Wal-Mart (WMT) and Amazon (AMZN) has a left many sellers with a “you can’t live with them, can’t live without them” proposition.

Gaining distribution through the “big two gorillas” can propel a business to tremendous sales growth and success and may actually be companies survival.

But it comes as a cost as Amazon and Wal-Mart leverage this power by extracting hefty demands, from extremely low prices, quick turnaround times on fulfillment, and they force less favorable terms on sellers regarding invoice and reimbursement.

Now vendors and sellers are learning not only is Amazon a tough partner to do business with, but it can also turn into a brutal competitor. Amazon has developed a pattern of taking hot item, producing their own variation or knock-off –which they underprice and overpromote—essentially co-opting many successful brands or products.

Amazon is taking similar aggressive action for companies, especially start-ups, that use its AWS platform to run their businesses. It has copied and implemented other companies software and data services, white labeling everything from batteries and detergent to data analytic tools.

But smaller retailers are finding alternatives and fighting back. Such as doing business on Etsy (ETSY), an online platform seller (and buyer), of mostly small businesses featuring unique or handcrafted items. It’s distinguished itself as the something of the anti-AMZN or at least a way not to get swallowed up by beast.

The handcrafted and personalization of many of the products it features appeals especially to millennials. Etsy works with the businesses to help them offer customization options which it says helps garner an average 30% increase in selling price.

Etsy’s top categories are fashion- including apparel and accessories such as jewelry– and home furnishing which combined comprise a $1.3 trillion addressable market.

Etsy, is not yet profitable but has been growing revenue by over 40% per year and more importantly boosting margins to above 30%, not an easy feat in cutthroat online merchandising, but crucial towards achieving profitability.

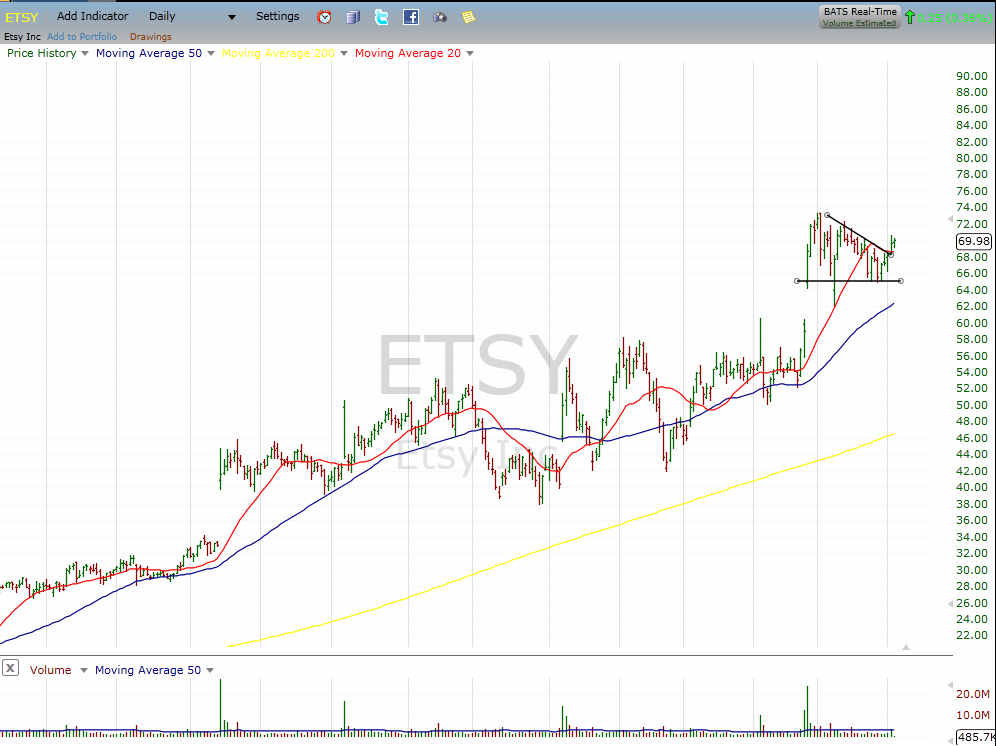

From a technical standpoint the chart shows a nice period of consolidation into a bullish flag following last month’s earnings gap up.

Source:FreeCharts.com

I think the company could make a run to new highs ahead of its next earnings report, scheduled for May 7, and I’m buying the May 70 calls for $5.50 per contract.

My target is for shares to hit $80 which would double the value of the calls.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!