- The primary ingredient in ethanol in the US is corn- In Brazil, it is sugarcane

- The US ethanol blend was a farming subsidy cloaked in an environmental initiative

- Brazilian cars run on ethanol

- ADM is at the center of the US ethanol and agricultural markets

- Bunge has huge Brazilian exposure in the sugar business

Elections have consequences. Aside from the many issues that divided former President Donald Trump and the current holder of the Oval Office, President Joe Biden, energy policy was on the ballot last November.

On his first day in office on January 20, 2021, President Biden canceled the Keystone XL pipeline project that moved crude oil from the oil sands in Alberta, Canada, to Steele City, Nebraska, and beyond to the NYMEX delivery point in Cushing, Oklahoma. The symbolic move ushered in a new era that ended the “drill-baby-drill” and “frack-baby-frack” policies under the Trump administration.

President Biden pledged to address climate change through a dramatic shift in US energy policy on the campaign trail. He has been following through on that promise. The US will increase regulations on the fossil fuel industry and support alternative and cleaner sources from the sun, wind, hydro, and biofuel sectors.

Archer Daniels Midland (ADM - Get Rating) and Bunge Limited (BG - Get Rating) are two of the ABCD companies that are leading agricultural firms. ADM and BG trade on the stock exchange, while the other two, Cargill and Louis Dreyfus, are privately held.

ADM and BG are involved in the supply chain that processes agricultural commodities into biofuels. Policy changes in the US will increase ADM and BG’s role in energy production.

The primary ingredient in ethanol in the US is corn- In Brazil, it is sugarcane

Ethanol is the biofuel that powers cars and other machinery worldwide. In the US, the government mandates an ethanol blend with the gasoline that powers automobiles. The US and Brazil are, by far, the world’s leading ethanol-producing countries.

The chart shows that while the US leads the world in ethanol output, no other country comes close to Brazil.

The US is the world’s leading producer and exporter of corn. The coarse grain is the primary input in US ethanol production. Meanwhile, the price of corn has skyrocketed over the past year, reaching its latest high on May 7.

Source: CQG

Source: CQG

As the monthly chart highlights, corn futures rose to their latest high at $7.75 per bushel on May 7, the highest level since October 2012. In 2012, corn reached its record peak at $8.4375 per bushel. Corn exploded higher from the $3 per bushel level in April 2020. The input cost for US ethanol production has been rising with the price of corn.

Brazil is the world’s leading sugarcane producer and exporter. In the South American nation, sugarcane is the primary input in ethanol production.

Source: CQG

Source: CQG

The monthly chart of ICE sugar futures shows the move from a low of 9.05 cents per pound in April 2020 to the most recent high of 18.94 cents in February 2021. At the February peak, sugar reached its highest price level since March 2017. Sugar was trading at nearly the 17.50 cents level at the end of last week. The input cost for Brazilian ethanol has increased because of the rise of sugar’s price.

Meanwhile, ethanol prices have exploded. While the futures contract is illiquid with minimal open interest, the price serves as a value benchmark.

Source: CQG

Source: CQG

The monthly chart shows that ethanol futures reached a new multi-year high last week at $2.44 per gallon wholesale. The last time ethanol futures reached the current level was back in April 2014. At that time, other energy and fuel prices were far higher.

In April 2014, the price of nearby NYMEX crude oil futures was about the $100 per barrel level, and NYMEX gasoline futures prices were over $3 per gallon wholesale. On May 7, nearby NYMEX crude oil was at the $64.90 level, with gasoline at $2.1269 per gallon. Higher corn and sugar prices are driving ethanol to the upside.

The US ethanol blend was a farming subsidy cloaked in an environmental initiative

In 2005, Congress enacted ethanol mandates and aggressively expanded them in 2007 with hopes of turning corn into fuel to replace regular gasoline. The politicians sold the ethanol mandate to boost the nation’s renewable fuels sector to help improve the environment by lowering toxic automobile emissions and reducing the US’s reliance on imported oil from the Middle East.

The ethanol mandate also serves another purpose as a farming subsidy, providing a new demand vertical for US corn production.

Source: CQG

Source: CQG

The quarterly chart shows that in 2005, corn prices reached a low of $1.8575 per bushel. The all-time high at that point was at $5.5450, the 1996 peak. The ethanol mandate established a higher range for corn prices, benefiting the US agricultural sector.

Brazilian cars run on ethanol

Most automobiles in Brazil run either on hydrous alcohol (E100) or on gasohol (E25 blend). The mixture of 25% anhydrous ethanol and gasoline is mandatory throughout South America’s leading economy and most populous country. Since 2003, dual-fuel ethanol flex vehicles that operate on any proportion of hydrous ethanol and gasoline have gained popularity.

Brazil is the world’s second-leading ethanol producer because of its domestic demand.

ADM and BG are two of the world’s leading integrated agricultural companies. ADM has a significant footprint in the US corn market, and BG has a substantial presence in Brazil.

ADM is at the center of the US ethanol and agricultural markets

ADM operates through three segments: Agricultural Services and Oilseeds, Carbohydrate Solutions, and Nutrition. Among ADM’s many products that feed the world, the company also powers the world through its presence in the biofuel market.

The company’s website spells out ADM’s involvement, “Today, biofuels such as ethanol and biodiesel are the leading alternative transportation fuels available to consumers, and ADM is a leading producer of both of them.”

Rising agricultural prices and explosive price action in ethanol and corn futures markets have been highly bullish for ADM shares.

Source: Barchart

Source: Barchart

The long-term chart highlights the bullish trading pattern in ADM shares that took them to their latest all-time high last week at $67.34 per share. ADM far more than doubled since the pandemic-inspired $28.92 low in March 2020.

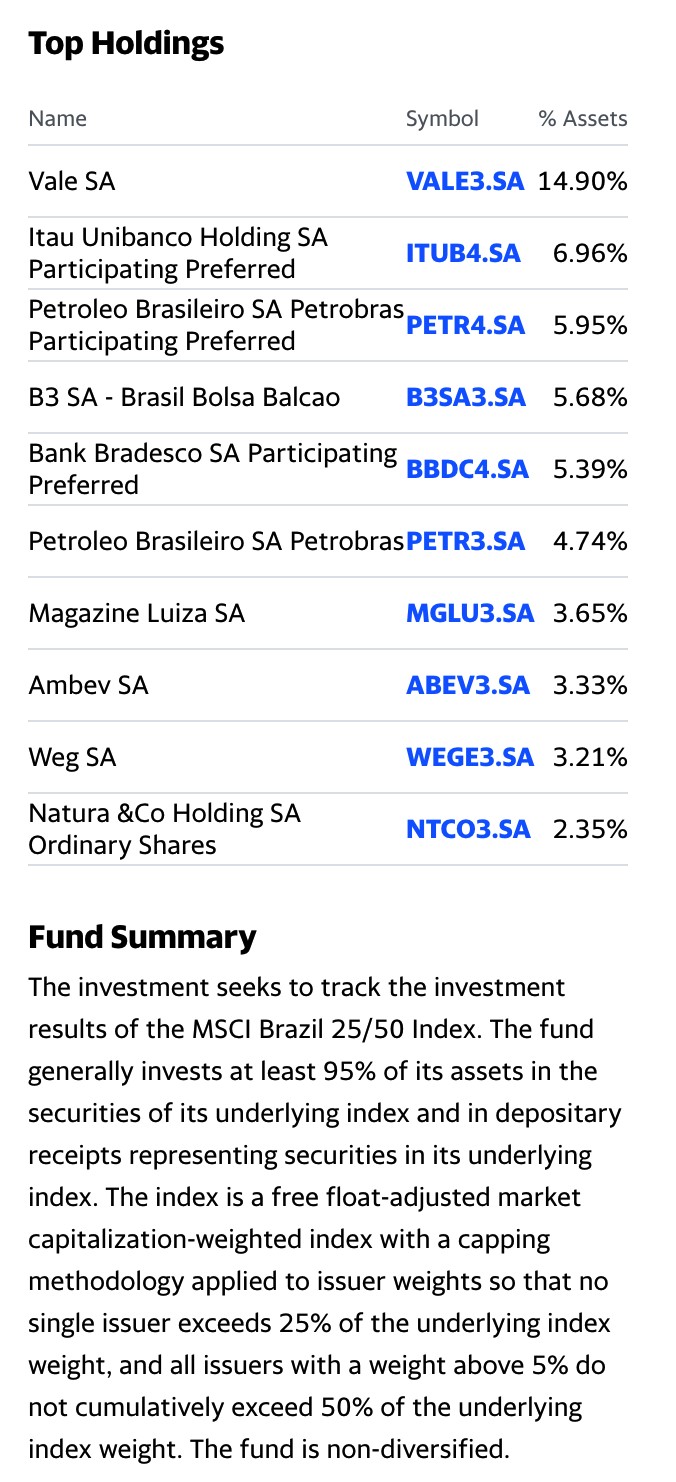

Source: Yahoo Finance

Source: Yahoo Finance

The chart shows that while ADM has beaten consensus EPS forecasts over the past four consecutive quarters, it blew away the Q1 expectations at $1.04 when it reported $1.39 on April 27. At $67.02 at the end of last week, ADM pays shareholders a $1.48 or 2.21% dividend. A survey of twelve analysts on Yahoo Finance has an average price target of $67.92 for ADM shares, with forecasts ranging from $53 to $78.

Bunge has huge Brazilian exposure in the sugar business

BG operates through five segments: Agribusiness, Edible Oil Products, Milling Products, Fertilizer, and Sugar and Bioenergy. While BG is a US multinational corporation, it has a significant footprint in Brazil. The company’s website highlights its annual crushing capacity of 32 million tons of sugarcane for processing into over 1.5 billion liters of ethanol.

Like ADM, Bunge is involved in all other facets of the agricultural sector along with biofuel.

Source: Barchart

Source: Barchart

The chart illustrates the rise in BG’s shares from the March 2020 $29 low to the most recent $91.99 high ion May 7. The nearby upside target stands at the December 2014 $93.17 high, with the all-time high from 2008 sitting at $135 per share. The weak Brazilian currency has likely weighed on BG shares over the past years. The real hit a high of $0.65 against the US dollar in 2008 when BG shares peaked. The currency relationship was just above the $0.1900 level at the end of last week.

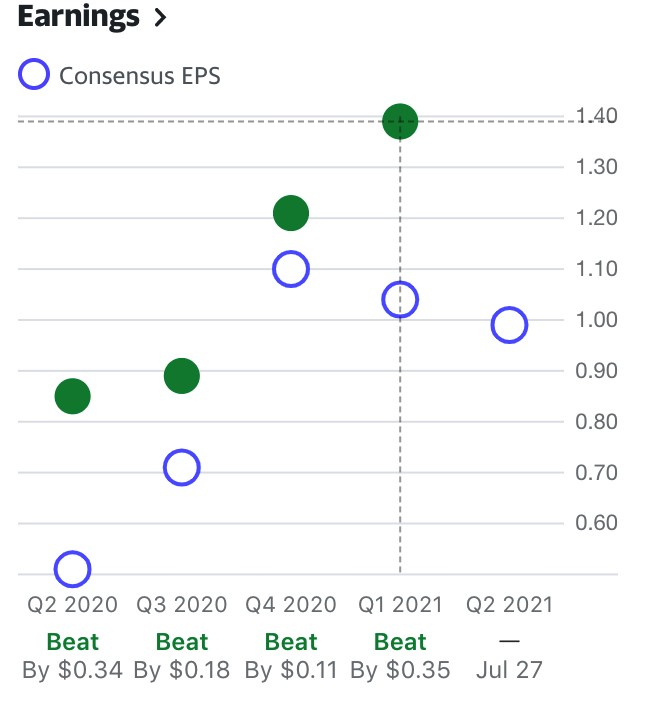

Source: Yahoo Finance

Source: Yahoo Finance

BG reported earnings last week and blew away EPS expectations for the fourth consecutive quarter reporting $3.13 per share compared to forecasts of $1.54. BG pays shareholders a $2.10 dividend, translating to a 2.3% yield at $91.32 per share. A survey of eight analysts on Yahoo Finance has an average price target of $94.13 for BG, with forecasts ranging from $72 to $104.

ADM and BG are agricultural companies that feed the world. Addressing climate change will increase biofuels’ role, making the two companies energy businesses over the coming years. The trend in both stocks is higher, and the trend is always your best friend.

Want More Great Investing Ideas?

ADM shares rose $0.53 (+0.79%) in premarket trading Monday. Year-to-date, ADM has gained 34.94%, versus a 13.35% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| ADM | Get Rating | Get Rating | Get Rating |

| BG | Get Rating | Get Rating | Get Rating |