latest news stories about MINGZHU LOGISTICS HOLDINGS LTD that investors may wish to consider to help them evaluate YGMZ as an investment opportunity.

Why Is ContraFect (CFRX) Stock Up 23% Today?ContraFect stock is on the move Monday with heavy trading of CFRX as investors react to the latest clinical trial update from the FDA! |

Why Is MingZhu Logistics (YGMZ) Stock Up 54% Today?MingZhu Logistics stock is a hot topic on Monday as shares of YGMZ rally higher despite a lack of news and heavy trading. |

Why Is Sigma Additive Solutions (SASI) Stock Down 27% Today?Sigma Additive Solutions stock is sliding lower on Monday as shares of SASI give up gains from an acquisition announcement on Friday! |

Why Is Nxu (NXU) Stock Down Today?Nxu stock is falling on Monday after the company reported insider selling of its shares as well as addressing a delisting notice. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start off the week with a breakdown of the biggest pre-market stock movers worth watching on Monday morning! |

YGMZ Price Returns

| 1-mo | -51.48% |

| 3-mo | -61.27% |

| 6-mo | -63.33% |

| 1-year | -77.86% |

| 3-year | -95.56% |

| 5-year | N/A |

| YTD | -64.89% |

| 2023 | -44.15% |

| 2022 | -58.95% |

| 2021 | -79.82% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...