Zoetis Inc. (ZTS): Price and Financial Metrics

ZTS Price/Volume Stats

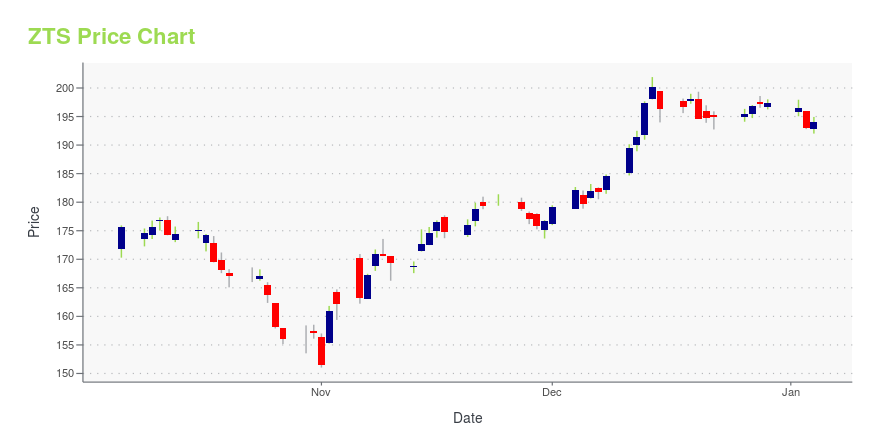

| Current price | $179.84 | 52-week high | $201.92 |

| Prev. close | $180.76 | 52-week low | $144.80 |

| Day low | $179.26 | Volume | 2,437,326 |

| Day high | $183.85 | Avg. volume | 2,826,854 |

| 50-day MA | $174.61 | Dividend yield | 0.96% |

| 200-day MA | $177.03 | Market Cap | 82.06B |

ZTS Stock Price Chart Interactive Chart >

Zoetis Inc. (ZTS) Company Bio

Zoetis Inc. is an American drug company, the world's largest producer of medicine and vaccinations for pets and livestock. The company was a subsidiary of Pfizer, the world's largest drug maker, but with Pfizer's spinoff of its 83% interest in the firm it is now a completely independent company. The company directly markets the products in approximately 45 countries, and sells the products in more than 100 countries. Operations outside the United States accounted for 50% of the total revenue. Contemporaneous with the spinoff in June 2013 S&P Dow Jones Indices announced that Zoetis would replace First Horizon National Corporation in the S&P 500 stock market index. (Source:Wikipedia)

Latest ZTS News From Around the Web

Below are the latest news stories about ZOETIS INC that investors may wish to consider to help them evaluate ZTS as an investment opportunity.

Zoetis to Host Webcast and Conference Call on Fourth Quarter and Full Year 2023 Financial ResultsPARSIPPANY, N.J., December 28, 2023--Zoetis Inc. (NYSE:ZTS) will host a webcast and conference call at 8:30 a.m. (ET) on Tuesday, Feb. 13, 2024. Chief Executive Officer Kristin Peck and Executive Vice President and Chief Financial Officer Wetteny Joseph will review fourth quarter and full year 2023 financial results and respond to questions from financial analysts during the call. |

Pet Care Profits: 3 Stocks Benefitting from the Pet BoomThese pet care stocks tap into a booming $246.66 billion market, offering unique investment stability and growth. |

GRFS or ZTS: Which Is the Better Value Stock Right Now?GRFS vs. ZTS: Which Stock Is the Better Value Option? |

Zoetis Inc. (NYSE:ZTS) Delivered A Better ROE Than Its IndustryOne of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will... |

Is Now The Time To Put Zoetis (NYSE:ZTS) On Your Watchlist?It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story... |

ZTS Price Returns

| 1-mo | 5.48% |

| 3-mo | 13.79% |

| 6-mo | -5.61% |

| 1-year | -3.74% |

| 3-year | -8.65% |

| 5-year | 62.02% |

| YTD | -8.20% |

| 2023 | 35.91% |

| 2022 | -39.51% |

| 2021 | 48.26% |

| 2020 | 25.76% |

| 2019 | 55.71% |

ZTS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ZTS

Here are a few links from around the web to help you further your research on Zoetis Inc's stock as an investment opportunity:Zoetis Inc (ZTS) Stock Price | Nasdaq

Zoetis Inc (ZTS) Stock Quote, History and News - Yahoo Finance

Zoetis Inc (ZTS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...