We can all agree that the last few months have been gutwrenching, even for patient and long-term investors. Even value-focused contrarians like me have been whipsawed by violent market reactions to seemingly every headline, rumor, blatant speculation, and musing or rants from our Twitter happy President.

But while the last few months of market declines (for some companies of 20%, 30% or more) has been rough, there are two big reasons why I am very confident that the Trade War that has sent stocks into a tailspin, will be over by February if not sooner. That means the bull market isn’t just likely to survive this correction, but likely continue for at least the next year.

President Trump Is Listening to the Market

President Trump has indicated he cares about just two things when it comes to Trade. First, he wants the cut the trade deficit between the US and China (which he incorrectly sees as a sign that we’re “losing”). Second, he wants revised US trade policies which will help the economy (and his 2020 re-election chances). For good or ill Trump’s key economic barometer appears to be the stock market. Trump spent most of 2017 tweeting about the market’s tax-cut fueled rally. What’s more, during his 2018 State of The Union he even took a victory lap over the market’s performance since his election before Congress, the Supreme Court and tens of millions of Americans watching on TV.

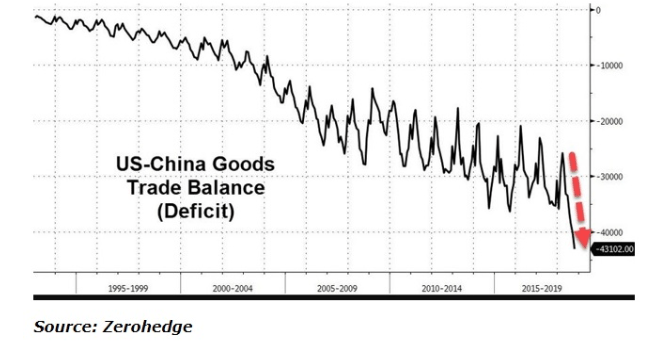

Well, he’s since fallen silent on the stock market, and trade war he’s single handily embarked upon (against the advice of most economists, business leaders, and advisors) has utterly failed to close the US/China trade gap.

In fact, the trade deficit with China has exploded since the trade war began and is now at an all-time high. From Trump’s perspective, this shows that trade wars are not in fact, “good and easy to win”. That’s because the Chinese Yuan has fallen by about 10% due to China’s slowing economy (made worse by the trade war). That has nearly entirely neutralized the current tariffs (effective rate of 12.5% on 50% of Chinese imports). And with the US economy being the strongest of any developed economy right now (thanks to fiscal stimulus including tax cuts) US demand for Chinese imports (which effectively cost the same) have increased. Meanwhile, retaliatory tariffs against US exports to China, including agricultural products grown mostly in deep red states, have fallen dramatically.

And of course, we all know how the stock market feels about the trade war.

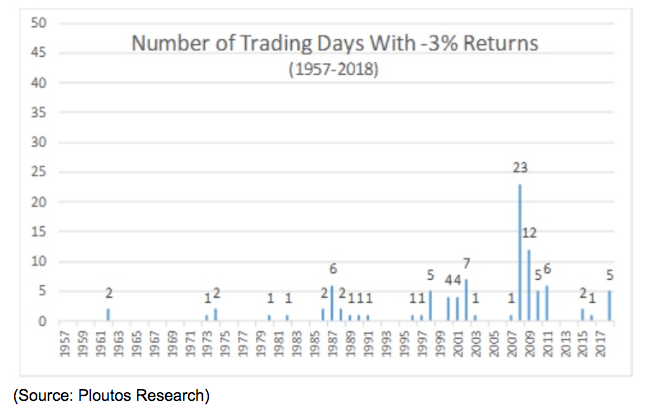

Not just have we had two corrections this year, but we’ve also seen five 3+% daily declines in the S&P 500. For context, since 1957 there have been just 98 such days in market history, one occurring, on average, every 1.5 years. They tend to cluster around bear markets and recessions, such as 2008 and 2001. 5% of these days have now occurred in 2018 when the US economy is expected to grow 3.1%, its strongest expansion since 2005.

And while it’s true that worries over the Fed hiking us into a recession are partly to blame for this correction, a few weeks ago Fed Chairman Powell reversed his early hawkish statements about the US being “nowhere close to neutral rates” and is now indicating far fewer hikes are coming. The latest Fed minutes showed a growing dovish consensus among the FOMC as well, which is why that week the S&P 500 had its strongest weekly rally in seven years. It was purely trade-related worries that caused the market to then given back 100% of those gains the following week. That included a 3.2% decline on Tuesday, December 4th (Trump’s infamous “Tariff Man” tweet) and a follow up 3% intraday decline on Thursday (the market was closed on Wednesday for the National Day of Morning). That 6% market slide caused $2 trillion in market cap to evaporate and was only halted by a 3% rally kicked off by a Wall Street Journal article confirming the Fed was looking to take a “one and done” approach (hike in December then pause).

Which brings me to the first big reason why I’m very confident the trade war will soon be over.

The Wall Street Journal reported on December 7th that an administration insider has been told that Trump is “glued” to the stock market each day and worried that the constant stream of contradictory statements (wild swings from claims of trade peace to threats of scorched earth trade war) might be causing the volatility we’re seeing now.

I don’t care if Trump’s use of the market to judge the economy is wrong (short-term market prices are often irrational and based on bi-polar likes swings in fickle sentiment). At least he is listening to something other than his gut, which he’s said often guides his decisions rather than advice from ivory tower academics and Wall Street “professionals”. I think it’s very possible that there would have been no trade truce deal struck at the G20 had the market not been in a correction, giving Trump reason to doubt his confidence in his trade warfighting prowess.

Ok, so maybe Trump appears to only listen to the stock market, but what evidence do I have that the trade negotiations will be successful by the looming March 1st deadline when tariffs go from 10% to 25% on that $200 billion round of imports? That would be from an increasing stream of news that seems to indicate that Trump’s new found desire to make a deal before he breaks the stock market, is causing good progress to be made.

Trade Negotiations Are Going Very Well

- December 3rd: “President Xi and I want this deal to happen, and it probably will” – President Trump

- December 7th: Trade talks are “extremely promising”- National Economic Advisor Larry Kudlow

- December 7th: “China talks are going very well!” – President Trump

- December 12th: “important announcement”, due to “productive conversations” – President Trump

Ok, so maybe there’s some talk from key officials, including the trade warrior in chief himself. But we all know how contradictory the White House can be on trade issues, sometimes even in the same statement. What specifics are there that indicate that progress is being made to end this trade war, eliminate these tariffs, and FINALLY allow this correction to end?

During the G20 dinner meeting, we heard some vague claims (some of which were later contradicted by China) about China’s willingness to make trade concessions. These included importing a large amount of US goods (up to $1.2 trillion over several years), reducing tariffs on US cars, and cracking down on intellectual property theft (a core issue for the US and rightly so).

Well, now we’re finally getting some concrete news about steps China is taking. Specifically, the “important announcement” is that, according to Bloomberg, China is now planning to reduce tariffs on US autos from 40% to 25%. The proposal, which reverses one of China’s retaliatory tariffs imposed in July, will be submitted to China’s cabinet “in the coming days”. It indicates that the US requested the arrest of Huawei’s CFO (who happens to be the founder’s daughter) hasn’t derailed trade talks.

Freya Beamish, the chief Asia economist at Pantheon Macroeconomic, explains the significance of this news well.

“Last week, events seemed to conspire to throw the truce into disarray, but the underlying incentives of both sides at the moment are to try to maintain that truce. Now we are seeing the possibility that China will come through with reductions of tariffs on U.S. autos and that’s another good, concrete step.”

I’d also like to point out that unlike in past weeks, where Trump would match most statements on good trade progress with table-pounding threats of imposing news tariffs if he didn’t get what he wants, now we’re seeing a more subdued president who seems to be looking to “take the win”. What do I mean by that? Well, specifically that in the past Trump has said he was looking for zero tariffs on cars in particular, and all goods in general. China is proposing a 25% reduction in tariffs but not to zero. Trump isn’t saying this is a good start but he wants more but is taking to Twitter to declare this is a huge step forward.

To me, that sounds like Trump is finally tiring of the never-ending trade war and the market volatility it’s been causing. He now realizes the magnitude of what’s at stake (because US economic growth has been slowing noticeably in recent months) and that further wild swings in sentiment could trigger a bear market. That would mean that something he chose to start, over the strong objections of so many “professionals” could very well kill the longest bull market in history.

Does that mean that Trump is going to go “twitter silent” from now on, and avoid stump speech messages like tweeting about how tariffs can “make America rich again!”? No, but it does mean that I expect to see Trump and most administration officials focusing far more on progress than threats, and highlighting what’s going right with negotiations as opposed to demanding everything on their wishlist.

Because at the end of the day, whether it’s the stock market (Trump’s apparent favorite economic gauge) or the exploding trade deficit objectively proving him wrong, Trump isn’t totally ignoring reality. The man realizes that campaign slogans and promises of great deals to come are no longer enough. He needs to actually deliver wins, otherwise a weaker economy and potential bear market will torpedo his re-election chances.

No matter what you may personally think of Trump, I think we can all agree, that, like all politicians, he values electoral victory and survival above all else. And as Trump now seems to realize, his own political survival beyond 2020 is tied to the survival of the bull market, and the good economy and strong job market that drives it.

Bottom Line: Trump Political Survival Depends on a Trade Deal

Turbulent times like these try all investors’ souls, but that’s why it’s important to keep a cool head, think rationally, and look at not just what important actors (like President Trump) say, but what they actually do. While Trump has been famous for his hawkish trade stances, at the end of the day his stated goals of cutting trade deals have lined up with what he’s ultimately done (with other countries). And with the President’s G20 deal seemingly confirming CNBC’s claims that he’s “glued to the market” during this correction, I am confident that the trade negotiations that are going very well by all accounts, will ultimately result in the trade war ending by February if not sooner.

That doesn’t mean that the economic or earnings damage that has already been done will be reversed entirely or quickly. However, it should be enough to avoid this correction turning into a full-blown bear market. While next year isn’t likely to be a repeat of 2017’s freakishly low volatility year-long rally, I expect the bull market still has at least 12 months left before it finally runs out of gas.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!