Dividend Cutters Are The Worst Performing Asset Class You Can Own

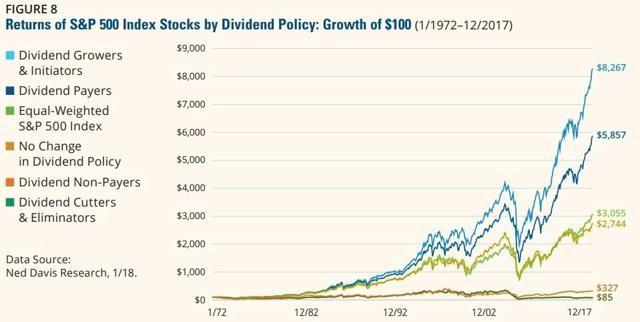

Since 1900 stocks have been the best performing asset class, and among stocks dividend growth stocks (and companies that start paying rising dividends) have been the best performers by far.

The absolute worst class of investment (including bonds and cash) has been stocks that have cut their dividends. GE hasn’t just cut its payout once, but three times now in the past 11 years, by a stunning 97% since its 2007 high.

But who cares about the dividend? GE is a pure deep value play, right? And under the leadership of new CEO Larry Culp, who led rival industrial conglomerate rival Danaher to 400% returns over his tenure, GE is going to right the ship and soar much higher in a few years, right? Well as Buffett once said:

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

And the sad fact is that GE’s business quality remains poor (and rapidly deteriorating) and its troubles are likely far from over.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!