Southern Copper Corp. (SCCO): Price and Financial Metrics

SCCO Price/Volume Stats

| Current price | $105.42 | 52-week high | $129.79 |

| Prev. close | $104.34 | 52-week low | $68.93 |

| Day low | $104.18 | Volume | 731,692 |

| Day high | $106.17 | Avg. volume | 1,191,350 |

| 50-day MA | $112.48 | Dividend yield | 0.04% |

| 200-day MA | $94.14 | Market Cap | 82.35B |

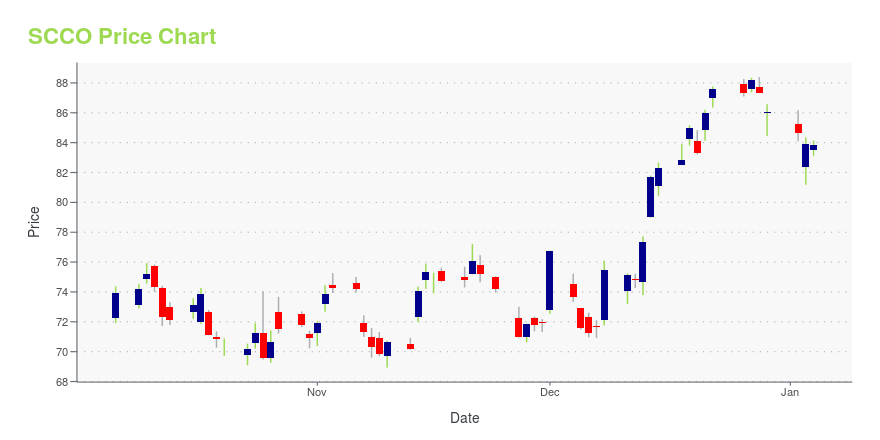

SCCO Stock Price Chart Interactive Chart >

Southern Copper Corp. (SCCO) Company Bio

Southern Copper Corporation is a mining company that was founded in 1952. The current incarnation of Southern Copper can be traced to the 2005 acquisition of Southern Peru Copper Corporation by the Mexican copper producer Minera México. (Source:Wikipedia)

Latest SCCO News From Around the Web

Below are the latest news stories about SOUTHERN COPPER CORP that investors may wish to consider to help them evaluate SCCO as an investment opportunity.

Quiet Income Kings: 3 Under-the-Radar Dividend Stocks to Buy NowDiscover under-the-radar dividend stocks with our in-depth analysis. |

15 Biggest Silver Mining Companies in the WorldThis article will list the world’s top silver mining companies and highlight the recent trends in the silver industry. You can skip our detailed overview of supply and demand intricacies of silver and read 5 Biggest Silver Mining Companies in the World. Global Silver Demand and Supply In 2022, the dynamics of global silver demand and […] |

High Return Hunt: 7 Dividend Stocks Offering Undiscovered ValueThese are the undervalued dividend stocks to buy as they represent fundamentally strong stories that can create value. |

15 Best Materials Stocks To Invest InIn this article, we will take a look at the 15 best materials stocks to invest in. To see more such companies, go directly to 5 Best Materials Stocks to Invest In. The year 2024 is poised to reveal the enduring consequences of substantial government expenditures and tax incentives aimed at bolstering manufacturing and infrastructure, […] |

Southern Copper Is More Likely to Head North Than SouthSouthern Copper Corp. was cut to an underweight (sell) rating at Morgan Stanley here on Monday with a $68 price target. Let's check out the charts and indicators of Southern Copper, which I last reviewed on July 26, to see if the analyst looked at the technical setup of the copper miner. In this daily bar chart of SCCO, below, I can see a slight upward progression over the past 12 months. |

SCCO Price Returns

| 1-mo | -3.10% |

| 3-mo | -9.84% |

| 6-mo | 27.99% |

| 1-year | 30.10% |

| 3-year | 89.44% |

| 5-year | 255.52% |

| YTD | 23.73% |

| 2023 | 50.12% |

| 2022 | 4.25% |

| 2021 | -0.62% |

| 2020 | 58.79% |

| 2019 | 44.61% |

SCCO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SCCO

Want to do more research on Southern Copper Corp's stock and its price? Try the links below:Southern Copper Corp (SCCO) Stock Price | Nasdaq

Southern Copper Corp (SCCO) Stock Quote, History and News - Yahoo Finance

Southern Copper Corp (SCCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...