Financials stocks, particularly large banks, have failed to keep pace with the broader market rebound. But, it looks like they are about to catch up. Here are the two best ways to play a break out in the banks.

Banks and other large financial firms were some of the prime beneficiaries of Trump’s election, thanks to ensuing rollback of onerous regulations and the then favorable tax reforms.

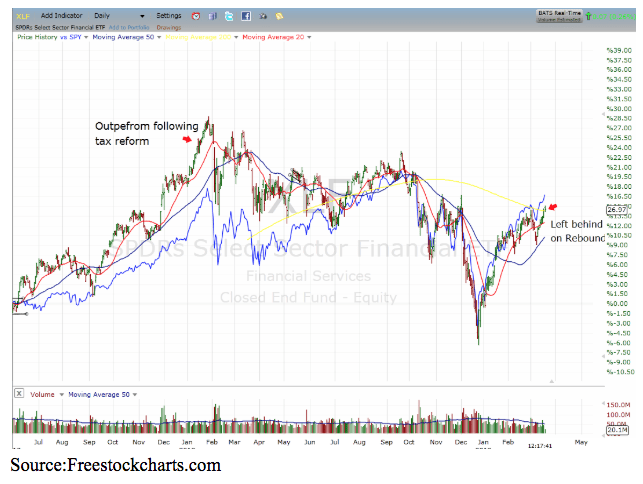

The SPDR Financial Index (XLF) outpaced the broader S&P 500 Index (blue line) by as much as 15 percentage points from 2017 through 2018. But, then the gap narrowed when the indices, led by big cap tech, surged to new highs during the summer.

The financials then fell with the broader market but has failed to keep up with the rebound in 2019.

The failure of the financials to enjoy the big bounce can be tied to three key issues;

- A global economic slowdown, which led to slack loan demand on decreased corporate capital expenditures

- The Federal Reserve reversing course on interest rate hikes, which created a flattening of the yield curve, which will hurt net interest margins

- A slow initial public offering market, or IPOs.

All three trends appear poised for a reverse, and a few banks are best positioned to benefit.

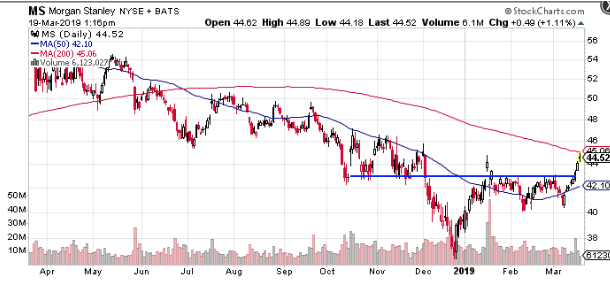

Morgan Stanley (MS) is my top pick for a number of reasons:

- A few years ago, the bank’s brokerage division switched from emphasizing trading to a focus on wealth management. This is not only in line with investors wanting advisors to have a higher fiduciary responsibility — and take a more holistic approach to asset allocation. But, the revenue stream is more predictable. Such an approach is also beneficial during a bull market, as total assets under management grows.

- MS’s investment bank is well positioned to be the lead, or co-underwriter in several highly-anticipated IPOs. 2019 is expected to see a surge in initial public offerings, including ‘unicorns’ such as riding sharing firms Lyft and Uber, vacation rental AirBnB, and work share software platform Slack, all of which will likely rise in excess of $100, which translates into fat fees for investment banks like Morgan Stanley.

- The chart’s technical picture is constructive. The stock recently broke through resistance at the $43 level. If it can take out the 200 dma average at $45, it should have a smooth move back towards the $50 level.

I’m buying July 45 strike calls for $2.25 per contract. If shares reach my $50 price target within the next four months, those calls would be worth at least $5, or over a 100% gain.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!