China Southern Airlines Company Limited (ZNH): Price and Financial Metrics

ZNH Price/Volume Stats

| Current price | $33.08 | 52-week high | $36.12 |

| Prev. close | $33.06 | 52-week low | $23.50 |

| Day low | $32.79 | Volume | 20,000 |

| Day high | $33.30 | Avg. volume | 39,686 |

| 50-day MA | $32.61 | Dividend yield | N/A |

| 200-day MA | $28.55 | Market Cap | 11.21B |

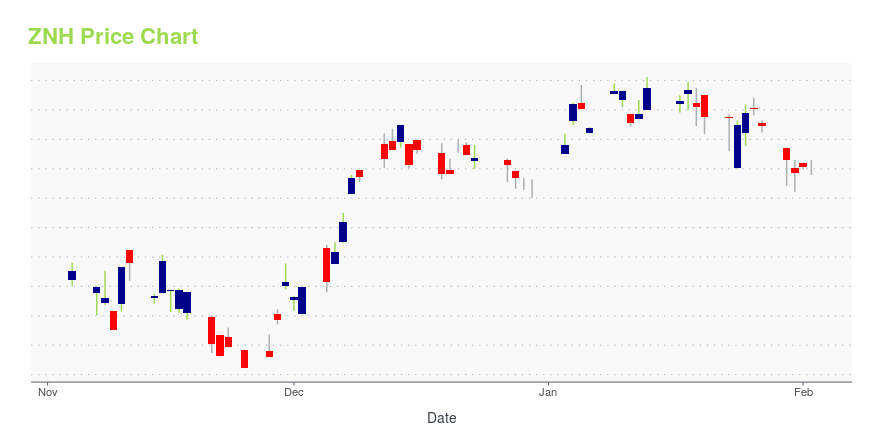

ZNH Stock Price Chart Interactive Chart >

China Southern Airlines Company Limited (ZNH) Company Bio

China Southern Airlines provides air transportation services in China and internationally. The company operates through Airline Transportation Operations and Other segments. The company was founded in 1995 and is based in Guangzhou, the Peoples Republic of China.

Latest ZNH News From Around the Web

Below are the latest news stories about CHINA SOUTHERN AIRLINES CO LTD that investors may wish to consider to help them evaluate ZNH as an investment opportunity.

7 Chinese Stocks to Buy as the Asian Giant ReopensWith the world’s second-largest economy finally reopening to travelers, these are the Chinese stocks to buy that could benefit the most. |

Chinese airline returns Boeing 737 Max to service after 4-year hiatusThe return of the Max to China's fleets is just the first step for Boeing in reestablishing deliveries — and, eventually, sales — to the high-growth market. |

China Southern Airlines to apply for delisting of American Depositary SharesChina Southern Airlines Company (ZNH) is set to apply for the voluntary delisting of its American Depositary Shares from NYSE. |

China Southern Airlines, China Eastern Airlines to delist from NYSE amid exodus of state-owned enterprises from US exchangesChina Southern Airlines and China Eastern Airlines said they will voluntarily delist ADRs from the NYSE, following the exits of five other Chinese state-owned enterprises in August. |

Boeing 737 Max Resumes Operation In China After 2019 Grounding: ReportBoeing Co (NYSE: BA ) has resumed commercial operations of 737 Max in China, after a four-year hiatus. China Southern Airlines Co (NYSE: ZNH ), China’s largest airline operated the 737-8 Max that was delivered in November 2017, Bloomberg reported. The flight took off from Guangzhou … Full story available on Benzinga.com |

ZNH Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 22.16% |

| 5-year | -1.64% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 9.24% |

| 2021 | 0.03% |

| 2020 | -11.76% |

| 2019 | 11.68% |

Continue Researching ZNH

Want to do more research on China Southern Airlines Co Ltd's stock and its price? Try the links below:China Southern Airlines Co Ltd (ZNH) Stock Price | Nasdaq

China Southern Airlines Co Ltd (ZNH) Stock Quote, History and News - Yahoo Finance

China Southern Airlines Co Ltd (ZNH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...