The York Water Company (YORW): Price and Financial Metrics

YORW Price/Volume Stats

| Current price | $41.14 | 52-week high | $42.49 |

| Prev. close | $40.70 | 52-week low | $33.32 |

| Day low | $40.80 | Volume | 32,200 |

| Day high | $41.31 | Avg. volume | 59,692 |

| 50-day MA | $37.70 | Dividend yield | 2.07% |

| 200-day MA | $36.89 | Market Cap | 590.15M |

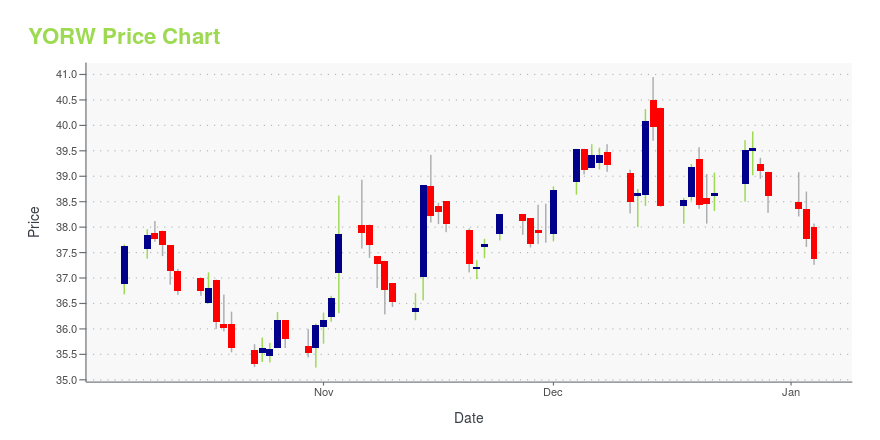

YORW Stock Price Chart Interactive Chart >

The York Water Company (YORW) Company Bio

The York Water Company impounds, purifies, and distributes drinking water. It owns and operates two wastewater collection and treatment systems. The company was founded in 1816 and is based in York, Pennsylvania.

Latest YORW News From Around the Web

Below are the latest news stories about YORK WATER CO that investors may wish to consider to help them evaluate YORW as an investment opportunity.

Reasons to Add The York Water (YORW) to Your Portfolio NowThe York Water Company (YORW) is an attractive stock to accumulate in the water industry given its long history of dividend payments, stable ROE and rising earnings estimates. |

Forever Favorites: 7 Dividend Stocks to Buy and Never SellSome investments just look after themselves. |

12 High Growth Utility Stocks to BuyIn this article, we will take a look at the 12 high growth utility stocks to buy. To skip our analysis of the recent market trends and activity, you can go directly to see the 5 High Growth Utility Stocks to Buy. The U.S. power and utilities industry maintained its focus on increasing its decarbonization […] |

2 Utility Stocks to Buy Hand Over Fist in 2024 and 1 to Avoid Like the PlagueTwo safe-haven utility stocks are phenomenal bargains following a difficult year, while another previously time-tested utility is rife with red flags. |

York Water (NASDAQ:YORW) Is Increasing Its Dividend To $0.2108The York Water Company's ( NASDAQ:YORW ) dividend will be increasing from last year's payment of the same period to... |

YORW Price Returns

| 1-mo | 11.88% |

| 3-mo | 16.97% |

| 6-mo | 16.88% |

| 1-year | 2.23% |

| 3-year | -8.62% |

| 5-year | 26.63% |

| YTD | 7.77% |

| 2023 | -12.40% |

| 2022 | -7.93% |

| 2021 | 8.60% |

| 2020 | 2.67% |

| 2019 | 46.40% |

YORW Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching YORW

Want to do more research on York Water Co's stock and its price? Try the links below:York Water Co (YORW) Stock Price | Nasdaq

York Water Co (YORW) Stock Quote, History and News - Yahoo Finance

York Water Co (YORW) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...