It’s been a tough week for the Gold Miners Index (GDX), as the sector has been pummelled with gold (GLD) dipping below the $1,720/oz level. While many gold miners were trading at reasonable valuations in April, the FOMO crowd pushed them into frothy territory in mid to late May. We’re now likely seeing the late-to-the-party bulls cough up their positions, as this trade to unwind a little at some point. Although several names in the sector are still not cheap, even after 15% corrections, three names remain significantly undervalued relative to their peers. Fortunately, this is a spot where investors looking to buy the dip can get a margin of safety.

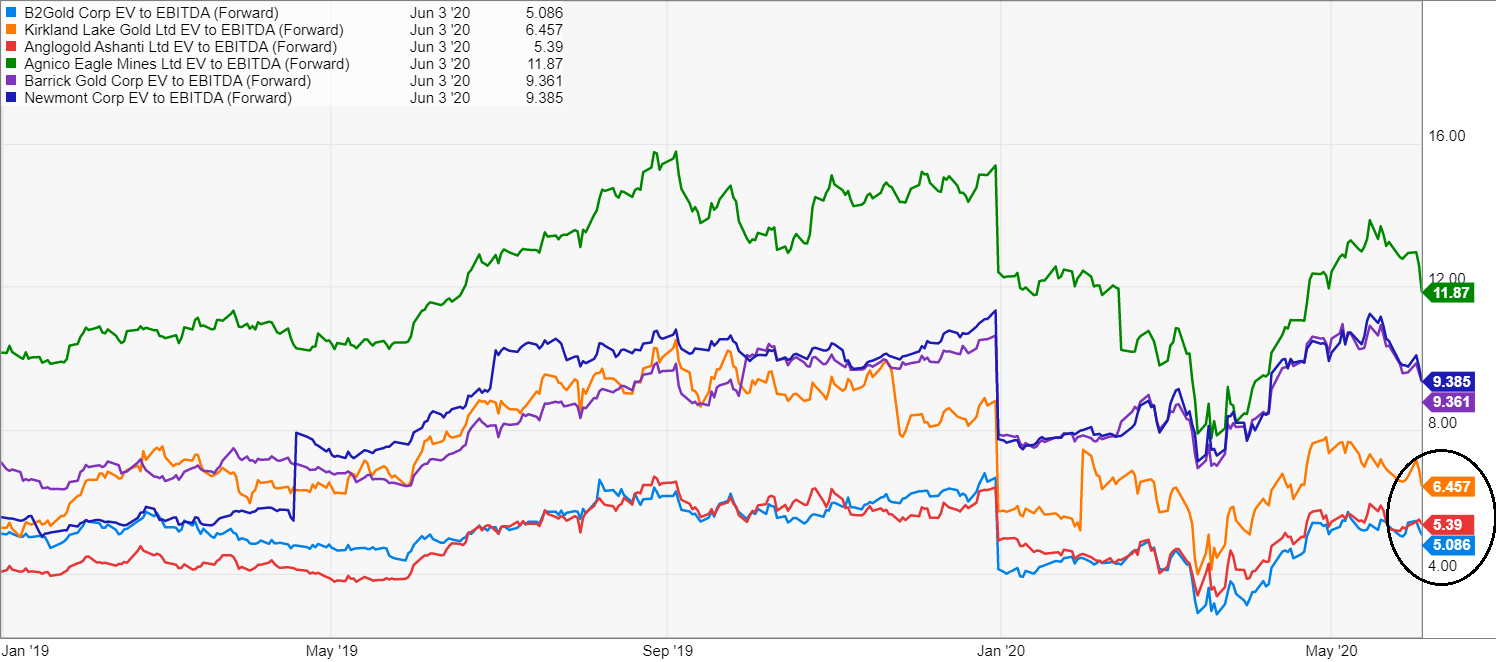

The three miners currently trading at attractive valuations have little in common, with all operating out of different continents, and most having different cost profiles. However, the one similarity between the three is that they’re all trading below 7x forward Enterprise Value to EBITDA, and they’re all 1-million plus ounce producers. This forward EV to EBITDA ratio is quite reasonable, given that most million-ounce producers are currently trading at a multiple of 10 or more. The three names that we’ll focus on today that stand out as undervalued are Kirkland Lake Gold (KL), B2Gold (BTG), and Anglogold Ashanti (AU). Let’s begin with Kirkland Lake Gold:

(Source: YCharts.com)

Kirkland Lake Gold was formerly the darling of the sector, putting up an incredible 800% return from 2016 to 2019, but it fell out of favor last year after acquiring Detour Gold. While the deal allowed Kirkland Lake to increase its annual gold production significantly, it also led to margin compression, as Detour Lake is a higher-cost asset than the company’s legacy high-grade and ultra-low-cost mines. The market immediately sold off the stock, and for a good reason, given the margin compression, as the stock was trading at a premium valuation to its peers. However, at 10x FY-2021 earnings, and with nearly $3.00 in cash, I believe the sell-off has gone too far. We can take a look at the earnings trend below:

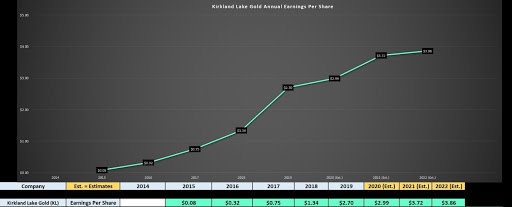

(Source: YCharts.com, Author’s Chart)

As we can see above, Kirkland Lake Gold has an incredible earnings trend, as the company managed to grow earnings by over 700% in just four years, from $0.32 to $2.70. In FY-2019, Kirkland Lake grew annual EPS by 101% to $2.70 per share, but FY-2020 earnings per share are going to decelerate materially, with annual EPS growth expected to come in at just 11%. This significant deceleration is due to a combination of the acquisition of Detour Gold, which led to a 30% increase in Kirkland Lake Gold’s share count, and tough year-over-year comps. However, anyone with any knowledge of growth stocks would understand that there’s no way a company can continue growing earnings at triple-digit growth rates forever. Therefore, while some investors are snubbing Kirkland Lake here due to the slower growth, this deceleration was inevitable and was to be expected. Going forward, however, estimates are calling for $3.72 in annual EPS in FY-2021, and $3.86 in annual EPS in FY-2022, suggesting that the stock is trading at barely 10x FY-2021 earnings. Meanwhile, the company has nearly $3.00 in cash and no debt and is still one of the highest-margin producers in the sector. While there’s no guarantee that the stock has bottomed out at $36.80, I always get interested when a sector leader goes on sale like this, and I think the name is a steal below 10x FY-2021 earnings.

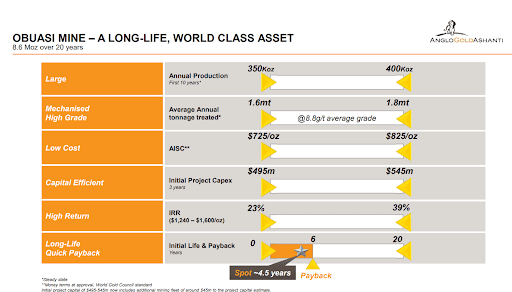

The next name on the list is Anglogold Ashanti, and the company also has an exceptional earnings trend, with annual earnings per share growing by 146% last year and expected to grow another 25% this year. This is incredible earnings growth, especially considering that the company is lapping a year of triple-digit-growth. The robust growth is attributed to the company’s low-cost Obuasi Mine ramping up, with commercial production beginning earlier this year. The Obuasi Mine, which is located in Ghana, is expected to deliver over 350,000 ounces of gold production per year at industry-leading costs of $775/oz, which should help with margin expansion for Anglogold. This is because the company’s current costs come close to $1,000/oz, and Obuasi’s projected costs are 25% lower.

(Source: YCharts.com, Author’s Chart)

If we look ahead to FY-2021 estimates, analysts are looking for annual EPS of $2.93, with FY-2022 estimates expected to head over $3.00. Therefore, this growth is expected to remain strong into FY-2021, helped by a stronger gold price, and a lower debt load that should slightly lower interest expense. Given that Anglogold is trading at just 8.5x FY-2021 earnings, it’s quite undervalued here, even if it is a slightly higher-cost producer relative to its peers. Assuming an average gold price of $1,700/oz in FY-2021, I believe these estimates are conservative, and I would not be surprised to see annual EPS of $2.96 in FY-2021.

(Source: Company Presentation)

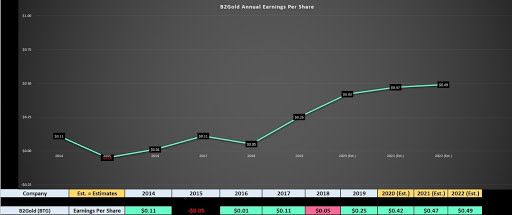

Last but not least, B2Gold (BTG) is the newest multi-million-ounce gold producer in the sector, and the company’s high-grade Fekola Mine in Mali has paved the way for the company’s massive production growth. B2Gold is on track to produce over 1 million ounces of gold in FY-2020, with all-in sustaining costs expected to come in below $850/oz, a figure that is more than 10% below the industry average of $980/oz. Therefore, while the company’s jurisdictions may be inferior to names like Kirkland Lake Gold that operate out of Australia and Canada, the company does have exceptional margins, with current gross margins of close to 50% at a $1,700/oz gold price. If we take a look at the company’s earnings trend below, we saw a breakout year for B2Gold in FY-2019, as the stock saw a new all-time high for earnings after a multi-year range stuck below $0.20 per share. If we look ahead to FY-2020, annual EPS is expected to grow by over 50% based on forecasts of $0.42, translating to over 70% growth year-over-year. It’s important to note that this is following a year of 400% growth in earnings. These are incredible numbers, explaining the stock’s 120% run since the mid-March lows.

(Source: YCharts.com, Author’s Chart)

Some investors would argue that it’s too late to buy the stock after such an incredible run, but I would disagree. When it comes to B2Gold, I believe that any pullbacks below $4.70 would present buying opportunities. This is because the stock would be trading at only 10x forward earnings at $4.70 per share, and I believe these estimates are likely conservative, with my estimates for FY-2021 coming in at $0.49. Meanwhile, on an EV to EBITDA basis, B2Gold is the cheapest of the group, trading at a forward multiple of 5.09. While Africa isn’t the greatest jurisdiction, and there are many producers in more attractive countries, I believe that B2Gold has a place in a precious metals portfolio as a speculative buy under $4.70.

While several of the largest gold producers have gotten quite expensive with funds piling into them at breakneck speed, KL, AU, and BTG offer investors with exceptional growth at a reasonable price, with the former two being the safest bets given their jurisdictions. Therefore, for investors looking to put a little money to work in the space but unsure of where to go after an incredible rally for the sector since March, I believe these are three areas with a margin of safety baked in, and a solid potential for returns going forward.

(Disclosure: I am long KL, AU)

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Bull Market or Bull S#*t? How to trade today’s stock market bubble and prepare for the return of the bear market.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

AU shares were unchanged in after-hours trading Thursday. Year-to-date, AU has gained 11.94%, versus a -2.69% rise in the benchmark S&P 500 index during the same period.

About the Author: Taylor Dart

Taylor has over a decade of investing experience, with a special focus on the precious metals sector. In addition to working with ETFDailyNews, he is a prominent writer on Seeking Alpha. Learn more about Taylor’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| AU | Get Rating | Get Rating | Get Rating |

| GDX | Get Rating | Get Rating | Get Rating |

| GLD | Get Rating | Get Rating | Get Rating |

| KL | Get Rating | Get Rating | Get Rating |

| BTG | Get Rating | Get Rating | Get Rating |