I think we can all agree that political chaos can be frustrating for investors. When the DC circus really gets going, the S&P 500, Dow Jones Industrial Average and tech-heavy and trade-sensitive Nasdaq can swing wildly from day to day, sometimes as much as 3% or even 4% intraday.

That kind of high volatility can understandably spook investors, who worry that our leaders might royally mess up and plunge the economy and market into a recession and bear market. Over the past year, we’ve had plenty of political risks, including the longest government shutdown in history and now an escalating trade war that has the market on edge.

Well as if all that wasn’t bad enough, now there’s news that an increasing number of House Democrats are pressuring speaker Nanci Pelosi to impeach President Trump. Here’s what you need to know about the risks of a long and chaotic impeachment process, what it might mean for our economy, and most importantly, how you can potentially protect your portfolio if political risks get even worse.

Impeachment Risks Are Rising Which Could Make Market Political Risk Even Higher

On May 21st, CNN reported that a growing number of House Democrats are pressuring house speaker Nanci Pelosi to move forward with articles of impeachment against President Trump over the results of the Mueller investigation that they feel provides sufficient evidence of obstruction of justice.

Up until now, Mrs. Pelosi has been firm that she doesn’t want to plunge the country into a meaningless circus that impeachment would cause. Here’s what she told the Washington Post in March 2019.

“I’m not for impeachment…Impeachment is so divisive to the country that unless there’s something so compelling and overwhelming and bipartisan, I don’t think we should go down that path, because it divides the country. And he’s just not worth it.”

However, the growing pressure might eventually cause her to change her mind (on May 22nd she publicly accused Trump of a “coverup”). Here’s CNN explaining

“House Judiciary Chairman Jerry Nadler discussed with Pelosi the advantages of an impeachment inquiry in terms of adding weight to a court case, according to a source with direct knowledge. Nadler, whose committee has been on the front lines of investigating the findings from within special counsel Robert Mueller’s report, broached the topic with Pelosi because several members of his committee have been pressing to open an inquiry… The tensions displayed behind closed doors underscore the growing divide within the caucus about how to proceed in the face of White House resistance to all its demands.”

Basically, the Trump administration is refusing various subpoenas the House is sending it, and Pelosi is getting fed up with what she sees as childish obstructionism and political obstinance. And with 2020 elections looming large, she’s apparently feeling increased pressure from various members of her caucus (who want to look tough on Trump) to make a grand political gesture.

A December CNN survey among registered Democrats found that 69% are in favor of impeaching Trump, even when told that this is an all but impossible feat. That’s because removing a sitting president requires impeachment by the House and 67 votes in the Senate. The Senate remains in GOP hands and there is virtually no chance that 19 Republican Senators would vote for such a move so close to a Presidential election.

In essence, an impeachment, while something that House Democrats can 100% do, is not going to actually make a difference to who sits in the White House. However, it certainly could cause a lot of political and even potentially economic and market chaos in the short-term.

How This Could Potentially Hurt the Economy

Impeachment, as we’ve just seen, is a two-step process, that requires both the House and Senate to agree upon (and with a ⅔ majority in the Senate that no party has had in over 50 years). But just because it would be meaningless political theater doesn’t mean it might not have important short-term economic effects.

That’s because President Trump is currently locking trade horns with not just China but no less than four important US trading partners.

- Canada/Mexico (if USMCA isn’t ratified by Congress Trump has threatened to pull the US out of NAFTA within six months)

- Threats of 25% tariffs on EU auto parts

- Threats of 25% tariffs on Japanese autos if that bi-lateral trade deal isn’t reached “within weeks”

- Threats of 25% tariffs on all Chinese imports

Unfortunately, the timing of most of these deals/deadlines tends to align relatively soon (the end of 2019) which also coincides with the debt ceiling increase that absolutely has to happen by no later than early November (lest the US default on its debt and trigger a potentially catastrophic global financial crisis).

An embattled President Trump, facing impeachment, would likely become even more unpredictable and could send the markets into wild daily swings as rampant speculation about the potential for trade/debt deals failing to be reached would cause recession risks to rapidly escalate (they are already at 10-year highs according to both the Cleveland and New York Federal Reserves).

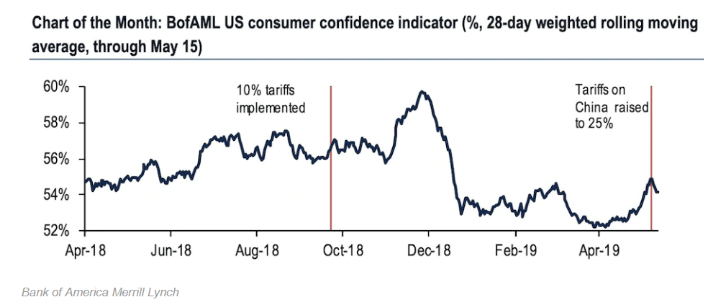

What’s worse the recent escalation in the US/China trade war, 25% tariffs going up on May 10th, is already having a significant negative effect on consumer confidence.

The University of Michigan monthly consumer confidence survey, which historically forecasts future consumer spending (68% of the US economy according to the St. Louis Federal Reserve) hit a 15 year high in April. However, that survey ended before the recent trade war escalation, which includes not just higher tariffs but the US targeting Chinese tech companies (more than just Huawei) with embargos.

Various media outlets have reported China has refused to schedule more trade talks as long as its tech firms are targeted which means that consumer (and business) confidence might take a big hit, as it did during the government shutdown in late December and most of January.

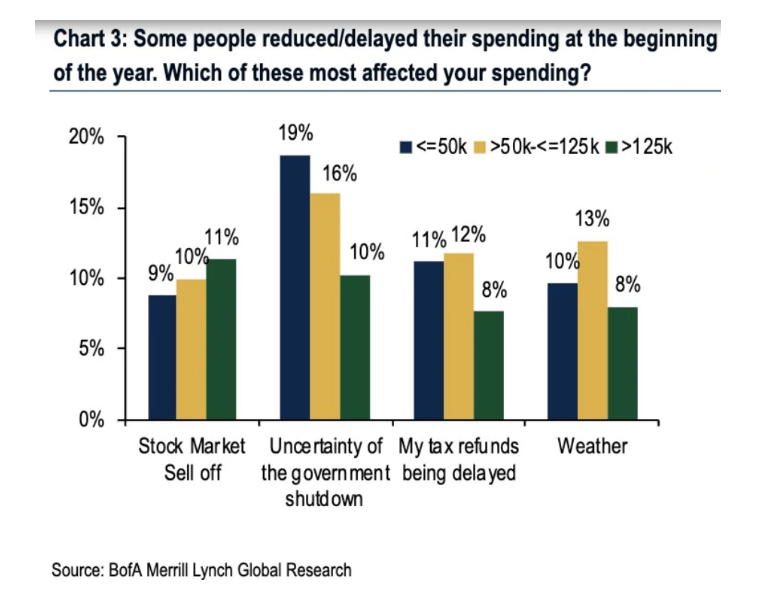

And as you can see from Bank of America’s consumer spending survey at the time, while consumers tend to shrug off things like stock market declines (no more effect on spending than bad weather) big government screwups can indeed impact retail sales and our economy.

And as you can see from Bank of America’s consumer spending survey at the time, while consumers tend to shrug off things like stock market declines (no more effect on spending than bad weather) big government screwups can indeed impact retail sales and our economy.

Should the House decide to proceed with impeachment, President Trump isn’t going anywhere. But should an enraged President decide to dig in his heels on trade deals and the trade war become a truly multi-front global conflict? Well, then the US economy and stock market might be headed for a mild recession/bear market after all.

So here’s how you can protect yourself from this kind of political risk.

How to Protect Your Portfolio If the DC Circus Gets Even Worse

The most important thing to remember about risk is that the stock market has NEVER experienced a time when one potentially bad thing or another wasn’t costing some investors sleep. Even the roaring ’90s, now seen as a golden age for stocks and the economy, was actually a turbulent time marked by an impeachment (Clinton) government shutdowns, corrections and pullbacks, two financial crisis (overseas) and a 1998 recession scare (yield curve inversion).

Market timing, the theoretically sound idea of selling stocks ahead of a correction/bear market, is a siren’s song that has cost many investors prosperous retirements.

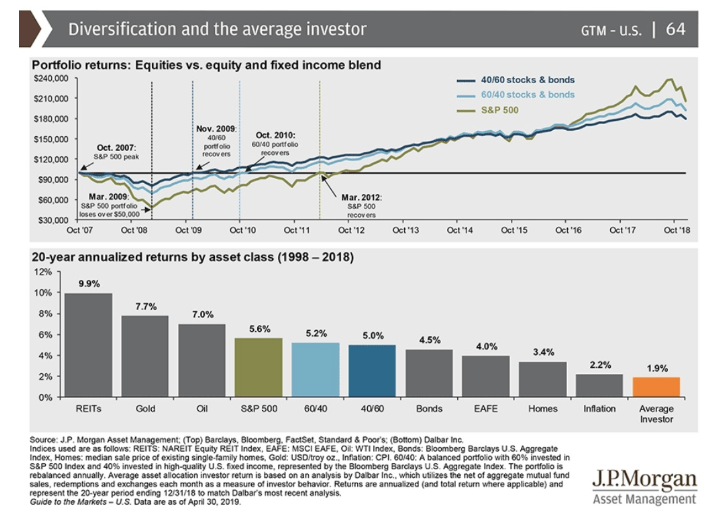

JPMorgan Asset Management is the 4th largest asset manager on earth. Its data shows that over the past 20 years, which included two 50+% market crashes (historically the average bear market sees stocks decline a peak of just 30% on average) catastrophically bad market timing has caused the average retail investor to underperform not just every asset class but even historically mild inflation.

In contrast, buying and holding the S&P 500 would have delivered 5.6% annualized returns. While that’s below the market’s historical 9.1% CAGR long-term return, it’s still decent growth of one’s nest egg.

1.9% returns over half an investing lifetime is a recipe for a poor retirement, or never being able to retire at all. But note that a 60/40 stock/bond portfolio (the default recommendation for most investors) almost matched the market’s gains over time. Even a super conservative 40/60 stock/bond portfolio managed 2.5 times the returns the average market timer achieved and with about 50% less volatility than being 100% in stocks.

This is damning evidence that Peter Lynch, who achieved 29% CAGR total returns at Fidelity’s Magellan Fund from 1977 to 1990 (second best-investing record in history behind Buffett’s) was correct in warning that

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.” – Peter Lynch

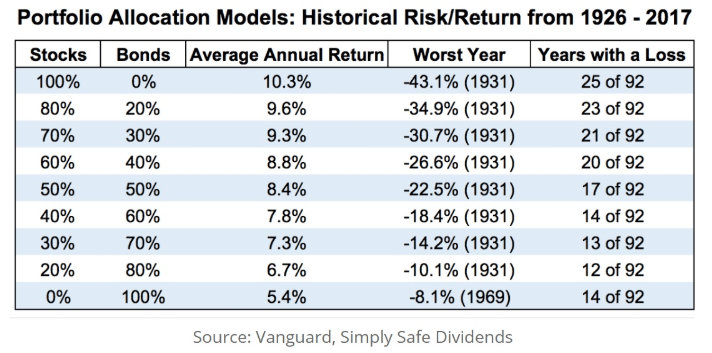

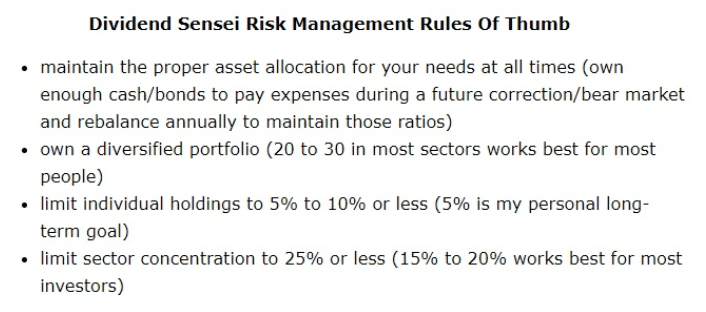

Instead, proper risk management via diversification and the right asset allocation for your needs/risk profile/goals is what investors need to use to protect their nest eggs from unavoidable short-term market mayhem (whatever the cause).

Bonds (including cash equivalents) are owned not just for income, but to reduce volatility and thus allow you to sleep well at night during corrections/bear markets and achieve superior returns to what the typical market timer is able to earn. They are also typically countercyclical assets to stocks, meaning bonds/cash (like T-bills) remain stable or appreciate when stocks falls. This gives you something to sell to pay the bills during market downturns (think retirees using the 4% rule).

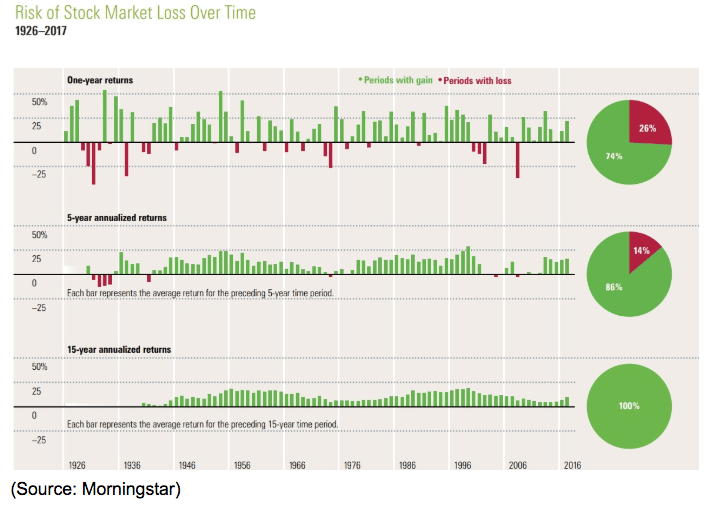

Stocks might be the best performing asset class in history and have never suffered a negative rolling 15 year period (not even during the Great Depression). But if you become a forced seller (or just get too scared) during corrections/bear markets then you’ll end up making costly mistakes that can decimate your long-term returns and make achieving your financial goals impossible.

This is why risk management is so important, a fact that I frequently point out to my readers via my risk management rules of thumb.

Bottom Line: A Well Built Portfolio Can Survive Almost Any Craziness That DC Can Throw at it

Thanks to the 24-hour news cycle, the media likes to blow almost everything political out of proportion. That includes the financial media where every market move needs a plausible explanation and potential market risks get discussed to death, even if they aren’t actually worth worrying about.

While it’s certainly true that the House Democrats COULD impeach Trump, it would be pure Kabuki theater, since it takes 67 votes in the GOP controlled Senate to actually remove a sitting president from office.

The bigger threat from such a scenario is that our already unpredictable president, who is currently threatening or engaged in no fewer than four trade wars (and has to sign off on a debt ceiling agreement by October) might feel boxed in and make potentially irrational or misguided mistakes.

However, even should impeachment actually occur, and the DC drama hit its highest levels in 20 years, ultimately that won’t matter for your long-term financial goals. That’s as long as you remember to use good risk management (diversification and asset allocation) and not market timing to protect and grow your wealth over time.

The daily market gyrations may help the financial media fill air time and sell ads, but ultimately the daily news out of Washington, even about important things like the trade war, is not likely to permanently break the US or global economy, nor stop the stock market from rising in 75% of years.

Never forget that stocks have and will always be a “risk asset” and the market’s historically great returns have come from a never-ending climb over a wall of worry composed of one scary worst-case scenario or another. Even the roaring ’90s were not a time of blissful calm and steadily rising stock prices.

If you construct your portfolio correctly, meaning the right asset allocation and owning high-quality companies bought at fair to great prices, then time really is on your side and you have little to fear from short-term market volatility, no matter what causes it.

Never forget the immortal words of Warren Buffett explaining the true secret to long-term investing success “we don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!