After a grisly May (the second worst May since the 1960s for stocks) the S&P 500 came roaring back in the first week of June, posting a 4.4% gain. The Dow managed an even more impressive gain of nearly 5%, snapping a six-week losing streak (the longest since 2011). And that rally may continue for a while longer now that the trade war with Mexico has been called off and news that China and the US may start talking soon also broke over the weekend.

However, we can’t ignore the pretty awful jobs reports that came out last week either, which missed economist expectations by a mile and might indicate that the cornerstone of America’s consumer-driven economy may be significantly weakening. So let’s take a look at both the bad news and the good news about that jobs data, to see why it’s not yet time to panic, nor assume that a recession is now inevitable.

The Bad News: Trade War Is Very Likely Hurting Job Creation

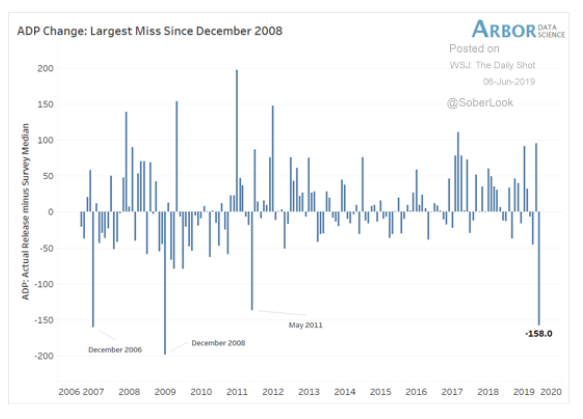

Economists had been expecting between 160,000 and 190,000 new jobs to be created in May (depending on the survey). June 5th’s ADP/Moody’s Analytics survey of private sector job growth came in at just 27,000, the weakest report in nine years.

That meant that, in terms of that report, the actual data missed expectations by nearly 160,000 the largest miss since December 2008 (it’s never good when any economic report is the worst since the dark days of the Great Recession).

The Bureau of Labor Statistic’s jobs report came in at 75,000, also badly missing expectations and the previous two month’s figures were revised lower by 75,000. Manufacturing, which last year added about 25,000 net jobs per month, has in 2019, averaged just 3,000, and most economists point primarily to the escalating trade war as the main cause of that.

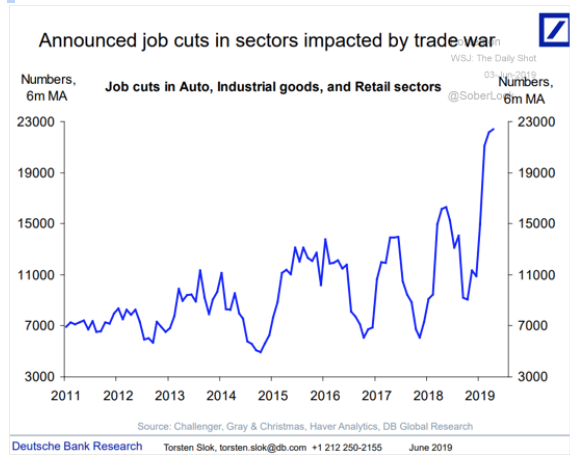

As Deutsche Bank points out in the following chart, job losses in trade-sensitive industries have soared in 2019, to the highest levels in a decade.

Business sentiment has also tanked in recent months, with trade uncertainty cited as the primary cause. Moody’s Analytics chief research, Mark Zandi, writing in June 5th’s report said that should the US make good on all of its tariff threats it would be “game over” and Moody’s officially would expect a US recession to begin in 2020.

Of course, a single terrible month’s data is hardly sufficient to declare the strongest job market since 1969 (the last time unemployment was 3.6%) dead, nor the longest US expansion in history (as of July 1st) doomed. But if we get two more such reports, potentially even showing negative jobs growth next month (snapping a streak of 107 consecutive months of positive jobs growth, the longest in history) then it will finally be time to declare that the trade war killed the jobs market.

However, that’s merely the bad news. There’s still plenty of good news to give investors hope of a brighter future, including a possible double-digit market rally over the coming year.

The Good News: A Resilient US Economy Isn’t Likely to Slide Into Recession Quickly

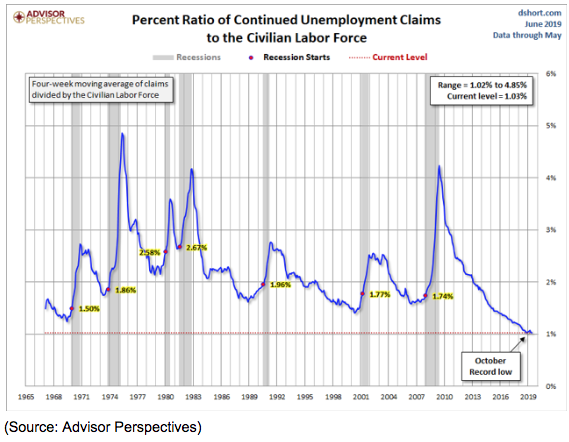

Last month job creation did slow significantly, there is no denying this. However, that doesn’t mean that companies are firing people en masse.

Weekly jobless claims remain near record low levels, which explains why May unemployment was 3.6% (u3) and 7.1% (the more accurate U6). That helped to push up average wage growth in May 3.1% for all workers and 3.4% for non-supervisory positions (80% of the US population). And given that core inflation is just 1.6%, inflation-adjusted real wage growth continues to be strong, which explains why retail sales have continued to be resilient, averaging about 5% YOY in the last few months.

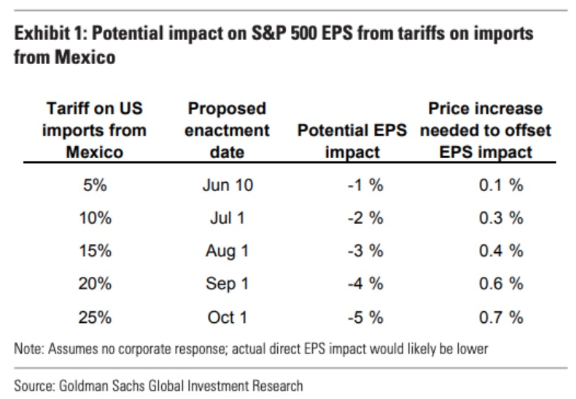

And even if the trade war is starting to show up in the jobs data, we can’t forget on on Friday, June 7th, the Whitehouse declared that it had come to an agreement with Mexico over its border issues (which Mexico actually agreed to months ago according to the New York Times) which means that the threatened 25% tariffs on all of Mexican imports has been called off “indefinitely.”

25% tariffs on $370+ billion in Mexican imports would have caused the S&P 500’s earnings to decline by 5%, according to Goldman Sachs. That could have caused 2019 EPS to decline by over 2% this year, or at least forced companies to raise prices by nearly 1%, raising core inflation to 2.3% or higher (vs Fed’s long-term goal of 2.0%).

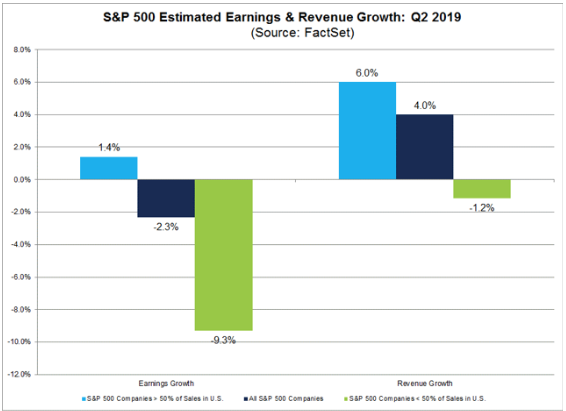

According to Factset Research, Q2 was already expected to be a horrible quarter for multi-nationals, who, on average derive 63% of their sales from overseas. Analysts are currently expecting these giant global corporations to report negative revenue growth and nearly double-digit earnings declines, led in large part by the tech sector that has long been a Wall Street darling (and now makes up about 25% of the S&P 500).

But there was also more good trade news over the weekend, that should lift the spirits of both workers and investors. On Saturday, June 8th Treasury Secretary Mnuchin told reporters that President Trump and Chinese President Xi would indeed be meeting at the June 28th/29th G-20 Summitt in Japan. Now it’s important to keep this good news in perspective.

The details are still murky, and since trade talks fell apart on May 10th, there has been no additional negotiations. Thus there is zero chance that a final deal will be announced at the end of June. Rather the best we can likely hope for is another November style (also announced at a G-20 summit) “deal to make a deal” in which the US potentially declares the final $300 billion round of Chinese tariffs postponed and Beijing and Washington agree to restart talks by scheduling a 12th round of negotiation.

But that’s certainly better than the alternative, which is the US declaring the final tariff list, which then would go into effect after a 90 day comment period ends (so final Chinese tariffs in September). And any good news is likely to bolster both business (the people making the hiring decisions) and investor confidence.

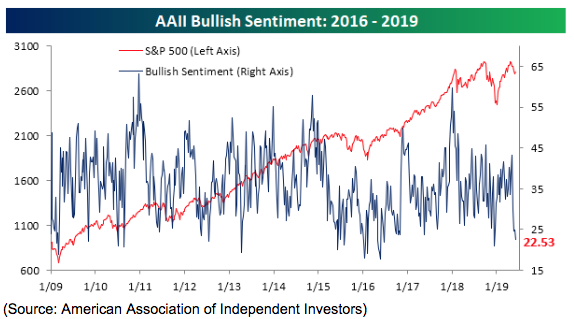

And as far as short-term market moves go, we can’t forget that May’s nearly 7% market decline caused bullish sentiment to plunge to nearly December 24th levels.

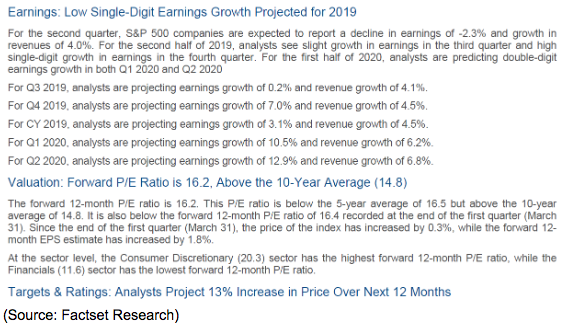

Remember that low sentiment is actually a contrarian indicator that bodes well for share prices. According to Factset Research currently, analysts expect the S&P 500’s forward 12-month return to be 13%. Now I’m the first one to warn readers to always be skeptical of forward estimates since 12-month stock returns are an educated guesstimate at best (which is why most analysts predict the market will rise 10% every year, which is close to its historical return).

Assuming we do get a final trade deal with China by the end of the year, then current analyst EPS growth estimates of roughly 11% over the next 12 month could be achievable. And given that the current forward PE is 16.2, equal to the 25-year average (and thus indicating the market is trading at fair value) the 13% 12-month forward forecast is also reasonable.

And while I’m hardly a fan of Wall Street’s irrational obsession with low-interest rates (slowing rising rates are a sign of a healthy economy which is fundamentally better for long-term share prices) there’s also falling rate expectations to keep in mind.

JPMorgan now expects 10-year yields to decline to 1.75% (down about 0.35% more) by the end of 2019. Commerzbank’s Christoph Rieger is even more bullish on bonds recently writing in a note that

“Once slowing economic growth and tariff fears force the central bank’s hand, the 10-year Treasury rate would fall toward a record low of 1.25% by year-end.”

Rieger expects 3 rate cuts by March 2020 to be a huge reason for long-term rates to fall to a new all-time low.

Now it’s important to remember that Wall Street’s 2014 to 2016 “bad news is good news because it means lower rates for longer” rally isn’t likely to persist should we actually get a recession (about 40% probability of that given current fundamentals and a yield curve of -15 basis points).

However, it is true that lower volatility pass-through stocks (like REITs, MLPs, and yieldCos) would indeed probably decline less than the broader market, if only because they are naturally lower volatility equities. And all dividend stocks are likely to benefit immensely from potentially record low 10-year yields (the Fed said last week it plans to buy more long-term US treasuries during future recessions). That’s especially true when it becomes obvious that any future recession isn’t going to be a repeat of 2007-2009’s 5.1% peak decline in GDP (since WWII and excluding the Great Recession, avg peak GDP decline is just 2.0%).

In other words, the Fed’s declaration that it will both cut short-term rates to zero AND buy as many bonds as it takes to avert another financial crisis means that the 70% style crash some permabears are predicting is almost certain to not occur. If only because any sufficiently sharp crash might cause the Fed to directly buy stocks just as the Bank of Japan has been doing for years with that country’s ETFs.

I personally, after seeing the latest economic data and reading the bond market tea leaves, have shifted my capital allocation strategy (what I do with my weekly savings) to a more bullish stance. I’m now planning on investing 80% of my monthly discretionary savings (money I won’t need for at least five years) into stocks, up from 60% as I was doing last week.

]Mind you I continue to only buy quality dividend blue-chip dividend growth stocks, and at March 2009 style valuations. For example, my last buy was an opening $2,000 position in Skyworks Solutions at 10.7 times forward PE (vs S&P 500’s forward PE of 10.3 at March 9th low), a roughly 30% discount to fair value for the single most trade sensitive stock in America (both in terms of China tariff and Mexico tariff exposure). As I write this that stock is up 4.3% today and I’m sitting on a 3% paper profit after owning this company for just a few hours.

Of course, it’s always possible that the company will crater in the coming weeks, should trade talks with China go nowhere. But in that case, I’ll just steadily buy more up to a 5% position in my portfolio, before moving onto Broadcom, another of my favorite trade sensitive chip makers.

Bottom Line: America’s Economy Has Faced Tough Challenges Before and Come Out on Top, and This Time Is Likely to Be No Different

There’s no sugar-coating the fact that May’s jobs data sucked and sucked hard. While it’s still too early to declare with certainty that the trade war is necessarily the reason for that weakness, evidence to that effect is getting hard to ignore.

Fortunately, the calling off of the US/Mexican trade war and now news that the US and China may soon resume trade talks should help avoid a worst-case scenario. That would be where job growth rapidly turns negative and accelerates at a pace that raises unemployment, causes wage growth to fall off a cliff and puts consumer spending into the toilet.

Recession risk appears to be about 40%, the highest in a decade. However, the good news is that America’s resilient and highly diversified economy is a mighty beast that can take a lot of sharp blows before rolling over.

With the Fed having no less than eight rate cuts in its quiver, and Powell recently making clear that it would be willing to use them all if necessary, it’s likely that we can still avoid both a recession and a bear market.

That might not prevent strong market volatility in the coming year but given current market valuations and the consensus EPS growth expectations analysts have, it does appear as if stock investors can potentially expect double-digit total returns over the coming year.

This means that today remains a good time to keep putting new money to work into quality companies. I’ve personally raised the percentage of monthly savings that I’m using to buy undervalued blue-chips from 60% to 80%.

While the market will always be uncertain in the short-term (thus the need for good asset allocation and risk management) over the long-term the immortal words of Peter Lynch, the second greatest investor in history behind Buffett, still ring true.

“Time is on your side when you own shares in superior companies…the key to making money in stocks is not to get scared out of them.”

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!