Lyft, Inc. - (LYFT): Price and Financial Metrics

LYFT Price/Volume Stats

| Current price | $12.23 | 52-week high | $20.82 |

| Prev. close | $12.21 | 52-week low | $8.85 |

| Day low | $12.16 | Volume | 10,377,491 |

| Day high | $12.57 | Avg. volume | 15,417,289 |

| 50-day MA | $14.28 | Dividend yield | N/A |

| 200-day MA | $14.38 | Market Cap | 4.93B |

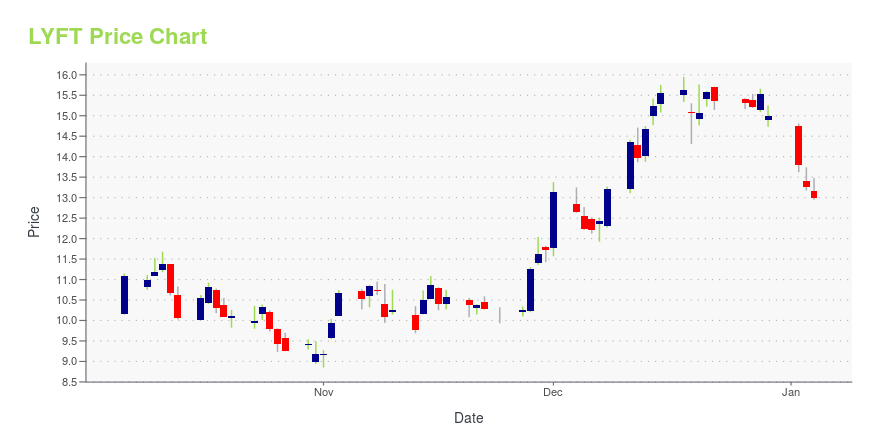

LYFT Stock Price Chart Interactive Chart >

Lyft, Inc. - (LYFT) Company Bio

Lyft is a transportation network company primarily providing ride-hailing services and based in San Francisco, California. It develops, markets, and operates the Lyft car transportation mobile app.

Latest LYFT News From Around the Web

Below are the latest news stories about LYFT INC that investors may wish to consider to help them evaluate LYFT as an investment opportunity.

Nomura Just Hit LYFT Stock With a New DowngradeLYFT stock is in the red after receiving a downgrade from Nomura analysts Anindya Das and Masataka Kunugimoto. |

Forget Lyft: Here Are 3 Reasons Uber Is the More Brilliant Stock to Buy in 2024It's clear which of these gig-economy businesses reigns supreme. |

20 Best US Cities To Live Without A CarIn this article, we will take a look at the 20 best US cities to live without a car. If you want to skip our discussion on shifting consumer preferences, you can go directly to the 5 Best US Cities To Live Without A Car. Due to the high interest rates as well as the […] |

The Lyft GapLYFT had a price gap from eons ago at $15.99. Yesterday the price leaked at $15.95 and is now backing off. |

Is Co-Founder John Zimmer Giving Up on LYFT Stock?Lyft co-founder John Zimmer reported selling $3.44 million worth of LYFT stock. |

LYFT Price Returns

| 1-mo | -8.25% |

| 3-mo | -25.29% |

| 6-mo | -2.94% |

| 1-year | 2.34% |

| 3-year | -77.06% |

| 5-year | -81.33% |

| YTD | -18.41% |

| 2023 | 36.03% |

| 2022 | -74.21% |

| 2021 | -13.03% |

| 2020 | 14.20% |

| 2019 | N/A |

Loading social stream, please wait...