Stronger companies were able to issue new debt for basically no cost and used those funds finance share buybacks. This was money that should have gone into capital spending such as research, equipment upgrades, new factories etc.

The passage of tax reform was supposed to boost cap-ex spending but we’ve seen little increase as the cost to borrow for such projects has moved significantly higher.

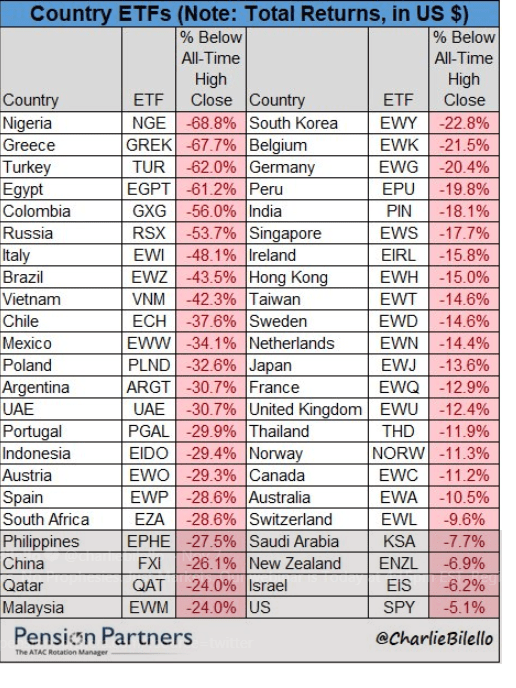

3. Global Markets. The decline in the U.S. stock market is recent but most of the global markets have been going down all year and many are in full bear market.

Source: Pension Partners

The U.S. is the leading market in the world but if the rest of the soldiers continue to fall back the general is eventually forced to retreat.

It seems we are seeing a global slowdown—and increased tariffs won’t help—that could take the U.S. economy into a recession and the stock market into a bear market.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!