- The trade war was a problem, what comes next could be worse

- A Baidu delisting in the US hurts China

- Alibaba is a bullish beast, but it could wind up a pawn in the geopolitical chess game

On the campaign trail in 2016, President Donald Trump pledged to level the playing field on international trade.

He argued that the US continued to treat China as an emerging market, even though its economy was growing and heading for a level that would surpass the United States. President Trump did not blame the Chinese, but the former leaders of the US. He promised to renegotiate trade and tilt the balance back towards the United States.

Since the 1970s, when President Nixon visited China, the US and the world’s most populous nation have had a love-hate relationship. Democracy in the US and a communist brand of authoritarian capitalism in China has created more than a few periods of tension between the world’s two leading nations. The trade war in 2018 and 2019 was a rough patch for relations. The aftermath of the global pandemic could be worse. Baidu, Inc. (BIDU - Get Rating) and Alibaba Group Holding Ltd. (BABA - Get Rating) are two Chinese companies that have raised capital in the highly liquid US market. As things heat up between the US and China, these two companies and other Chinese firms could find themselves without access to the US capital markets.

The trade war was a problem, what comes next could be worse

On Friday, May 29, President Trump held a press conference where he terminated the US relationship with the World Health Organization, citing China and the WHO’s lack of information over the coronavirus that could have saved lives. At the same time, he took the Chinese government to task over violations of promises to the US. He also said that China violated its treaty obligations over autonomy for Hong Kong. The President said his administrations would be making decisions on “protecting US markets” from the Chinese over the coming weeks. There were few specifics in the announcement, but the rapprochement since the “phase one” trade deal seems to be over. We are likely to see the rhetoric between Washington and Beijing increase.

The escalating trade war in 2018 and 2019 created an environment of uncertainty in markets. China’s actions in the wake of the coronavirus outbreak that led to the global pandemic could push tensions to a new high.

A Baidu delisting in the US hurts China

Baidu, Inc. (BIDU) is a Chinese internet search company. BIDU’s IPO in 2005 and its ten for one stock split in 2010 made the stock a darling for many investors.

Source: Barchart

The stock reached a split-adjusted high of $284.22 a year ago in May 2019. Since then, BIDU shares have been falling steadily, closing at $106.55 on March 29.

(Source: Yahoo Finance)

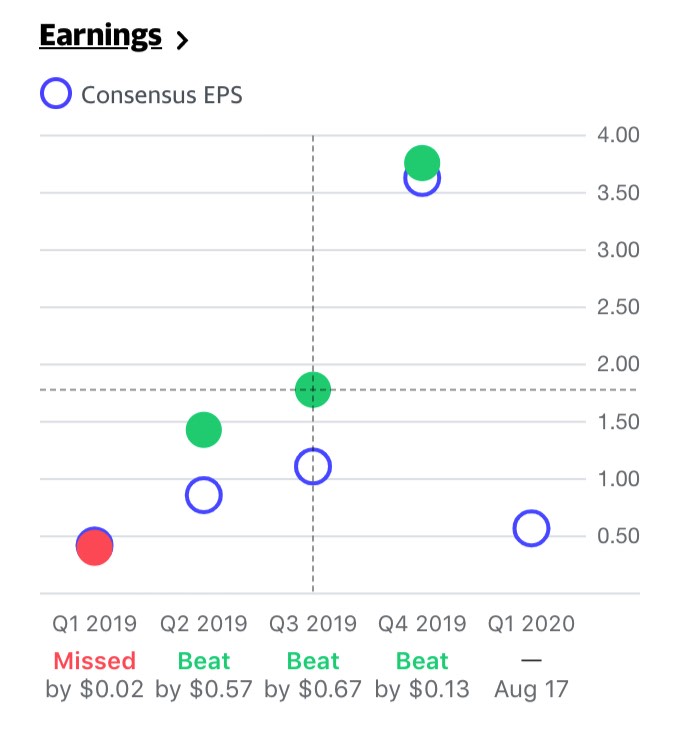

As the chart shows, the company has an impressive earnings record. BIDU has a market cap of $36.724 billion and trades an average of over 5.27 million shares each day.

In May, the US Senate unanimously passed legislation to take on Chinese companies listed on US stock exchanges. The bill requires them to submit multiple provisions if they wish to remain listed on the world’s leading capital raising market. The President’s latest announcement could mean that the US will tighten the noose further on Chinese companies like BIDU, leading to the delisting of their shares. BIDU has fallen out of favor with many investors. The company experienced a decrease in bullish sentiment over the past months. Increased pressure on Chinese companies would put roadblocks in front of raising capital in the world’s most liquid equities market.

Alibaba is a bullish beast, but it could wind up a pawn in the geopolitical chess game

While BIDU shares have dropped dramatically over the past year, Alibaba Group Holding (BABA) shares have gone the other way. BABA came to the US IPO market at $68 per share in 2014. The company is China’s answer to Amazon (AMZN).

(Source: Barchart)

The chart shows that the high in BABA shares was in January 2020 at $231.14 and was trading at $207.39 on May 29. BABA has a market cap of $556.788 billion and trades over 20 million shares on average each day.

(Source: Yahoo Finance)

The chart shows that BABA has a record of beating analyst estimates and is a cash machine.

President Trump’s announcement on May 29 that the US would limit student visas, end its relationship and support for the WHO, and heighten oversight of Chinese companies listed on US exchanges came without many specifics. As the administration rolls out its plans for restrictions on Chinese companies, we could see lots of turbulence in BIDU, BABA, and other Chinese companies that may even lead to delistings. It is a time for caution when it comes to Chinese stocks that trade in the US.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

What If I Am Wrong About the Bear Market? Even stubborn bears need to contemplate why the market continues to rally above 3,000.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

BABA shares were trading at $204.14 per share on Monday morning, down $3.25 (-1.57%). Year-to-date, BABA has declined -3.75%, versus a -4.68% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BABA | Get Rating | Get Rating | Get Rating |

| BIDU | Get Rating | Get Rating | Get Rating |