ZIM Integrated Shipping Services Ltd. (ZIM): Price and Financial Metrics

ZIM Price/Volume Stats

| Current price | $17.03 | 52-week high | $23.82 |

| Prev. close | $17.38 | 52-week low | $6.39 |

| Day low | $16.53 | Volume | 3,652,693 |

| Day high | $17.34 | Avg. volume | 6,263,484 |

| 50-day MA | $19.69 | Dividend yield | 5.03% |

| 200-day MA | $12.96 | Market Cap | 2.05B |

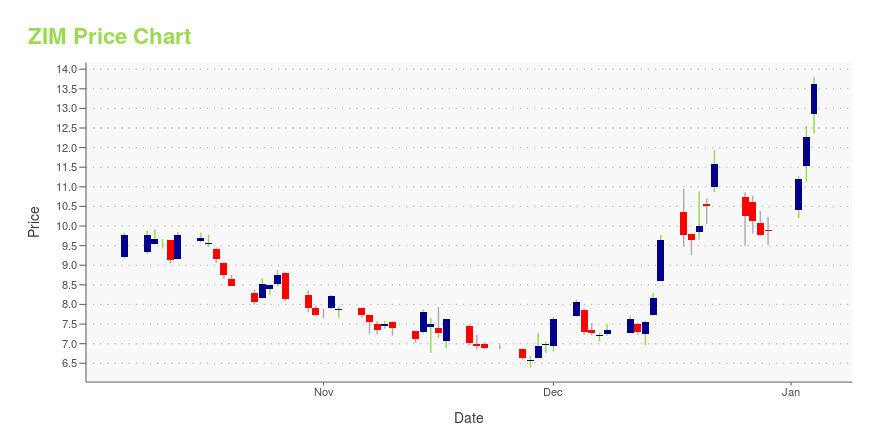

ZIM Stock Price Chart Interactive Chart >

ZIM Integrated Shipping Services Ltd. (ZIM) Company Bio

ZIM Integrated Shipping Services Ltd. engages in the provision of shipping and logistics services. It offers services such as shipping agencies, storage, distribution, forwarding and land transportation. The company was founded in 1945 and is headquartered in Haifa, Israel.

Latest ZIM News From Around the Web

Below are the latest news stories about ZIM INTEGRATED SHIPPING SERVICES LTD that investors may wish to consider to help them evaluate ZIM as an investment opportunity.

Red Sea ship attacks send ocean freight rates soaringMore on ZIM Integrated Shipping |

How safe is Red Sea? Different shipping lines have different answersShipping stocks are under pressure as some ocean carriers show faith in military protection from Red Sea attacks. The post How safe is Red Sea? Different shipping lines have different answers appeared first on FreightWaves. |

Stocks Extend Gains As Oil Prices RiseThe short sprint to the end of 2023 is off to a good start, with the Dow Jones Industrial Average, S&P 500 Index, and Nasdaq Composite all sporting solid gains this afternoon. |

Stocks Flat Despite Improving Consumer SentimentStocks are muted this afternoon, with both the Dow Jones Industrial Average and S&P 500 Index trading near breakeven. |

Why Are Shipping Stocks ZIM, GNK, EGLE, SBLK Up Today?Shipping stocks are up on Monday after BP announced that it will no longer be using shipping routes that travel through the Red Sea. |

ZIM Price Returns

| 1-mo | -21.16% |

| 3-mo | 30.22% |

| 6-mo | 28.08% |

| 1-year | 19.63% |

| 3-year | 16.78% |

| 5-year | N/A |

| YTD | 74.41% |

| 2023 | -21.06% |

| 2022 | -52.70% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

ZIM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...