Zentalis Pharmaceuticals Inc. (ZNTL): Price and Financial Metrics

ZNTL Price/Volume Stats

| Current price | $1.41 | 52-week high | $5.44 |

| Prev. close | $1.44 | 52-week low | $1.01 |

| Day low | $1.41 | Volume | 412,800 |

| Day high | $1.49 | Avg. volume | 1,330,942 |

| 50-day MA | $1.32 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 101.45M |

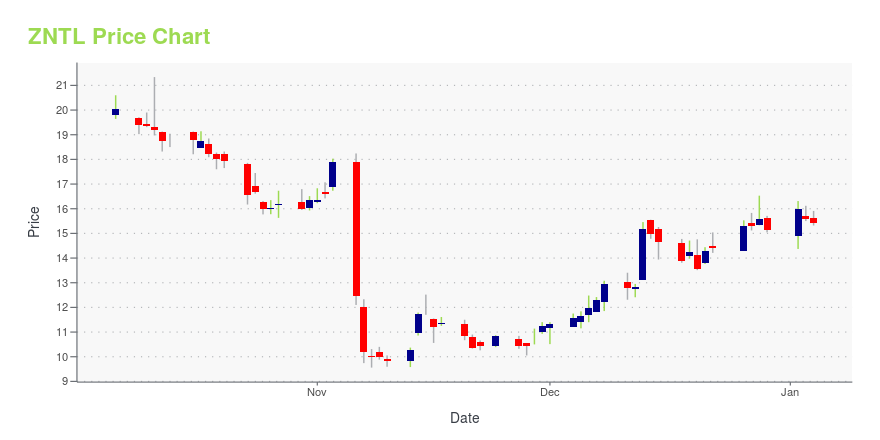

ZNTL Stock Price Chart Interactive Chart >

Zentalis Pharmaceuticals Inc. (ZNTL) Company Bio

Zentalis Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering and developing clinically differentiated, novel small molecule therapeutics targeting fundamental biological pathways of cancer. It develops a broad pipeline of product candidates with an initial focus on validated oncology targets with the potential to address large patient populations. Its lead product candidate, ZN-c5, is an oral selective estrogen receptor degrader (SERD) for the treatment of estrogen receptor positive, human epidermal growth factor receptor 2-negative (ER+/HER2-) advanced or metastatic breast cancer. The company was founded by Kevin D. Bunker on December 23, 2014 and is headquartered in New York, NY.

ZNTL Price Returns

| 1-mo | 8.46% |

| 3-mo | -4.08% |

| 6-mo | -37.61% |

| 1-year | -61.89% |

| 3-year | -94.83% |

| 5-year | -96.66% |

| YTD | -53.47% |

| 2024 | -80.00% |

| 2023 | -24.78% |

| 2022 | -76.04% |

| 2021 | 61.84% |

| 2020 | N/A |

Loading social stream, please wait...