The Fed is set to meet today and tomorrow to decide their interest rate policy. Three months ago, this meeting was being viewed as pro-forma; there was a near-unanimous agreement among economists and investors it would result in another 25 basis hike in Fed Funds rate and probably indicate there would be another 1-2 more hikes coming in 2019.

But things have changed. Tomorrow’s decision and the language around it are now viewed as one of the most important meetings in years.

So why the sudden shift? First and foremost, it was at the September meeting Powell indicated there could be other 3-4 hikes, saying “we are still far below neutral rates” and his tone and language suggested he would proceed regardless of what the economic data, let alone the stock market, was doing.

That basically triggered the beginning of the now three months and counting of heightened volatility and steep declines in the stock market.

Now many people, from policymakers to portfolio managers to the President are thinking that the Fed should go on pause for this meeting.

In fact, President Trump was practically pleading with Powell to tweet this morning, which read:

“I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make yet another mistake. Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!”

Trump’s request to “Stop with the 50 B’s” is a reference to the program of asset-portfolio reduction, in which $50 billion a month is rolled off the Fed’s balance sheet. This reduction has a tightening effect and drains liquidity from the bond market which, in turn, can dry up capital available to invest in stocks.

The asset reduction program, which has been humming quietly in the background for nearly 12 months now, is potentially more dangerous than another rate hike.

The economy is still strong enough to deal with what would still be historically low rates, around 2.7% to 3% on the 2-year note and 10-year treasury.

But, for the stock market that had come to rely on “free” money via various QE programs and considered there to be a “Fed Put” under the market, allowing investors to “buy the dip” over the past few years. The removal of that safety net creates a whole new level of risk.

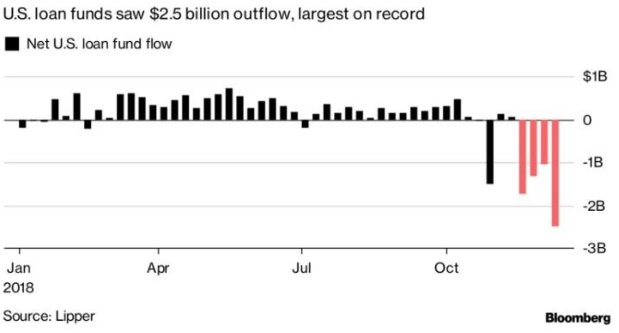

To understand how a lack of liquidity can lead to structural damage in the financial markets, consider the $1.5 billion corporate leverage loan market, which has been practically frozen for the past three weeks as outflows hit record levels.

Things aren’t much better in the corporate bond market, where not a single company has borrowed money through the $1.2tn US high-yield corporate bond market this month. If that freeze continues — until the end of the month — it would be the first month since November 2008 that not a single high-yield bond priced in the market, according to data providers Informa and Dealogic.

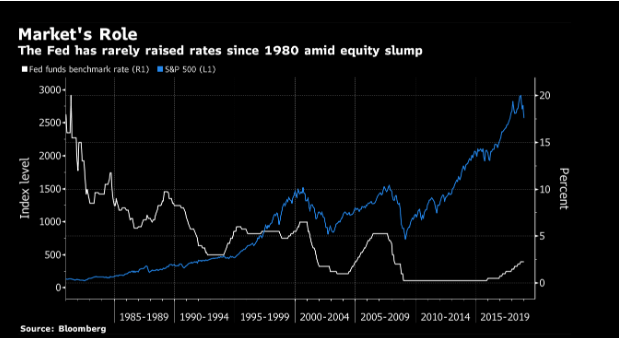

Another reason people feel Powell should pause is that a rate hike tomorrow would be the first time since time 1994 that they tightened in a down trending market. Right now, the S&P 500 is down over the last three, six and 12 months, a backdrop that has accompanied just two of 76 rate increases since 1980.

With over half the S&P 500 down by more than 20%, another hike could be the last straw that breaks the bulls back, sending stocks into full bear mode.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!