Stocks began a steep slide in early May when trade talks with China were halted which culminated at a low in one month later when the proposed tariffs with Mexico were put on hold. During the ensuing 11 trading days, the major indices have galloped an impressive 7.4% higher, and are now a mere 1.2% from all-time highs.

To my mind, this investor’s bullishness is severely misplaced, and the financial markets seem to be putting too much trust that the Federal Reserve will begin a series of interest rate cuts, possibly as soon as tomorrow’s FOMC meeting.

I’m betting, or rather hoping, the Fed does nothing and resumes its stance to be data dependent rather than lean towards pre-emptive action.

When Jerome Powell first became Chairman of the Federal Reserve in late 2017, he seemed determined to act independently from both politics and the stock market, outlining a monetary policy that would be based on economic conditions and a decidedly conservative bent regarding things such as debt and unconventional tools such as quantitative easing which distort the cost of money (ie ZIRP) that cause financial repression and lead to inordinate risk-taking.

His plan was to raise rates and reduce the balance sheet in a very mechanical process until they reached what he perceived as “normal” for a non-crisis environment.

I was ecstatic; we could finally get back to trading based on fundamentals and technical analysis without all this Fed talk about “punch bowls and sugar highs.”

Well, as Ronald Reagan famously said in his 1980 debate with Jimmy Carter “There you go again.”

Last month, Powell and other Fed Governors began indicating that given some slowing economic data that a rate cut, or two or three, might order over the coming months.

This morning, ECB head Mario Draghi sent yields tumbling, with half of Europe now with negative interest rates, after saying he was ready to supply more stimulus.

The U.S bond market followed suit as the yield on a 10-year has sunk to 2.01%, the lowest level in over two years.

The reality is the data in the U.S hasn’t really slowed at all, it’s merely growing at a slower rate. But, the market sell-off at the end of last year following the December rate hike must have spooked Powell and hence the initial pivot.

That turn in positioning has only become more pronounced as the trade wars have heightened and now threaten a true slow down.

The irony is that President Trump, who has been criticizing and trying to bully Powell into cutting rates for months, may, in fact, be forcing his hand by escalating the tariffs. Some even believe that Trump is doing this on purpose to orchestrate a renewed bull market that would then go into hyper-mode when he reaches a deal prior to the election.

With the range of options for this week’s Fed meeting still wide open and the outcomes of the Group-of-20 summit look unlikely to yield any trade agreements the markets seem too sanguine.

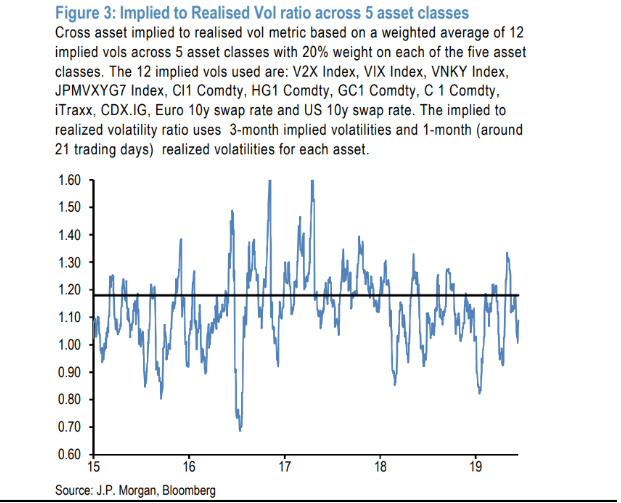

Yet despite the potential for major market moves from these events the options market volatility risk premium is significantly below its historical average.

A report from JP Morgan (JM) cited a gauge of implied to realized volatility using 12 measures across five asset classes, saying, “Option markets have not embed enough cushion against the significant event risk markets are facing over the coming weeks.”

“Other oddities include a large number of short positions on futures tied to the VIX — the so-called fear gauge tied to U.S. stocks — and a low amount of hedging as seen in the put-to-call open-interest ratio for S&P 500 Index options, the JPMorgan team wrote in a note Friday.

Also of concern, is the heavy allocation to U.S. equities especially from hedge funds concentrated in the same stocks as the S&P 500, while in equity futures it’s near the top its historical range.

The resilience of the equity market suggests investors are leaning on the thesis of a preemptive Fed in that they might lose the power of surprise should they hold off this week, then lower rates in the aftermath of a negative outcome on trade talks.

That leaves equities vulnerable to a Fed disappointment. A more cautious and patient Fed next week could cast doubt on the above thesis, creating the risk of an equity market correction.

I’m hoping Powell if not taking away the punch bowl, at least doesn’t spike it more. Eventually, that hangover will be a doozy.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!