U.S. Treasury bonds have surged over the past few days, sending yield on the 10-Year note to its lowest level since last February.

The flight into bonds is indicative of investors dour outlook for the economy, and by extension stocks. But, this fear seems overwrought — and the rally in bonds overdone.

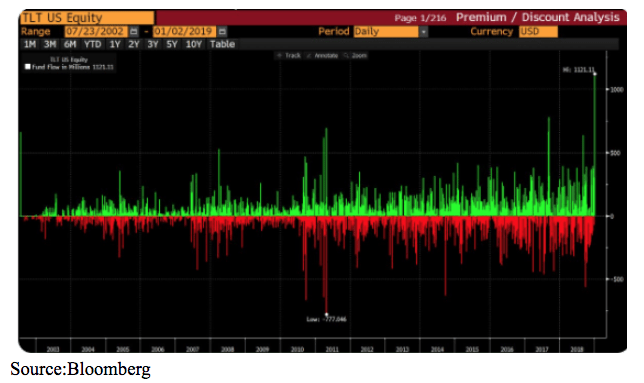

Bloomberg data shows that bond-based exchange-traded funds, especially on the long end such as iShares Barclay’s 20+ Treasury Bond (TLT), saw record inflows over the past few days.

TLT saw record inflows on of over $1.2 billion on Wednesday.

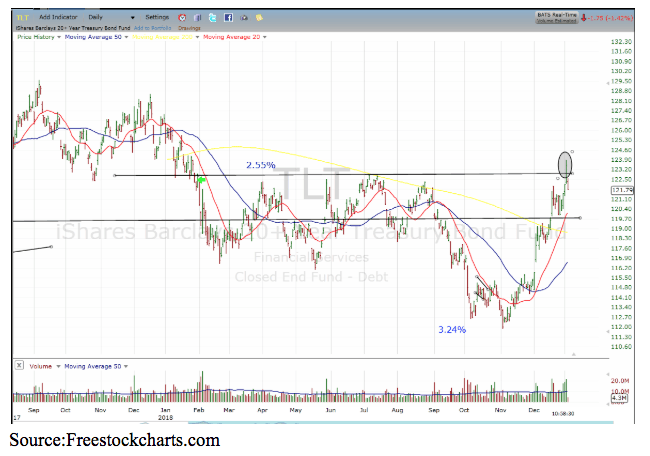

The rush into bonds sent prices higher with the chart suggesting a major breakout through the 2.60% resistance level as dropped as low as 2.55%.

I believe this will prove to be a false breakout caused by unwarranted fear that the U.S. economy is heading for a recession.

Indeed, following this morning’s blow out jobs number followed by Fed Chairman Powell providing a more flexible viewpoint on the path raising interest rates has caused a reversal, sending yield back to the 2.65% level and leaving a bearish spike on the chart.

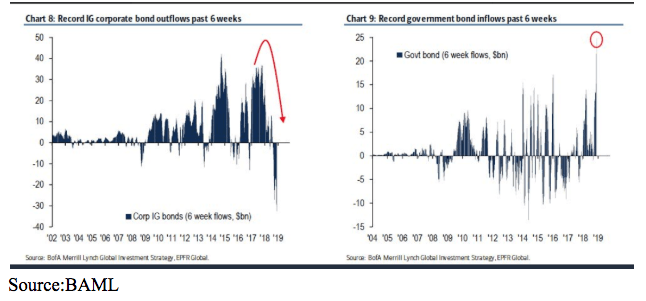

We know this rush into government-backed bonds was done out of fear or a flight to safety rather than a hunt for income, as it coincided with massive outflows or selling in corporate bonds which offer higher yields yet are deemed riskier.

While some of the recent economic data has indicated a slowdown and analysts are rushing to reduce earnings estimates, especially in the wake of Apple’s warning, I would repeat what I said here, there is a big difference between growing at a slower rate and actually turning negative.

I think the sentiment indicators turned way to negative given the hard data has only softened moderately.

I can understand the stock market being overly cautious as it hates unknowns and the end game of the trade war is still very uncertain.

But bonds are usually bound tighter to what is known, and what we know is that Powell would prefer to have another one or two rate hikes and strong data such as this morning’s jobs number provides him cover to do so.

For this reason, think the people that went rushing into bonds thinking they were hiding in a safe place will find themselves regretting it when yields move back towards the 2.80%-2.85% level in coming weeks.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!