As the 2020 elections approach and the political rhetoric surrounding income inequality heats up, one of the obvious-and-easy targets are corporations. Among the regulatory arrows being fired are proposals for restrictions, or outright bans on stock buybacks.

But, you know who’s not talking about buybacks? The companies themselves. That’s because prior earnings reports are considered a “quiet period” in which corporations are not only restricted from what information they can disclose, but also must halt their share repurchase programs. Now, as we cross half-way through “earnings season,” companies are revealing their buyback plans.

And they are set to hit a new record as zero interest rates allow for borrowing at no cost to finance buybacks and uncertainty over trade tariffs and regulation leave them reluctant to increase cap-ex spending.

I’ve written recently about some studies showing that buybacks aren’t an efficient use of capital and often don’t improve a stock’s performance over the long term. But, there is no denying that the activity can prop up share prices in the short term.

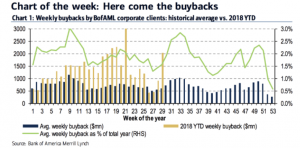

Not only do buyback programs kick in once earnings are reported, but the summer seems to historically be the seasonal high point for share repurchases.

Meaning, we are about to see some massive buying from the corporations themselves. This comes on top of what has already been two consecutive years of record buybacks with 2019 set to surpass over $850 billion buybacks.

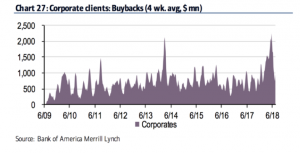

I think it’s clear that, thanks to the tax cut, 2019 is going to be a year to remember. Here’s the post-crisis history of buybacks on a 4-week rolling average.

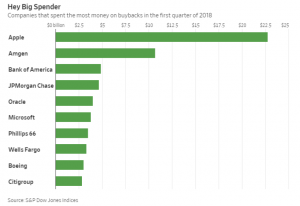

The most active buyers are big tech companies, which until recently, have already been the best performers.

While the criticism is valid that buybacks are evidence a company lacks new ideas or the willingness to invest in its future through capital investments, research or even acquisitions, there is no denying that they can increase the perceived value of a company’s shares.

When a company buys back stock, it is often positioned as “returning cash to shareholders,” but it really isn’ — at least in the same way a dividend does. What buybacks do are help boost earnings per share results, since the profits are spread out over a lower denominator (shares), making the EPS look a lot bigger. Repurchased shares get retired, basically locked in the corporate vault, and are not included in calculating EPS. As such, buybacks represent a tailwind to share prices. It is estimated that the number of total shares outstanding for S&P 500 companies have declined by 31% over the past five years. Basically, the stock market has been shrinking.

This may seem like nothing more than some unproductive, sleight of hand accounting where no one gets hurt but buybacks actually do have a significant downside; the repurchased stock is dead and the cash is in the hands of the seller. Where there was once a liquid stock and cash, there is now just cash. So half the previously existing economic value has been eliminated, the outstanding share count has gone down — which is fine until you remember EPS isn’t a measure of financial health. Net income is.

What the company retains are debt load and interest payments. Companies very, very seldom flip from buying back stock to doing secondaries. Doing so would absolutely kill their shares. That means liquidity is restricted even beyond interest. Financial commentator Jeff Macke describes buybacks thusly: “A buyback is financially tantamount to buying shares and lighting them on fire then paying an annual fine for pollution. If you’re lucky, the interest rate paid on buyback loans is roughly equal to the dividend payments saved.”

It also means companies are not investing in research, capital equipment, or other items on which to build future growth. Goldman Sachs estimated that 27% of the cash that companies spend in 2019 will be used for stock buybacks.

What buybacks do are help boost earnings per share results, since the profits are spread out over a lower denominator (shares), making the EPS look a lot bigger. Repurchased shares get retired, basically locked in the corporate vault, and are not included in calculating EPS.

As such buybacks represent a tailwind to share prices that just might send stocks sailing to new highs in coming weeks.

AAPL shares were trading at $209.99 per share on Tuesday afternoon, up $0.31 (+0.15%). Year-to-date, AAPL has gained 34.21%, versus a 21.61% rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of Stock News.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AAPL | Get Rating | Get Rating | Get Rating |