Last week, I made the case that investors who had fled into bonds would soon regret that decision. Well, it’s not even a week later and people are now fleeing that safe haven. I think this quick about-face is just the beginning of the exodus out of bonds.

The schizophrenic nature of the market can be seen in the money flows; last week had a record amount of money, some $1.3 billion, flow into bond products such as Barclay’s 20+ Bond (TLT).

On Tuesday, nearly all of that was extracted as Investors pulled $745 million yesterday from Vanguard’s $27.2 billion short-term bond ETF, the fund’s biggest one-day withdrawal in its history.

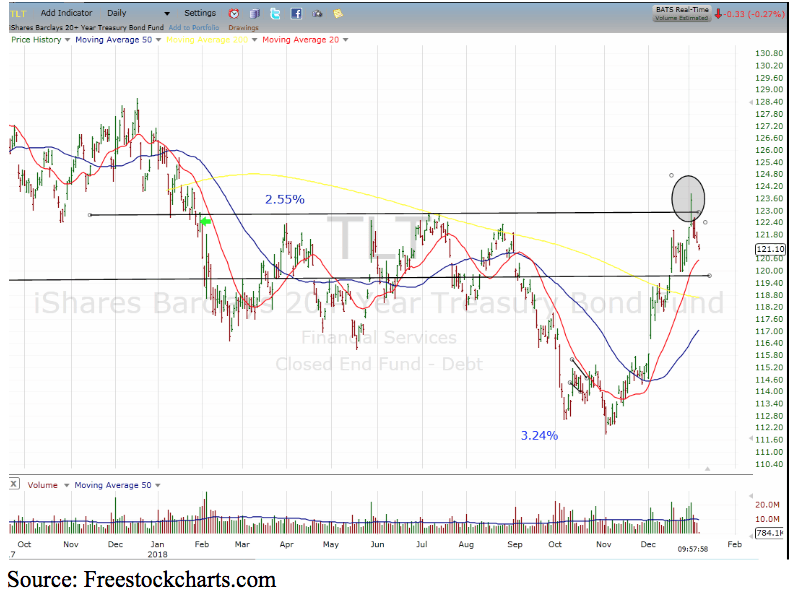

I pointed out that the TLT chart had left a bearish spike after a false breakout when yield dropped below 2.55%. That reversal is now clearly defined, and the chart suggests a pullback towards the $119 level which would equate to an approximate yield of 2.85%.

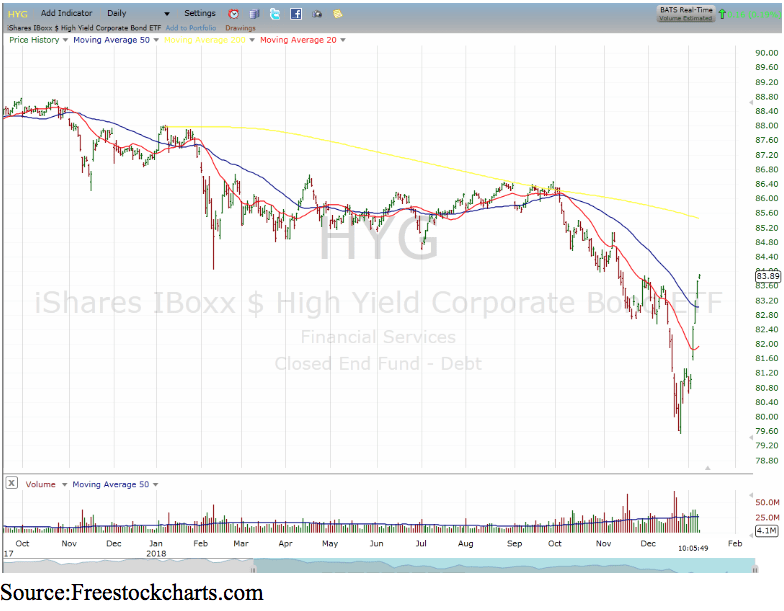

So where has the money gone? Back into the corporate bonds, especially high yield or junk bonds.

The bulk of high yield corporate debt is tied to the capital intensive energy market. With the rebound in oil prices, there has been a surge in those high yield bonds as illustrated by the iShares High Yield Corporate Bond ETF (HYG)

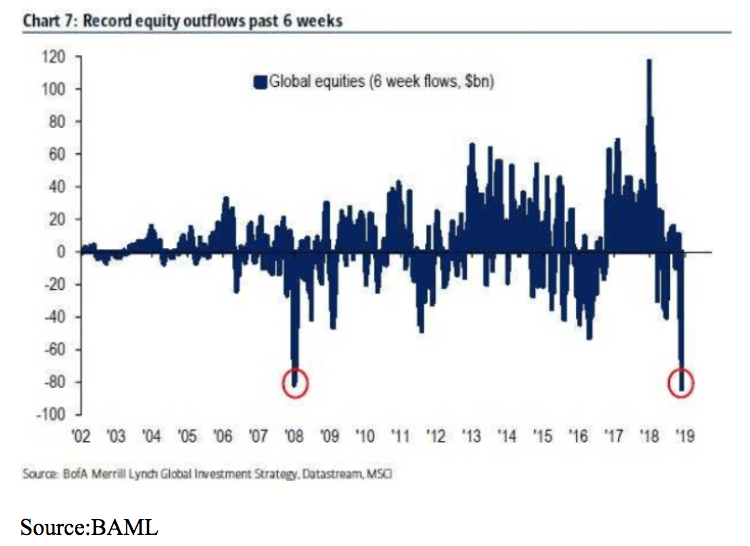

But what’s interesting to note is despite the stock market’s recent rally, it is now some 9% off the recent lows, has also seen outflows over the past few weeks.

This suggests two things; much of the bounce has been short covering and that most of the selling is now exhausted.

Essentially, the market seems to reset itself at a place of equilibrium as we await this quarters earnings reports. What companies say will probably determine the path of interest rates and, by turn, the direction the stock market will take.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!