Zomedica Corp. (ZOM): Price and Financial Metrics

ZOM Price/Volume Stats

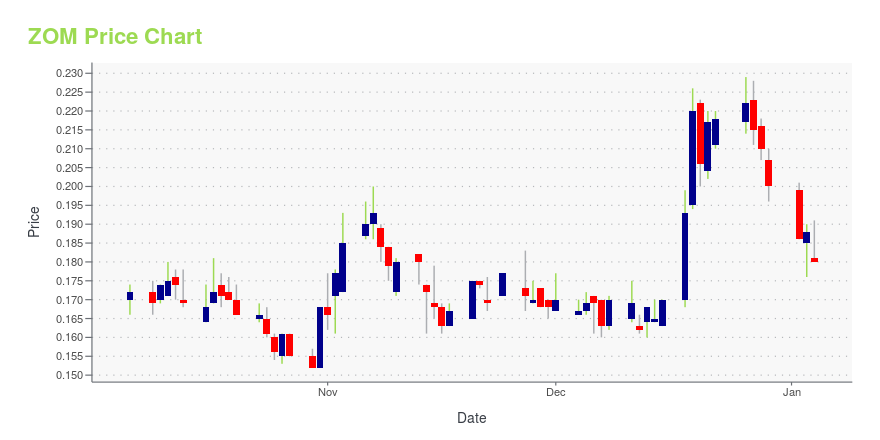

| Current price | $0.10 | 52-week high | $0.20 |

| Prev. close | $0.10 | 52-week low | $0.09 |

| Day low | $0.09 | Volume | 790,900 |

| Day high | $0.10 | Avg. volume | 5,428,122 |

| 50-day MA | $0.12 | Dividend yield | N/A |

| 200-day MA | $0.14 | Market Cap | 95.35M |

ZOM Stock Price Chart Interactive Chart >

Zomedica Corp. (ZOM) Company Bio

Zomedica Pharmaceuticals Corp. operates as a veterinary pharmaceutical company in the United States. It focuses on the discovery, development, and commercialization of drugs, novel drug delivery systems, devices, and diagnostics for the health and wellness of companion animals, such as canine, feline, and equine. The company has a research collaboration agreement with Celsee Diagnostics, Inc. to test the feasibility of Celsee's liquid biopsy technology for veterinary application as a canine cancer diagnostics. Zomedica Pharmaceuticals Corp. was founded in 2015 and is based in Ann Arbor, Michigan.

ZOM Price Returns

| 1-mo | N/A |

| 3-mo | -17.15% |

| 6-mo | -21.26% |

| 1-year | -42.43% |

| 3-year | -57.63% |

| 5-year | -54.02% |

| YTD | -16.67% |

| 2024 | -40.06% |

| 2023 | 22.82% |

| 2022 | -46.82% |

| 2021 | 32.91% |

| 2020 | -30.33% |

Loading social stream, please wait...