Ecoark Holdings, Inc. (ZEST): Price and Financial Metrics

ZEST Price/Volume Stats

| Current price | $0.17 | 52-week high | $2.80 |

| Prev. close | $0.18 | 52-week low | $0.16 |

| Day low | $0.17 | Volume | 611,200 |

| Day high | $0.20 | Avg. volume | 536,900 |

| 50-day MA | $0.27 | Dividend yield | N/A |

| 200-day MA | $1.14 | Market Cap | 6.56M |

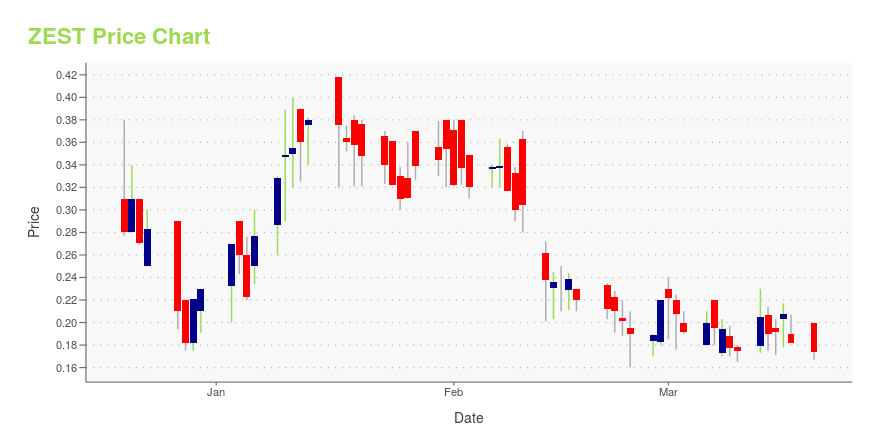

ZEST Stock Price Chart Interactive Chart >

Ecoark Holdings, Inc. (ZEST) Company Bio

Ecoark Holdings, Inc. engages in the development of solutions that reduce food waste, improve delivered freshness and product margins for fresh and perishable foods through its subsidiary. It operates through three segments technology, commodities & financial. The company was founded by Randy Scott May on November 19, 2007 and is headquartered in San Antonio, TX.

Latest ZEST News From Around the Web

Below are the latest news stories about ECOARK HOLDINGS INC that investors may wish to consider to help them evaluate ZEST as an investment opportunity.

Ault Alliance and Ecoark Holdings Announce BITNILE.COM Has Surpassed 225,000 Active Users in Under Two Weeks From LaunchLAS VEGAS, March 14, 2023 (GLOBE NEWSWIRE) -- Ault Alliance, Inc. (NYSE American: AULT), a diversified holding company (“Ault Alliance” or “Company” ) and Ecoark Holdings, Inc., to be renamed BitNile Metaverse Inc. (“Ecoark”) (Nasdaq: ZEST) announced today that in just 12 days from the launch of the early access version of its metaverse platform (“Platform”), BITNILE.COM has surpassed the milestone of 225,000 7-day active users. The Platform, which went live to the public on March 1, 2023, offer |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're starting the final day of the week with a breakdown of the biggest pre-market stock movers worth watching on Friday! |

Ecoark Holdings Plans to Change Its Name to BitNile MetaverseCompany to focus on building out its browser-based metaverse solution as its core business to capture market share in booming metaverse industrySAN ANTONIO, March 10, 2023 (GLOBE NEWSWIRE) -- Ecoark Holdings, Inc. (NASDAQ: ZEST) (“Ecoark” or the “Company”) today announced its plan to rename the company to “BitNile Metaverse Inc.”, and change its stock ticker symbol to “BNMV”. The name and ticker symbol change are subject to regulatory approval and are expected to be completed within the next 10 |

Ault Alliance and Ecoark Holdings Complete $100 Million Share Exchange Agreement for BITNILE.COM Metaverse PlatformAult Alliance and Ecoark Holdings join forces to capture market share in booming metaverse industryLAS VEGAS, March 07, 2023 (GLOBE NEWSWIRE) -- Ault Alliance, Inc. (NYSE American: AULT), a diversified holding company (“Ault Alliance”) and Ecoark Holdings, Inc. (“Ecoark”) (NASDAQ: ZEST) announced today that they have completed the previously announced share exchange agreement (the “Agreement”), whereby Ault Alliance and other founders sold BitNile.com, Inc., including the BITNILE.COM metaverse p |

Ault Alliance and Ecoark Holdings Remind Stockholders to Participate in Online Tour of BitNile.comThe Metaverse The Metaverse Online Tour Scheduled for Today – Tuesday, February 28, 2023 at 3:00pm PT / 6:00pm ET BitNile.com to launch what it believes to be the first metaverse super-app that runs entirely in web browser with no pixel LAS VEGAS, Feb. 28, 2023 (GLOBE NEWSWIRE) -- Ault Alliance, Inc. (NYSE American: AULT), a diversified holding company (“Ault Alliance”) and Ecoark Holdings, Inc. (“Ecoark”) (NASDAQ: ZEST) today reminded investors to participate in the online tour of its next-gene |

ZEST Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -96.77% |

| 5-year | -95.07% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -89.70% |

| 2021 | -77.70% |

| 2020 | 120.85% |

| 2019 | 13.20% |

Loading social stream, please wait...