- Cash rules during risk-off periods

- Microsoft will survive and thrive

- Apple could go on a shopping spree

During risk-off periods, the phrase “Cash is king” always comes out of the closet because of the belief that money is more valuable than any other form of investment tool during troubled times. Cash buys food, goods, and services, and when the chips are down, cold hard cash goes a long way. The value of fiat currencies is a topic for another piece, but these days, a lot of investors wish they had cash instead of stocks in late February when the stock market reached its last record peak.

The global pandemic has wreaked havoc with markets across all asset classes. In late February and throughout March, the bull market in stocks turned into a roaring bear. Coronavirus infections passed the one million level last week, and sadly, fatalities continue to rise. The decade-long bull market in stocks was a fatality of COVID-19. The trend that lasted from 2009 through February 20, 2019, was put to rest by a deflationary spiral that had not been seen in the United States since the 1930s. While bankruptcies will rise over the coming weeks and months, those cash-rich companies with stable revenue streams could be in a position to emerge even stronger. Microsoft (MSFT - Get Rating) and Apple (AAPL - Get Rating) both had lots of cash at the end of last week.

Cash rules during risk-off periods

The United States and the world are going through the most challenging period since the 1930s. The two-week tally on first-time claims for unemployment benefits in the US rose to an incredible ten million last week, and the number will grow. Individuals are concerned about their economic futures and wellbeing, and companies are struggling to survive. People and companies with significant cash reserves are in the best position to weather the current economic storm.

Two companies that have retained their status in the trillion-dollar market cap club are Microsoft Corporation (MSFT) with $1.17 trillion and Apple (ASPL) with $1.056 trillion. As of Friday, April 3, the S&P 500 index was at 2,488.65, 26.7% below the record high of 3,393.52 on February 19.

Microsoft will survive and thrive

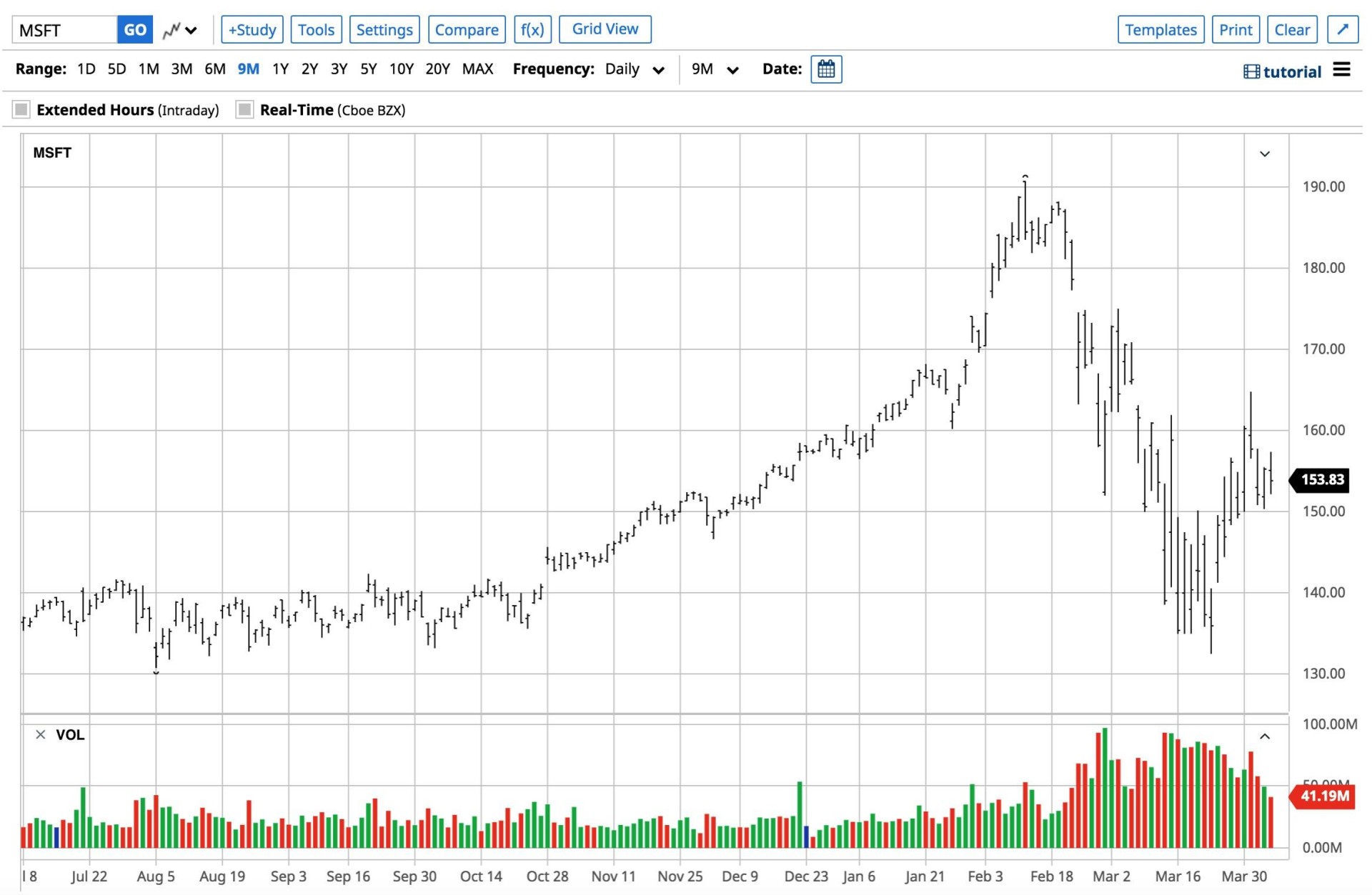

Over the period, shares of Microsoft Corp (MSFT) outperformed the benchmark index.

Source: Barchart

MSFT rose to a record high of $190.70 per share on February 11 and was trading at $153.83 on April 3, 19.3% lower.

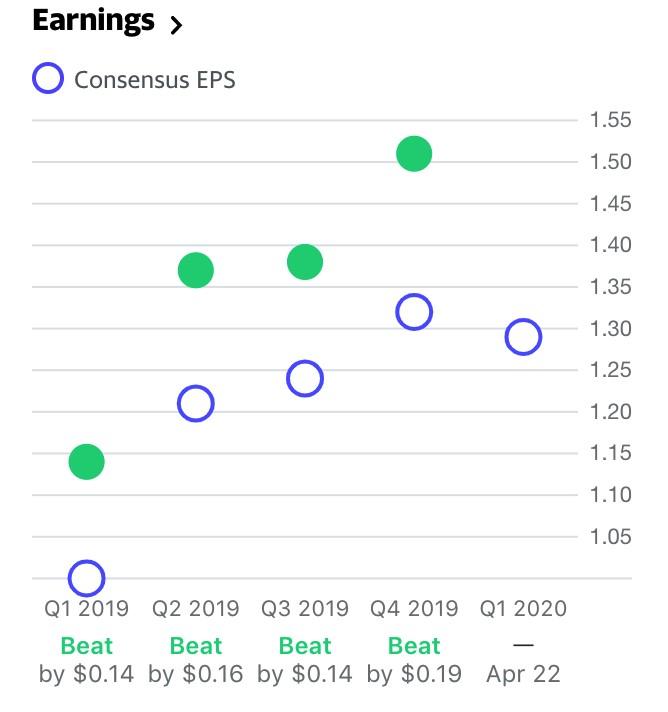

Source: Yahoo Finance

As the chart shows, Microsoft (MSFT) has an excellent track record of beating consensus EPS estimates. However, the current projection for Q1 2020 at $1.29 per share will be more than a challenge for the company. Microsoft’s software franchise will continue to place the company in a leadership position in the aftermath of the global pandemic as the world works its way through the financial rubble.

Apple could go on a shopping spree

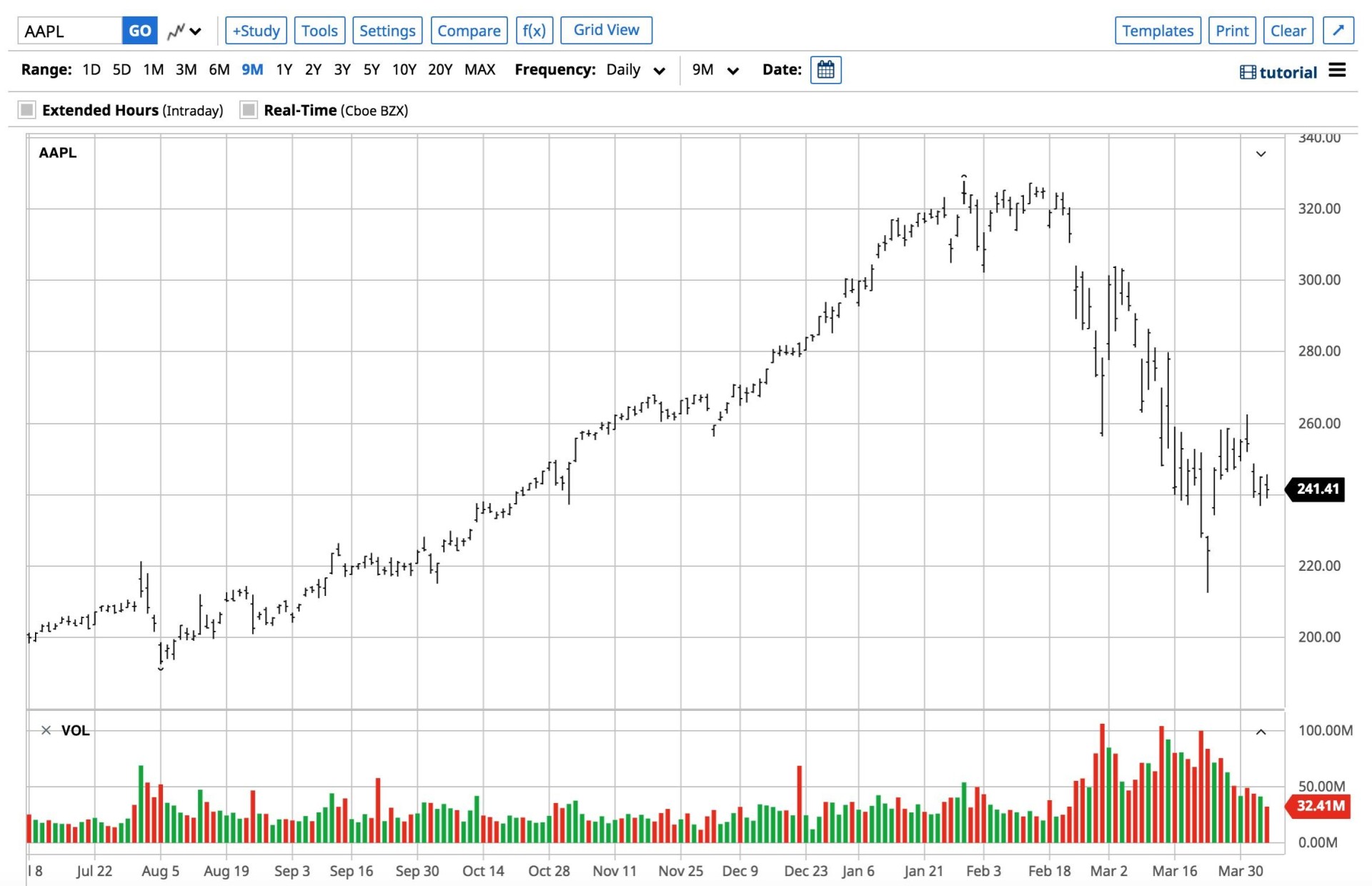

While Microsoft did better than the overall market since the February peak, Apple Inc (AAPL) mirrored the performance of the S&P 500.

(Source: Barchart)

The chart illustrates that Apple (AAPL) shares fell from a high of $327.85 on January 29 to $241.41 at the end of last week, a decline of 26.4%.

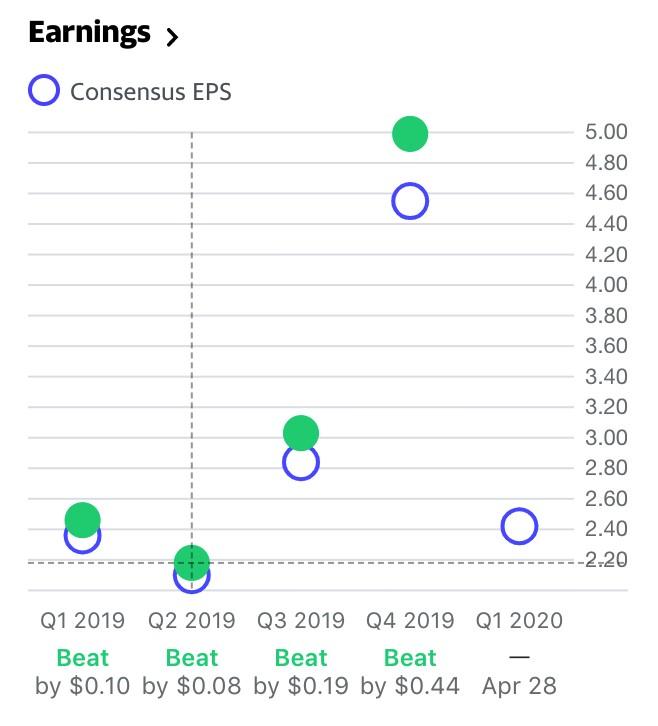

(Source: Yahoo Finance)

Apple also has an excellent record of beating consensus earnings estimates. However, Q1 projections of $2.42 per share will also be a target that the company is not likely to reach. Meanwhile, the company has a dominant position in the smartphone and hardware business, as well as a robust line of other products and services.

Both Microsoft (MSFT) and Apple (AAPL) both have significant cash on hand to make it through the pandemic. Moreover, each company could find itself in a position to pick up more than a few bargains when it comes to acquisitions now that valuations have declined dramatically. On any significant risk-off periods that send the shares of either company lower, remember that cash is king. Both companies are in a position to emerge from the ashes and thrive in the years ahead. Lower share prices for MSFT and AAPL should create bargains for the future.

Want more great investing ideas?

The Fake Rally is Over! – Why the bear is still in charge. Along with the right investment strategy to generate profits while stock prices head lower.

How to Make Money in a Bear Market – Learn more about this vital webinar with famed investor Marc Chaikin.

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

AAPL shares were trading at $253.68 per share on Monday afternoon, up $12.27 (+5.08%). Year-to-date, AAPL has declined -13.41%, versus a -18.15% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AAPL | Get Rating | Get Rating | Get Rating |

| MSFT | Get Rating | Get Rating | Get Rating |