Zedge, Inc. (ZDGE): Price and Financial Metrics

ZDGE Price/Volume Stats

| Current price | $3.81 | 52-week high | $5.18 |

| Prev. close | $3.85 | 52-week low | $1.68 |

| Day low | $3.73 | Volume | 29,125 |

| Day high | $3.91 | Avg. volume | 68,690 |

| 50-day MA | $3.10 | Dividend yield | N/A |

| 200-day MA | $2.72 | Market Cap | 53.13M |

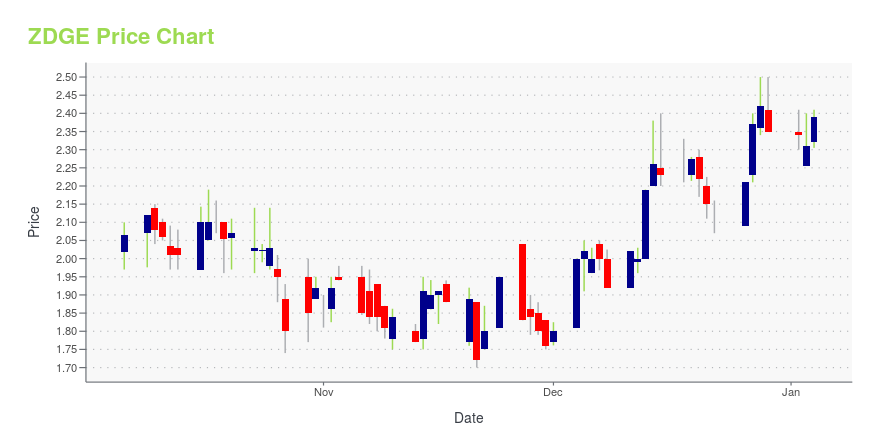

ZDGE Stock Price Chart Interactive Chart >

Zedge, Inc. (ZDGE) Company Bio

Zedge, Inc. operates as a content distribution platform. The Company enables consumers to personalize their mobile devices with free ringtones, wallpapers, home screen application icons and notification sounds. Zedge serves customers worldwide.

Latest ZDGE News From Around the Web

Below are the latest news stories about ZEDGE INC that investors may wish to consider to help them evaluate ZDGE as an investment opportunity.

Zedge, Inc. (AMEX:ZDGE) Q1 2024 Earnings Call TranscriptZedge, Inc. (AMEX:ZDGE) Q1 2024 Earnings Call Transcript December 13, 2023 Operator: Good afternoon and welcome to Zedge’s Earnings Conference Call for the First Fiscal Quarter 2024 Results. During management’s prepared remarks, all participants will be in listen-only mode. [Operator Instructions] After today’s presentation by Zedge’s management, there will be an opportunity to ask questions. […] |

ZDGE Stock Earnings: Zedge Beats Revenue for Q1 2024ZDGE stock results show that Zedge beat on revenue for the first quarter of 2024. |

Q1 2024 Zedge Inc Earnings CallQ1 2024 Zedge Inc Earnings Call |

Zedge Announces First Quarter Fiscal 2024 ResultsNEW YORK, NY / ACCESSWIRE / December 13, 2023 / Zedge, Inc. (NYSE American:ZDGE), a leader in building digital marketplaces and friendly competitive games around content that people use to express themselves, today announced results for its first ... |

Zedge to Report First Fiscal Quarter 2024 ResultsNEW YORK, NY / ACCESSWIRE / December 6, 2023 / Zedge, Inc. (NYSE American:ZDGE) will report financial and operational results for its first fiscal quarter 2024, ended October 31, 2023.Zedge's earnings release will be filed on Form 8-K and posted on ... |

ZDGE Price Returns

| 1-mo | 33.68% |

| 3-mo | 59.41% |

| 6-mo | 34.63% |

| 1-year | 73.97% |

| 3-year | -77.96% |

| 5-year | 130.91% |

| YTD | 62.13% |

| 2023 | 33.52% |

| 2022 | -79.29% |

| 2021 | 40.73% |

| 2020 | 292.21% |

| 2019 | -37.14% |

Continue Researching ZDGE

Want to see what other sources are saying about Zedge Inc's financials and stock price? Try the links below:Zedge Inc (ZDGE) Stock Price | Nasdaq

Zedge Inc (ZDGE) Stock Quote, History and News - Yahoo Finance

Zedge Inc (ZDGE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...